Rising prices and increasing investor trust define a bull market in cryptocurrencies. Discover the main ideas and best practices that will enable you to maximize gains in a crypto market in a positive phase.

The crypto market is still one of the most interesting parts of the world’s financial scene, yet it is known for being very unstable. Investors and traders constantly search for strategies to profit from market trends. Rising prices and general optimism define a bull market with many profit possibilities.

This article discusses the best trading strategies in a crypto bull market and includes useful information for new, experienced, and intermediate players. These techniques will help you optimize your possibilities during a cryptocurrency bull run.

Understanding Bull Market

A bull market is a phase in a financial market during which prices are predicted to climb or are already climbing. The word “market” is usually used to refer to the stock market, but it can also refer to commodities, real estate, and even cryptocurrency.

In traditional financial markets, a bull market usually starts when the prices of stocks or other goods rise by 20% or more from their recent lows and continue rising for a long time.

Usually accompanying this phase is great investor confidence, economic recovery, low unemployment, and general hope. A bull market causes a longer-term price rise as demand for stocks or securities exceeds the current supply. Although there is no specific length of time for this rise to be regarded as a bull market, usually speaking, this is a continuous period spanning several months or perhaps years.

What is Bull Run?

While the cryptocurrency market runs differently because of its volatility and short history, it resembles conventional financial markets. Within weeks or months in a crypto bull market, 20%, 50%, or even higher price rises can occur. Influenced by more considerable market sentiment, adoption rates, legislative changes, and technological improvements, the length of a crypto bull market can vary significantly from a few months to over a year.

Best Trading Strategies in Crypto Market

Navigating a bull market in cryptocurrencies successfully requires strategic planning, discipline, and a strong awareness of market dynamics combined. Five main trading techniques mainly meant for the crypto market’s optimistic conditions below:

-

Momentum Trading

Mostly a short-term approach, momentum trading takes advantage of the theory that assets with strong trends usually follow the same path. This strategy is especially successful in the crypto market, where assets with great upward momentum can maintain their path for a long time.

Traders can make money in a bull market by looking for cryptocurrency whose prices are increasing, and the number of trades is increasing.

You can find assets with strong movement using technical analysis tools like MACD, Williams %R, Relative Strength Index (RSI), and moving averages. Traders can start a buy position and plan an exit strategy to sell at a high when this happens, which maximizes the asset’s value increase.

Potential for High Profits: Momentum trading can offer significant rewards, especially in positive markets with more defined trends.

Accessibility: The approach is simple and fits traders with different degrees of experience since it depends on obvious indicators and patterns.

Flexibility: This method allows traders to match it with their schedules and risk tolerance by being flexible enough to fit different time frames.

Prospects for Momentum Trading

1.Breakout Trading

With significant trading volume, a trader notes that Ethereum (ETH) is breaking out from a consolidation pattern, suggesting vigorous buying activity. Confirming the strength of this trend, they use momentum indicators and choose to go in a long position. The trader closely watches the momentum as ETH keeps moving upward to decide the best exit opportunity, guaranteeing gains before any possible trend reversal occurs.

2.Following Trends in Markets During Recovery

With its price regularly creating higher highs and lows, Bitcoin (BTC) shows indications of recovery after a market slump. A momentum trader employs the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) to confirm the positive momentum and start a trade. Riding the recovery trend allows the trader to leave the position when the indications show that momentum is declining, generating profits during recovery.

3.Taking Advantage of Current Events

Following an essential alliance with Cardano (ADA), the price and trading volume jumped. Seeing this as a momentum chance, traders swiftly position themselves to benefit from the higher investor interest. Closely observing the price activity helps the trader leave the deal when the first enthusiasm fades and the price momentum slows, ensuring gains from the event-driven price increase.

Emphasizing trends and volume, momentum trading offers an active approach to profiting from positive periods in the bitcoin market. By understanding fundamental ideas and applying robust risk management strategies, traders can earn notable profits while controlling the market’s volatility.

2. Buy and Hold

People who want to earn money from the crypto market’s long-term growth prospects must use the “buy-and-hold” method. Investors can benefit from the market’s general trend of moving up by buying lower-priced assets and holding on to them for a long time.

For this strategy to work, you must pick assets with strong bases, like great technology, a skilled development team, and market promise. Investing and making money from the market’s growth is easy, making daily trading less necessary.

An examination of the DCA approach | Source: TradingView

Buy in Bearish Market: Investing during a bearish market might be a calculated move. Reduced prices present an opportunity to get discounted assets. The emphasis should be on selecting suitable cryptocurrencies predicted to appreciate over time.

During Retracements in a Bull Market: Consider making investments during bull market brief declines or retracements. Usually followed by a recovery to the upward trend, these phases offer valid access points.

Consider using the Dollar-Cost Averaging (DCA) approach to control volatility. Regardless of the asset’s present value, this method entails continual money investments made over regular periods. You could commit a set monthly payment to Bitcoin.

This approach lets assets increase in value over time and helps them accumulate. Automated recurrent purchases help average the buy price and reduce the chance of mistakes in market timing, thereby facilitating this operation.

3. Swing Trading

A unique approach in the trading scene, swing trading aims to profit from price swings over days to weeks, thereby leveraging the volatility of the crypto market. During a bull market, when the general trend is upward, but short-term price swings still offer chances for profit, this strategy is beneficial.

Swing traders find entrance and exit points using several indicators, just like momentum trading. The key instruments are moving averages, RSI, Bollinger Bands, Williams %R, and MACD. Examining market trends and patterns can also point to possible swing trading prospects. Maintaining current knowledge of market news and trends is crucial since this material may be beneficial for timing trades.

Chances to trade Litecoin at a discount | Source: TradingView

Pros of Swing Trading

Perfect Duration: Swing trading provides significant rewards while avoiding the continuous monitoring needed by more short-term trading strategies.

Competitive Adaptability: Swing traders use several technical indicators to modify their plans based on the market’s state.

Prospects for Swing Trading

Trend Retracements: Despite temporarily pulling back, litecoin (LTC) is increasing. Suggesting a likely reversal, a swing trader notes that this entrance on the RSI and Bollinger Bands reaches a noteworthy support level. The trader chooses to buy since LTC is expected to continue its increasing path. A few days later, LTC recovers and runs across a resistance level; the trader sells to generate a profit.

Reaction to News: The price shows notable swings after a Ripple (XRP) new blockchain update announcement. Seizing the chance to buy during the initial slump, a swing trader expects a favorable attitude about the upgrade to propel the price. Closely observing the price, the trader sells whenever the momentum slows down after the announcement, profiting from the news-generated price fluctuation.

Breakout Trading: Trading within a limited range, Ethereum ( ETH) suggests a possible breakout. Closely observing the MACD and Williams %R indicators, a swing trader starts a trade when ETH breaks out of its range with more volume, indicating significant buying demand. Based on past resistance levels, the trader targets a price and closes the position as the price approaches this level, guaranteeing profits on the breakout.

-

Scalping

A short-term trading tactic aiming at profit from minor price swings is scalping. Usually, traders applying this approach complete many trades in one day. In bull markets especially, this approach is quite successful because of the higher volatility that generates lots of chances for little gains. The quick price swings help scalpers to accumulate gains using several little transactions.

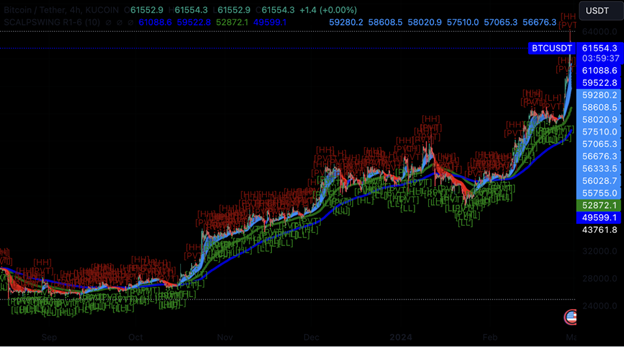

The Bitcoin/USDT chart and the scalping trading method | Source: TradingView

Focusing on trading pairs with excellent liquidity is crucial for effective scalping, guaranteeing the speedy execution of orders at target prices. Creating successful chances depends much on volatility. Leverage should be utilized carefully to control related risks, even if it can increase possible rewards.

Using tight stop-loss orders is crucial for quickly exiting bad investments and safeguarding cash. In high-volume trading pairs, scalpers can also profit from the bid-ask spread by placing buy orders just above the bid price and sell orders somewhat below the asking price.

-

Taking Long Positions in the Futures

Traders who expect the price of an asset to rise in the future use long positions in the futures market. This strategy effectively bets on an asset’s price rising over time by promising to buy it at a specific price and date. Taking long positions in futures might be an excellent strategy to profit from expected rising price movements during a positive trend in the bitcoin market.

Under this approach, a trader signs a futures contract to buy a cryptocurrency at a designated price on a future date. This choice is justified by the hope that, at contract expiration, the cryptocurrency’s price will be higher than when it was started. If the market price at expiration surpasses the contract price, the trader gains by acquiring the item at the reduced contract price.

Thorough market research is necessary to properly apply this approach and find cryptocurrencies with excellent development potential. Considering expiration date and leverage aspects, choose futures contracts that fit your market perspective and risk tolerance. Track the market constantly and change your posture as needed. To control risk and guarantee gains, be ready to use take-profit or stop-loss orders.

Pros of Futures Trading

-Leverage: Futures trading lets users take leveraged positions to increase possible gains from market swings.

-Hedging: Offering some price stability and long-term investments helps offset spot market volatility.

-Market Access: Future markets may give access to cryptocurrencies that may be unavailable because of limited capital.

Final Thoughts

The article discusses long positions, momentum trading, hodling, and risk management. These strategies can help traders make money when the market performs well. However, a trader’s success depends on how well they can adapt these strategies to risk tolerance, investment goals, and the constantly changing crypto market.

Since bull markets offer great chances to earn money, they also pose significant risks. It is very important to stay up to date, use sound risk management strategies, and trade systematically. Traders can make better choices and reach their investing goals if they deal with problems like regulatory uncertainty, market volatility, and fear of missing out (FOMO).