Bitcoin (BTC) hovered around the $66,000 mark on Wednesday, grappling with minor outflows from U.S. spot Bitcoin ETFs the previous day. This movement coincides with the ongoing distribution of Mt. Gox funds for repayment, which could exert additional downward pressure on Bitcoin’s price.

According to data by Lookonchain, on July 23, Mt. Gox moved 37,477 BTC, worth $2.47 billion. Since July 5, Mt. Gox has transferred 52,509 BTC, valued at $3.31 billion, to Bitstamp, Kraken, and Bitbank for return needs.

With Mt. Gox owning $5.95 billion in Bitcoin, this significant cash flow has driven FUD (Fear, Uncertainty, Doubt) among traders, hence contributing to the current drop in the price of Bitcoin.

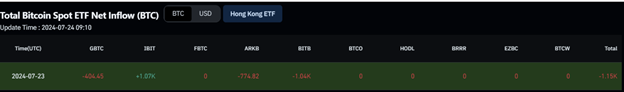

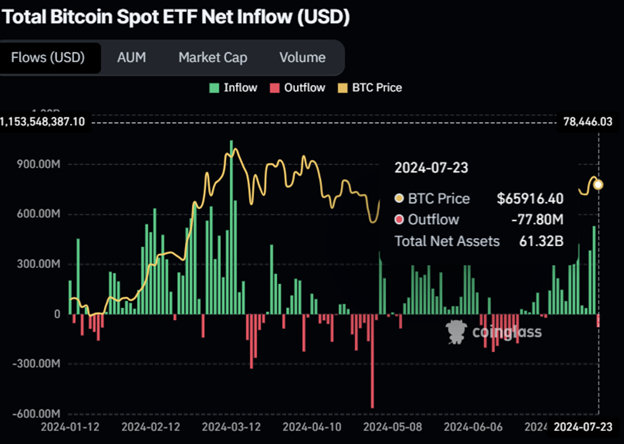

US Spot Bitcoin ETFs Experience $77.80 Million Outflow

On July 23, U.S. spot Bitcoin ETFs lost $77.80 million. Blackrock (IBIT) gained 1,070 BTC. Meanwhile, Grayscale (GBTC), ARK 21Shares (ARKB), and Bitwise (BITB) lost 404.45 BTC, 774.82 BTC, and 1,040 BTC.

This fall suggests a minor loss of investor confidence, which would help explain Tuesday’s short drop in Bitcoin’s price.

Understanding market dynamics and investor mood depends on knowing the net inflow statistics from ETFs. Right now, the 11 American spot Bitcoin ETFs own reserves totaling $53.16 billion in Bitcoin.

Bitcoin Magazine reports that Kamala Harris, a Democratic candidate, will join Donald Trump at the Bitcoin Conference. It will be held from July 25 to 27. If true, this could spark a major presidential race. Democrats are especially concerned about Trump’s increasing appeal to crypto investors.

By analyzing the realized prices and age ranges of ownership, CryptoQuant claims that the UTxO Realized Price Age Distribution offers a set of indicators of investor behavior.

These measures enable investors to grasp the holding behavior of diverse cohorts by overlaying several realized prices. Dividing the Realized Cap by the overall supply helps one get the realized price.

Bitcoin Price Analysis

In recent Bitcoin movements, the price briefly dipped and stabilized around $65,915. This range is close to the average purchase price of $66,500 for holders of BTC aged 1-3 months, potentially serving as a support level.

However, further correction could bring support to around $63,800. This price reflects the average purchase range of BTC holders aged 3-6 months.

Bitcoin fell into trouble at the weekly level of $67,209, causing it to drop 2.3% on Tuesday. As of July 24, BTC is trading at about $65,632.

If BTC keeps going down, it might find support at $64,913, close to the 61.8% Fibonacci retracement line of $64,921. This key support zone should be closely watched from the high point at $71,997 on June 7 to the low end on July 5 ($53,475).

If the support level remains at $64,913, BTC may rise by 11% and aim for a high of $71,997 on June 7.

The market has strong bullish momentum, as shown by the technical indicators on the daily chart. They remain above their neutral thresholds of 50 and zero, which apply to the Relative Strength Index (RSI) and the Awesome Oscillator (AO).

Setting a lower low on the daily timeframe would change the market from bullish to bearish. It would happen with a close below $62,736 and by breaking the uptrend line from swing lows since July 5. Targeting a retest of its July 12 low at $56,405, this situation might cause a 10% drop in the price of Bitcoin.

Could China’s Bitcoin Ban Reversal Trigger a Price Surge?

Recent rumors suggest China might lift its Bitcoin ban. These rumors stem from unsourced tweets and insights about the Chinese government’s Bitcoin plans. Legalizing a Bitcoin Exchange-Traded Fund (ETF) in Hong Kong has fueled more speculation.

Examining Bitcoin’s legal situation in China and the consequences of the recent prohibitions can help one understand these rumors. My book on China and Bitcoin delves thoroughly into this subject.

Understanding the situation in China depends on knowing the political terrain there. Following the demonstrations, the difference between Hong Kong’s and Mainland China’s governance under the One Country, Two Systems paradigm has become hazy. Nonetheless, Hong Kong has a different legislative attitude regarding Bitcoin and cryptocurrencies.

Despite new rules limiting over-the-counter trading, crypto exchanges are still lawful in Hong Kong. Physical currency stores enabling peer-to-peer Bitcoin and Tether exchange still run under specific exceptions. The Basic Law of Hong Kong offers some protection for Bitcoin trade, so a ban like to Mainland China is improbable as long as the Basic Law stays the same.

The launch of spot Bitcoin ETFs in Hong Kong is special. Three famous Mainland Chinese asset managers, ChinaAMC, Harvest, and Bosera, will participate through their Hong Kong subsidiaries.

However, issuers have periodically cited interest from Mainland investors via “offshore” routes. Mainland Chinese investors are banned from investing in Bitcoin ETFs in Hong Kong’s spot and futures.

Mainland China strictly controls Bitcoin. People have been arrested for trading Tether and utilizing virtual currency, among other offenses. Since Bitcoin mining is forbidden, conferences have been moved outside of Mainland China, and significant hash/mining capabilities have also been relocated there.

As crypto exchanges typically block Chinese IP addresses, they no longer enable Yuan trades for cryptocurrencies. Furthermore, the Great Firewall blocks the IP addresses of some foreign exchanges.

Evaluating China’s Stance on Bitcoin Amidst Regulatory

China’s ban on Bitcoin is a set of notices from the government that became stricter in 2021 involving law enforcement. Even with these rules, Chinese judges have always said that Bitcoin is a property protected by the law. This has often led to rumors that China is changing its mind about its position on Bitcoin.

China has gone through some significant modifications. For example, a scientist in Hong Kong said that banning Bitcoin mining was a mistake because it brought in more tax money for the US. China might continue investigating Bitcoin, as with “blockchain” and Web3. This trend could continue if a Trump government that supports Bitcoin comes to power.

But it’s not likely that China will change its Bitcoin stance. The People’s Bank of China and SAFE, which are in charge of Bitcoin bans and rules, stick to long-standing policy lines. One of Xi Jinping’s trusted economic aides, Liu He, put the mining bans into effect, even though Xi Jinping’s orders have sped up policy changes in the past.

Given Xi Jinping’s predicted hold on power until at least 2029, a significant policy reversal would need a dramatic change from him, particularly given the deep ideological hostility to Bitcoin inside the Chinese Communist Party. China was among the first countries to acknowledge Bitcoin’s challenge to its hold over capital and energy. The Digital Yuan project fits the long-standing concentration on preserving the Chinese Communist Party’s economic control.

Promoting central bank digital currencies and restricting Bitcoin policies seem unlikely to alter. Thus, any headlines from China are unlikely to indicate policy changes. They could lift the market mood across party lines by showing China’s adoption of Bitcoin as property. Tests of a spot Bitcoin ETF in Hong Kong and research on the US President’s stance offer alternative avenues. These approaches could yield valuable insights and progress.