It can be hard for people new to crypto to understand how standard financial markets and the crypto space are connected. One important part is the effect of the Federal Reserve’s interest rate cuts, which is an important topic in the online world right now.

Traders in standard finance (TradFi) and crypto believe the market might go upwards. Will this really happen when the Fed moves to lower rates?

This guide will introduce the Federal Funds Rate and how it affects the economy as a whole. It will also examine how interest rate cuts might affect the prices of cryptocurrencies and give buyers ideas on how to prepare for this expected event.

Understanding the Federal Funds Rate and Its Economic Impact

In the federal funds market, banks lend the funds that they have in stock to each other overnight at the Federal Funds Rate (FFR). It’s an essential component of how the Federal Reserve controls the amount of money in circulation and the interest rates that everyone pays.

There is no doubt that the FFR has a significant impact on the economy. The Federal Reserve can try to reach a number of important business goals by changing this rate.

Stimulating Economic Growth

Banks find borrowing less expensive when the Fed reduces the FFR. This motivates them to finance companies and consumers more, hence increasing investments and expenditures.

Reduced interest rates make borrowing more possible, stimulating demand for goods and services. Businesses need to hire more people as they grow often helps to encourage economic development.

Reducing Inflation

The Fed raises the FFR to control inflation. Higher rates increase the cost of borrowing, which lowers corporate growth and expenditures. By reducing demand for major purchases and corporate investments, the Fed controls rising costs and helps relieve inflationary pressures.

Ensuring Financial Stability

Strategic FFR adjustments by the Fed help to prevent economic crises and stabilize the nation. Rising the FFR helps to cool an overheated economy and stop bubbles from developing in high inflationary times. On the other hand, reducing the rate promotes development during recessionary times.

Low rates can also raise credit default risk since they might encourage borrowers to accept unsustainable debt. The Fed can help lower this risk by progressively boosting interest rates as the economy recovers.

Knowing how the Federal Reserve employs the FFR to affect the economy’s general state helps us investigate how a possible rate reduction would affect the crypto market.

Appreciating the Federal Reserve’s Lower Interest Rate Policy

Examining the series of events that led the U.S. economy to its present situation helps one to understand why the Federal Reserve is thinking of reducing interest rates and why it has delayed such a change.

Important Reasons Behind American Record-High Inflation

Following the epidemic, the American economy saw a notable increase in inflation. Government-issued stimulus funds, disrupted supply chains, and rising consumer demand all helped explain this jump. The Federal Reserve moved quickly to start a series of forceful interest rate hikes meant to lower inflation and bring it near its target of 2% once it became abundantly evident that it was not a passing problem.

These rate increases meant to slow down economic activity and lower inflationary pressures. The federal funds rate (FFR) thus attained levels not seen since the dot-com era. These rising interest rates started to affect general economic development over time, which sparked worries about a recession may be approaching.

Has the Fed’s approach been overly constrictive?

Maintaining high interest rates for a long time by the Federal Reserve demonstrates its concentration on controlling inflation, which has stayed constantly high. Recent economic data, however, points to a change possibly on hand. Unemployment numbers are beginning to rise even if big tech firms with solid earnings reports point to steady U.S. economic development.

This begs the issue: Is the economy now at jeopardy following a protracted period of high interest rates? Recessions predicted by the Sahm rule and other indicators have set off alarms and stoked worries about the economy perhaps declining more than expected.

Possible Results from Reducing the FFR

By motivating greater spending and borrowing, lower interest rates can help to boost economic development.

Still, it’s crucial to balance the possible hazards and trade-offs—that is, the prospect of revived inflationary pressures, market swings, and more general effects on long-term economic stability. Cutting the FFR could revive inflation even while it helps the economy. Furthermore, it is still somewhat difficult to forecast how such cuts might affect the world economy over long run.

The Federal Reserve’s decision to lower interest rates is a significant event with a wide range of effects. It is important to consider the risks and trade-offs that come with this change in monetary policy, even though the goal is to boost economic growth and avoid a slump.

What’s the relationship between Interest rates and cryptocurrencies?

Many traders think that interest rates and cryptocurrency prices are linked in a way that is opposite to what you might think. This means that when interest rates decreases cryptocurrency prices tend to increases, and when interest rates increase they tend to decline. What makes this link work? A lot of important things affect how interest rates and crypto work together.

Shift in Opportunity Cost

When interest rates go down, traders often move their money from safe, low-yielding investments like bonds to riskier ones like cryptocurrencies in search of better returns. This change in cash can make more people want crypto, which could make its value go up.

Higher Willingness to Take Risks

Traders often take on more risk when interest rates are low because it costs less to borrow money. This “risk-on” behavior can lead to more dealing with borrowed money, which is good for the market as a whole. So, this situation is good for cryptocurrencies, which are known for being risky and volatile.

Better Market Sentiment

Interest rates are usually low, which gives the market a more positive outlook. Because cryptocurrencies are seen as high-risk and unpredictable investments, they tend to do better when the market is optimistic, making them even more appealing.

Relationship with Regular Stock Markets

There has been a link between cryptocurrencies and standard financial markets (TradFi), like the stock market. As an example, when interest rates are lowered and stock markets go up, the good mood may spread to the bitcoin market. As we can see by comparing Bitcoin to the S&P 500, lower interest rates can help both types of assets go up in value.

Flexibility in regulations

In some cases, when interest rates are low and regulations are friendly to cryptocurrency, the two can go hand in hand. During the pandemic, many countries used rate cuts and other economic stimulus steps to get the economy going again after it had slowed down.

Because of this, some governments have become less strict about controlling cryptocurrencies. For example, they have loosened Know Your Customer (KYC) rules, lowered capital gains taxes on crypto trades, or even set up regulatory frameworks to help crypto businesses understand the rules.

A Relationship With Lots of Layers

A lower federal funds rate (FFR) can help cryptocurrencies grow, but it’s important to keep in mind that interest rates and crypto prices have a complicated relationship. Things like how the market feels, new technologies, and changing rules all have a big impact on bitcoin prices, making it a complex dynamic.

In conclusion, lowering interest rates can increase demand for cryptocurrencies and make dealing easier, but traders need to look at a lot of different factors when judging how the crypto market is moving.

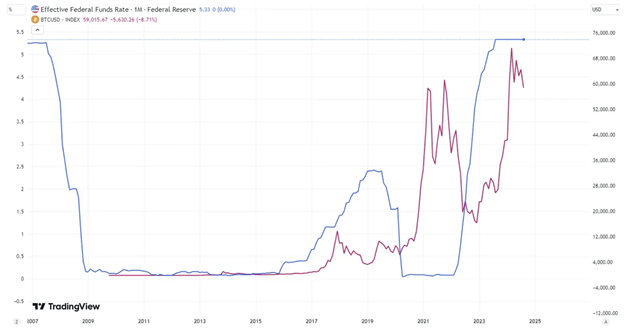

Impact of Historical Interest Rate Reductions on Bitcoin Prices

To figure out how crypto prices might respond to possible interest rate cuts in 2024, it helps to look at what has happened in the past and see how the coin market did when the Federal Reserve (Fed) lowered rates. Bitcoin will be used as a common example of the crypto market as a whole for this study.

The Global Financial Crisis of 2008

During the Global Financial Crisis of 2008, the Federal Reserve lowered interest rates by a large amount to help the economy recover.

While Bitcoin wasn’t created until late 2008 in reaction to the problems that the crisis brought to light in the financial system, we can use the stock market to show how risky assets were during that time when interest rates were going down. The Federal Funds Rate (FFR) dropped sharply from 5.25% in 2007 to just 0.25% at the end of 2008.

The stock market went down a lot at the same time that interest rates dropped sharply. During this time, the S&P 500 index, which is a key measure of the US stock market, dropped by more than 50%. When Bitcoin first started out, it needed to be fully integrated into financial markets. However, investors looking for bigger returns in times of low interest rates may have helped Bitcoin grow in the future.

The 2020 COVID-19 Pandemic

The COVID-19 pandemic caused a lot of problems for the economy. To fix them, the Federal Reserve used strict monetary policies, such as lowering interest rates almost to zero and giving out boost payments. The goal of these actions was to keep the economy stable and stop it from getting worse. Low interest rates made it easier for people to take risks and make speculative investments when paired with stimulus spending.

This set the stage for a rise in many types of assets, including cryptocurrencies. Prices for cryptocurrencies like Bitcoin went up very quickly and reached all-time highs by the end of 2021.

The relationship between interest rate cuts and crypto prices has changed because of things like more institutions getting involved, better technology, and changing rules. Because of this, the connection between interest rates and riskier investments like cryptocurrencies is more complicated now than it was in the past.

Understanding the Effects of Interest Rate Cuts on Crypto Trading for Beginners

Those just starting out in the realm of cryptocurrency trading should understand how changes in interest rates could affect the market. These important ideas will enable new traders to negotiate the possible changes in the market resulting from such economic developments.

Handling Market Volatility Triggered by Interest Rate Cuts

The crypto market usually shows more volatility when the Federal Reserve reduces interest rates; values fluctuate between extremes before settling. For traders, particularly those with leveraged portfolios, this might present difficulties since, in poorly managed positions, margin calls could arise.

Using Crypto Options to Manage Risk and Hedge Your Portfolio

Hedging can be a helpful tactic to reduce risk for individuals experienced with crypto options. Implicit volatility (IV) is probably going to rise once the Federal Reserve releases its official statement since the market expects a rate cut. For seasoned option traders, this increasing volatility offers chances to profit.

The strangle options approach is one possible tactic that might help when bitcoin option premiums rise in expectation of major policy developments. To preserve their holdings while yet keeping exposure to possible gains, traders could also think about a covered call strategy.

Accepting Dollar Cost Averaging (DCA) as a Long-Term Strategy

Warren Buffett’s well-known financial idea—that “time in the market is better than timing the market”—also holds true for crypto trading. Dollar-cost averaging (DCA) could be a wise strategy if you want to boost your crypto holdings but worry about a possible market decline following interest rate reductions.

DCA can simplify the process—especially for those new to the market—and help lower the emotional influence on trading decisions by spreading out investments across time. In a volatile environment like crypto trading, this approach lets one make regular investments independent of market swings.

Is It Too Late for the Federal Reserve to Cut Interest Rates?

Traders’ arguments nowadays mostly revolve around whether the Federal Reserve (Fed) is cutting the Federal Funds Rate (FFR) too late. Some contend that before the Fed acts with rate cuts, the economy sometimes shows great pressure.

Under this perspective, the delay causes a more severe recession than what may have happened had the Fed acted earlier, proactively. Given the present economic ambiguity, this case is especially pertinent to the U.S. markets today.

According to this viewpoint, the Fed usually waits until economic data show a notable decline before acting with rate decreases. Critics argue that by the time action is taken, the economy might already be in recession, making it more difficult to boost recovery and stop a more extreme collapse.

The Case for Lagging Data and Caution

That being said, there are reasons against this point of view. The Fed has many problems because it relies too much on often outdated economic data. Because of this delay, it’s hard to know when an economic slowdown will happen, and the situation can change anytime. Also, the Fed might not want to act too strongly because it wants to avoid going too far and causing other problems in the economy, like prices going up.

Final Thoughts and Future Considerations

If the Federal Reserve decides to lower the Federal Funds Rate in 2024, it could significantly affect the bitcoin market. Lowering interest rates can help the economy grow and improve cryptocurrencies, but market mood, regulation changes, and new technologies will also affect their effects.

It’s essential for people who are new to trading crypto to know that the market could go up and down. Managing risk with hedging strategies, keeping up with changes in the market, and making intelligent decisions are all critical for navigating this ever-changing environment.