Due to the growing interest in crypto currency trading and other uses, the cryptocurrency market has experienced a tremendous increase in the last few years and is now composed of long-time investors as well as people who have just heard about the existence of such a market. One of the many trading styles the community of cryptocurrencies apply include crypto leverage trading, which is considered one of the most effective in generating extraordinary profitability.

However, as they say, ‘with great opportunity comes great responsibility,’ and therefore there are dangers. It is crucial to learn crypto leverage trading in the virtual currency geopolitical arena for anyone who would wish to invest in these volatile markets.

Leverage trading as the name suggests involves trading using someone else’s money and with a view of expanding the trading position so as to make however small the price fluctuations may be. This strategy is like applying a lever to turn a big boulder with less force, it gives traders the facility to manage accounts that exceed their actual equity. For instance, let a trader set a 10x leverage, this means he can control a position worth ten times the amount of capital he or she has invested, which means the trader can gain big if the market is on his or her side.

Nevertheless, the opportunities to increase the profits are always associated with the threat to increase the losses. In a volatile environment of cryptocurrencies, where the value changes can be dozens of percentage points per minute, leverage trading is both good and bad. It only takes a few moments of misplacing the bet, and instead of generating earnings, wrong bets result in losses that are greater than the original stake thus the need to understand the function and effects of the games.

While embracing leveraging trading becomes an interesting perspective for new investors engaged in cryptocurrency, many aspects can be regarded as challenging. The market is fickle, and it takes good management of risks and having the right strategy in place. As such, this article seeks to provide insights into crypto leverage trading, the opportunities that come with it, the risks and the most important factors that are necessary in order to effectively trade in such an environment. For traders irrespective of their experience, it is pertinent to learn more on Leverage trading especially in this developing world of cryptocurrencies.

What is Crypto Leverage Trading?

Leverage trading simply means using borrowed capital to increase the size of a trader’s position in the cryptocurrency market. When leverage is used, it is possible for traders to get higher rates of return on their investments.

Leverage is usually in terms of multipliers like 2x or 10x.

This meant that you could manage a one thousand dollar position just by putting down one hundred US dollars with a ten times leverage. Some of the costs and benefits are scaled up due to increased exposure which makes risk management even more crucial.

Anonymous leverage enables the trader to make big profits through small market shifts. But it requires an effective planning, accurate market analysis and clear vision of such risks turning the passionate into professionals.

Basic Concept

Leverage trading can be defined as the direct use of borrowed capital in an attempt to increase the potential return of an investment. Speculative means when a trader is engaged in the use of borrowed capital or money from a broker or an exchange to control a large position. Leverage is usually measured in terms of a ratio such as 2:1, 10:1 or even 100:1 to signify the degree by which the trading position is magnified in relation to the amount of assets the trader is trading with.

For instance, if the leverage ratio is 10:1 the trader’s capital of $1,000 will control a position of $10,000. This therefore implies that wherever a trader is positioned in the asset, a small percentage change in the asset price could potentially be very profitable or very costly depending on the position taken by the traders. Levage trading enables traders to manage larger positions than the sizes of their stakes, meaning that they can stand to make greater returns on their investments in more unstable markets such as cryptocurrencies.

Leverage Mechanism

The mechanism of crypto leverage trading involves several key components: margin, borrowed capital, and the multiplier effect.

Margin is the initial capital that a trader must deposit to open a leveraged position. It acts as a security deposit that covers potential losses and is typically a fraction of the total value of the trade. The margin requirement is determined by the leverage ratio chosen by the trader. For instance, if a trader wants to use 10x leverage, they would need to deposit 10% of the total trade value as margin.

Borrowed Capital is the additional funds provided by the broker or exchange, allowing the trader to open a position larger than their own capital would permit. This borrowed amount is essentially a loan that the trader must repay, and it is crucial to understand that the broker will require collateral in the form of margin to cover the risk of loss.

The Multiplier Effect is what makes crypto leverage trading so appealing—and risky. By using leverage, traders can multiply their exposure to price movements, thus potentially amplifying their profits. However, this multiplier effect also applies to losses. If the market moves against a trader’s position, losses can be magnified to the same extent as potential gains.

Consider this example: A trader uses 10x leverage to open a $10,000 position with $1,000 of their own capital. If the asset price increases by 5%, the trader gains $500, achieving a 50% return on their initial investment of $1,000. However, if the price decreases by 5%, the trader loses $500, equating to a 50% loss of their initial investment.

How Crypto Leverage Trading Works

Margin trading in the cryptocurrency market helps the trader to take a leveraged position, which means the trader is able to increase his position in the desired market by using borrowed funds.

This strategy involves the use of leverage ratios, which are measures of the trader’s position size in relation to his/ her own capital. Knowledge of these ratios and how they are applied is therefore very important to anybody who would want to venture into crypto leverage trading.

Leverage Ratios

Leverage ratios are a fundamental aspect of leveraged trading, representing the multiplier effect on a trader’s capital. Common leverage ratios in crypto trading include:

- 2x Leverage: With 2x leverage, a trader can double their position size. This ratio is often considered conservative, as it allows for moderate exposure while still providing the potential for increased returns. It’s a suitable choice for traders looking to reduce risk while still enhancing their trading opportunities.

- 10x Leverage: A 10x leverage ratio means a trader can control a position ten times larger than their initial capital. This level of leverage is popular among traders seeking to maximize profits on short-term price movements, offering significant exposure to market volatility.

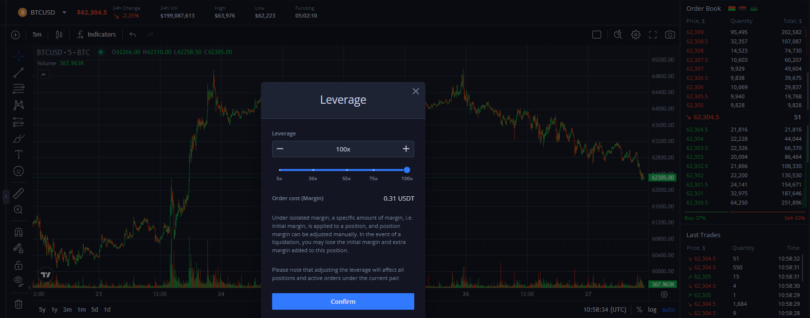

- 100x Leverage: At 100x leverage, traders can control positions a hundred times their actual capital. This high level of leverage is primarily used by experienced traders willing to accept substantial risk in exchange for the potential for massive gains. However, the risk of rapid liquidation is high, as even small price fluctuations can result in significant losses.

Each leverage ratio comes with its own set of risks and rewards. While higher leverage can lead to larger profits, it also increases the likelihood of substantial losses. Therefore, it’s crucial for traders to understand these dynamics and apply appropriate risk management strategies.

Example of a Leveraged Token Trade

To illustrate how bitcoin leverage trading works in practice, let’s go through a step-by-step example of a leveraged trade in cryptocurrency:

- Initial Setup: Suppose a trader has $1,000 in their account and wants to trade Bitcoin (BTC) using 10x leverage on a platform like Binance. This means they can control a position worth $10,000.

- Opening a Position: The trader anticipates that the price of Bitcoin will rise from $30,000 to $31,000. They decide to open a long position using 10x leverage, borrowing $9,000 from the exchange to increase their position size to $10,000.

- Price Movement: If the price of Bitcoin rises to $31,000, the trader’s position value increases proportionally. The value of the position becomes $10,333.33 (since $10,000 divided by the initial price of $30,000 equals approximately 0.3333 BTC, which is then multiplied by the new price of $31,000).

- Profit Calculation: The trader closes the position at $31,000. The profit is calculated by subtracting the borrowed amount and the initial margin from the total position value, resulting in a profit of $333.33.

- Return on Investment: Given the initial investment of $1,000, the profit of $333.33 translates to a 33.33% return, significantly higher than what could be achieved without leverage.

- Risk of Loss: Conversely, if the price of Bitcoin had fallen to $29,000, the trader’s position value would have decreased, potentially leading to a margin call or liquidation if losses exceeded the initial margin. This demonstrates the high-risk nature of leverage trading.

Benefits of Bitcoin Leverage Trading

Margin trading in cryptocurrency markets has increased popularity as it provides traders with improved market access and maximization of potential profits. Some of the advantages of leverage trading are that it provides individuals with the capacity to buy more stocks or securities for a particular period, has higher earning prospects, and allows one to be more dynamic in their trading options.

Increased Buying Power

This one is one of the most convincing points of leverage trading – the ability to buy more with the same amount of money. Leverage on allows traders to open a position that in size may be many times the total amount of their capital. This is done through taking funds from a broker or exchange so as to increase control of assets that could be controlled with personal capital alone.

For instance, for a trader with $1000, the trader can open a trade of $10000 through leverage of 10 times. The advantage of being able to manage bigger positions using a small amount of capital also brings the effect that traders are able to access markets and opportunities which they would not be able to otherwise. Higher purchasing capacity is especially helpful in sexy and unpredictable assets such as cryptocurrencies since small changes in prices can create substantial values. These fluctuations in prices of products offer traders that have compiled their buying power the opportunity to make higher profits.

Potential for Higher Profits

What is Leverage trading crypto? It can be more advantageous than fixed trading because it boosts the size of gains given to traders in relation to price variations. The application of leverage is beneficial when the trade is positive because it holds the potential of boosting the gains of an investment. This is because the trader gets to enjoy all the position size and not just the initial money required to open the position.

Suppose a trader decides to maintain 10 times leverage to enter a long position trading on Bitcoin. It means that when the price of a Bitcoin goes up by 5%, the trader’s position will also go up by 5%. Nevertheless, since the position is 10 times the initial investment, the trader makes double his or her first capital. The kind of leverage that we have here permits traders to sort out much better and much faster valuable circumstances while increasing the returned results.

Note, however, that leverage can work for a trader both for better results and for worse, that is for both profit and losses. Leverage trading exposes traders to risks, and therefore traders should always be careful when trading and adapt to the right measures of risk management.

Flexibility in Trading Strategies

Leverage trading offers traders increased flexibility in their trading strategies, allowing them to adapt to various market conditions and opportunities. By using leverage, traders can employ a range of dynamic strategies that may not be feasible with a smaller capital base.

- Short Selling: Leverage allows traders to take short positions, enabling them to profit from declining markets. This flexibility is particularly valuable in the volatile cryptocurrency market, where prices can experience rapid fluctuations.

- Scalping and Day Trading: Traders can use leverage to implement short-term trading strategies, such as scalping and day trading, which involve making numerous trades over brief periods to capture small price movements. Leverage enhances the potential returns from these strategies, making them more attractive to active traders.

- Hedging: Leverage can be used to hedge existing positions, providing protection against adverse market movements. By taking a leveraged position in the opposite direction of their primary trade, traders can mitigate potential losses and manage risk more effectively.

- Portfolio Diversification: Leverage enables traders to diversify their portfolios by opening multiple positions across different assets and markets. This diversification can reduce overall risk and increase the likelihood of capturing profitable opportunities.

What Is Leverage Trading Crypto Risk?

While crypto leverage can indeed supercharge returns, it can equally amplify losses. High leverage introduces a heightened level of risk, especially in the inherently volatile crypto market.

Due to the volatile nature of the market, small price movements can lead to significant gains or losses.

Moreover, trading with leverage requires a meticulous understanding of the market, necessitating due diligence and advanced risk management strategies. Unexpected market movements can quickly result in a margin call, where traders must deposit additional funds.

Such scenarios can cause liquidations, where positions are forcibly closed to prevent further losses, leaving traders with substantial financial deficits. The trading key to success with leverage lies in moderate usage and a well-constructed risk management plan. Staying informed and adaptable can empower traders to navigate the complexities and optimize their strategies.

Amplified Losses

One of the most significant risks of leverage trading is the potential for amplified losses. Just as leverage can magnify profits, it can also intensify the impact of adverse price movements on a trader’s position. When a trade goes against a leveraged position, losses can exceed the trader’s initial investment, potentially leading to financial distress.

For example, consider a trader who uses 10x leverage to open a $10,000 position with only $1,000 of their own capital. If the asset’s price decreases by 10%, the position loses $1,000 in value, effectively wiping out the trader’s entire initial investment. If the price drops further, the trader can incur losses beyond their capital, resulting in a debt to the broker or exchange. This scenario underscores the importance of understanding and managing the risks associated with leverage trading.

Market Volatility

The cryptocurrency market is notorious for its high volatility, with prices capable of fluctuating dramatically within short time frames. This volatility can significantly impact leveraged positions, increasing the risk of rapid and substantial losses. Even small price movements can have outsized effects on leveraged trades, making it crucial for traders to monitor the market closely and react swiftly to changing conditions.

Volatility can also lead to the risk of liquidation, where a trader’s position is forcibly closed by the exchange if the losses exceed a certain threshold. Liquidation occurs when the value of the position falls below the required maintenance margin, effectively terminating the trade to prevent further losses for both the trader and the exchange. This risk is particularly pronounced in high-leverage scenarios, where even minor market shifts can trigger liquidation.

Margin Calls

A margin call is a critical concept in leverage trading that occurs when a trader’s position falls below the required margin level. When this happens, the broker or exchange demands that the trader deposit additional funds to maintain the position. If the trader fails to meet the margin call, the position may be liquidated to cover the losses.

The process typically unfolds as follows:

- Initial Margin Requirement: When opening a leveraged position, traders are required to deposit an initial margin, which serves as collateral against potential losses. The size of this margin depends on the leverage ratio and the total value of the position.

- Maintenance Margin: This is the minimum equity that must be maintained in the trading account to keep the position open. If the market moves against the trader, reducing the account’s equity below this threshold, a margin call is triggered.

- Response to Margin Call: Upon receiving a margin call, the trader must either deposit additional funds to restore the required margin level or close the position to prevent further losses. Failure to act promptly can result in the automatic liquidation of the position.

Margin calls serve as a protective mechanism for both traders and brokers, ensuring that positions are adequately collateralized and minimizing the risk of excessive losses. However, they also highlight the inherent risk of leverage trading, particularly in volatile markets where sudden price swings can quickly erode a trader’s equity.

Risk Management Strategies

What is leverage trading crypto? Leverage trading in the cryptocurrency market offers the potential for substantial returns but also comes with significant risks. Effective risk management strategies are crucial for traders to protect their investments and minimize potential losses. Key strategies include setting stop-loss orders, diversifying leveraged positions, and conducting thorough risk assessments to understand personal risk tolerance and leverage usage.

Setting Stop-Loss Orders

One of the most fundamental risk management tools in leverage trading is the stop-loss order. A stop-loss order is a pre-set instruction to automatically close a position once the asset’s price reaches a specified level. This tool helps traders limit their losses and manage risk by providing a safety net against adverse market movements.

How Stop-Loss Orders Work:

- Defining Loss Thresholds: Traders determine the maximum amount they are willing to lose on a particular trade and set the stop-loss order at a price level that corresponds to that loss threshold.

- Automatic Execution: Once the market price reaches the stop-loss level, the order is automatically triggered, closing the position. This automation helps traders avoid emotional decision-making and ensures that losses do not exceed predetermined limits.

- Protection Against Volatility: In the highly volatile cryptocurrency market, prices can change rapidly. Stop-loss orders protect traders from unexpected price drops, providing peace of mind and allowing them to focus on other trading opportunities.

By using stop-loss orders effectively, traders can reduce the risk of significant losses and maintain greater control over their trading outcomes. It is important to set stop-loss levels strategically, considering factors such as market conditions, asset volatility, and individual risk tolerance.

Diversification

Diversification is another essential risk management strategy that involves spreading investments across various assets to reduce overall risk exposure. In the context of what is leverage trading crypto, diversification can help mitigate the impact of adverse price movements in any single asset or market.

Benefits of Diversification:

- Risk Reduction: By holding a diverse portfolio of assets, traders can minimize the risk associated with a single asset’s poor performance. If one asset underperforms, gains from other assets may offset the losses.

- Exposure to Opportunities: Diversification allows traders to take advantage of multiple market opportunities simultaneously. This can increase the potential for profits while reducing reliance on a single asset or market.

- Smoother Returns: A well-diversified portfolio tends to experience less volatility, resulting in more stable returns over time. This stability can be particularly valuable in the unpredictable cryptocurrency market.

To diversify effectively, traders should consider investing in a range of cryptocurrencies with different characteristics, such as market capitalization, technology, and use cases. Additionally, traders may explore other financial instruments, such as stocks, bonds, or commodities, to further diversify their portfolios beyond cryptocurrencies.

Risk Assessment

Conducting a thorough risk assessment is a critical step in managing leverage trading risks. Risk assessment involves evaluating personal risk tolerance, understanding the potential impact of leveraged positions, and using leverage responsibly.

Key Components of Risk Assessment:

- Evaluating Risk Tolerance: Traders must assess their willingness and ability to tolerate risk. Factors to consider include financial situation, investment goals, and emotional capacity to handle market fluctuations. Understanding risk tolerance helps traders determine appropriate leverage levels and position sizes.

- Understanding Leverage Impact: Traders should recognize that leverage amplifies both potential profits and losses. It is essential to understand how different leverage ratios affect position size and risk exposure. Traders should use leverage levels that align with their risk tolerance and trading strategy.

- Responsible Leverage Use: Responsible use of leverage involves setting realistic profit and loss expectations, using risk management tools, and avoiding excessive leverage that could lead to significant losses. Traders should focus on long-term success rather than short-term gains and prioritize capital preservation.

- Regular Portfolio Review: Ongoing assessment of trading performance and risk exposure is crucial. Traders should regularly review their portfolios, analyze past trades, and adjust strategies as needed to adapt to changing market conditions.

By conducting thorough risk assessments and using leverage responsibly, traders can make informed decisions that align with their financial goals and risk tolerance. This disciplined approach to crypto leverage trading can enhance the likelihood of achieving sustainable and consistent returns over time.

How to choose crypto leverage trading platform

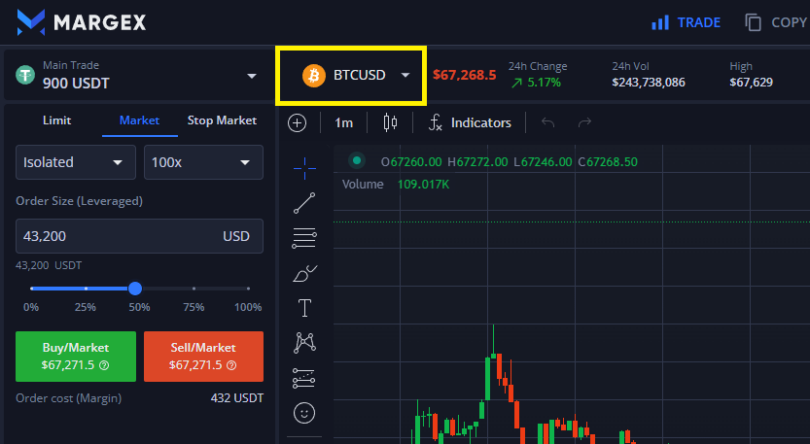

Choosing the right leverage trading platform is a crucial decision for anyone looking to engage in a cryptocurrency trading plan. With numerous platforms available, each offering different features, leverage options, and security measures, it’s important to carefully evaluate your options to ensure you select one that aligns with your trading goals and risk tolerance. Margex is a popular leverage trading platform known for its user-friendly interface, advanced security features, and competitive trading conditions. This article will explore how to choose a crypto leverage trading platform, using Margex as an example to highlight key considerations and advantages.

Key Considerations When Choosing a Leverage Trading Platform

Security and Reliability

Security should be a top priority when choosing a trading platform. A secure platform protects your funds and personal information from potential threats such as hacking or fraud. Margex employs advanced security measures, including two-factor authentication (2FA), SSL encryption, and cold storage for client funds. This ensures a high level of security and reliability, giving traders peace of mind when trading on the platform.

Leverage Options

Different platforms offer varying levels of leverage, allowing traders to choose the level that best suits their risk appetite and trading strategy. Margex offers leverage up to 100x on various cryptocurrency pairs, providing traders with the flexibility to select leverage levels that align with their trading goals. This wide range of leverage options makes Margex suitable for both beginners and experienced traders seeking different levels of risk exposure.

User-Friendly Interface

A platform with an intuitive and user-friendly interface can enhance the trading experience by making it easier to navigate and execute trades efficiently. Margex is designed with simplicity in mind, offering a clean and straightforward interface that is easy to use for traders of all experience levels. The platform provides clear access to trading tools, charts, and order types, allowing traders to focus on making informed trading decisions.

Trading Fees and Costs

Understanding the fee structure of a trading platform is essential to ensure that trading costs do not erode your profits. Margex offers a competitive fee structure with transparent pricing, including low trading fees and no hidden charges. This allows traders to manage their trading costs effectively and maximize their potential returns.

Asset Variety

The range of assets available for trading is another important consideration. A platform that offers a diverse selection of cryptocurrencies and trading pairs provides more opportunities for diversification and profit. Margex supports a variety of popular cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, as well as several trading pairs. This variety allows traders to explore different markets and strategies.

Customer Support

Access to reliable customer support can be invaluable when encountering issues or seeking assistance on a trading platform. Margex offers responsive customer support through various channels, including live chat and email, ensuring that traders can get timely help when needed. The availability of comprehensive resources, such as guides and tutorials, also aids traders in navigating the platform effectively.

Advantages of Using Margex for Leverage Trading

- Advanced Risk Management Tools: Margex provides traders with advanced risk management tools, such as customizable stop-loss and take-profit orders, enabling them to effectively manage risk and protect their investments. These tools are essential for implementing robust risk management strategies and minimizing potential losses.

- Fair Pricing System: Margex employs a unique price aggregation mechanism that ensures fair and accurate pricing by sourcing data from multiple liquidity providers. This system helps prevent price manipulation and ensures that traders receive competitive and transparent pricing.

- No Price Manipulation: Unlike some platforms that engage in unfair practices, Margex is committed to maintaining a fair trading environment. The platform’s anti-manipulation technology helps protect traders from market manipulation and ensures a level playing field for all users.

- Flexible Deposit and Withdrawal Options: Margex supports a variety of deposit and withdrawal methods, including cryptocurrencies and traditional payment methods. This flexibility makes it easy for traders to manage their funds and access their profits efficiently.

- Innovative Features: Margex continually updates its platform with new features and improvements to enhance the trading experience. These innovations ensure that traders have access to the latest tools and technologies, enabling them to stay competitive in the fast-paced cryptocurrency market.

At the End

Leverage trading in the cryptocurrency market offers traders the opportunity to maximize their potential returns by controlling larger positions with relatively small amounts of capital. This trading strategy can be highly lucrative, particularly in a volatile market like cryptocurrencies, where even small price movements can lead to significant gains. However, it is crucial to understand that leverage trading also comes with substantial risks. The same mechanism that amplifies profits can equally magnify losses, making it essential for traders to approach leverage with caution and discipline.

A solid understanding of how leverage trading works, including the platforms available, common leverage ratios, and the mechanics of margin and borrowed capital, is fundamental to navigating this complex trading strategy successfully. Additionally, effective risk management strategies—such as setting stop-loss orders, diversifying positions, and conducting thorough risk assessments—are vital in protecting investments and minimizing potential losses.

While leverage trading opens up exciting opportunities for profit, it requires a careful and informed approach. Traders should thoroughly educate themselves on the risks involved and continuously monitor their positions and market conditions. By doing so, they can leverage the potential of this trading strategy while minimizing the associated risks.

Ultimately, leverage trading in crypto is a powerful tool that, when used responsibly and strategically, can enhance a trader’s ability to capitalize on market opportunities. As the cryptocurrency market continues to evolve, leverage trading will remain an essential strategy for those looking to maximize their trading potential and achieve their financial goals.