Vitalik Buterin, co-founder and core developer of the Ethereum (ETH) network, is spearheading the celebration of Ethereum’s ninth anniversary. In a recent post on X, Buterin conveyed his excitement for the platform’s future.

Happy 9th birthday, Ethereum!

Looking forward to seeing what the next decade brings. pic.twitter.com/bXq56mIff7

— vitalik.eth (@VitalikButerin) July 30, 2024

Since the development of smart contracts, Ethereum has been a significant player in the Web3 space, drawing the attention of traders and institutional buyers worldwide.

Ethereum first ran on a proof-of-work consensus system, similar to Bitcoin. However, the effective Merge event turned the network into a proof-of-stake (PoS) system, improving its security and efficiency.

Ethereum’s Nine-Year Journey

Ethereum’s commitment to strong security is shown by the over 35 million Ether currently committed to guarding the network.

Among numerous significant changes Ethereum has seen are the recent Dencun update and the London hard fork. Because of their deflationary properties, these improvements have helped Ethereum establish its reputation as “ultra-sound money.”

$ETH Price on Ethereum’s Birthday 🎂

2024: $3,319

2023: $1,881

2022: $1,739

2021: $2,383

2020: $318

2019: $211

2018: $466

2017: $197

2016: $13— CoinGecko (@coingecko) July 30, 2024

Spot Ethereum ETFs are now legal in several countries, especially the US, which is a victory for Ethereum in its first ten years.

Reflecting an increase of more than 750,000 percent, Ethereum’s price has climbed from over 43 cents to almost $3,336 during the previous nine years. The growing acceptance of digital assets and Web-based technologies helps to explain this rise.

The first scenario stands for $ETH.

Price consolidated at $3,100 and bounced back upwards.

If the outflows are stagnating during this week, then I’m assuming we’ll be seeing a break above $3,500 and a rally to $3,800-4,000. pic.twitter.com/rwFgDHRSOO

— Michaël van de Poppe (@CryptoMichNL) July 29, 2024

Ethereum’s price should stay within its current range before hitting new highs. However, August has become an uncertain month for the crypto market because of the next FOMC statement. Expert Michaël van de Poppe predicts that Ethereum’s price might drop to $2,563 if the support level around $3,136 doesn’t hold.

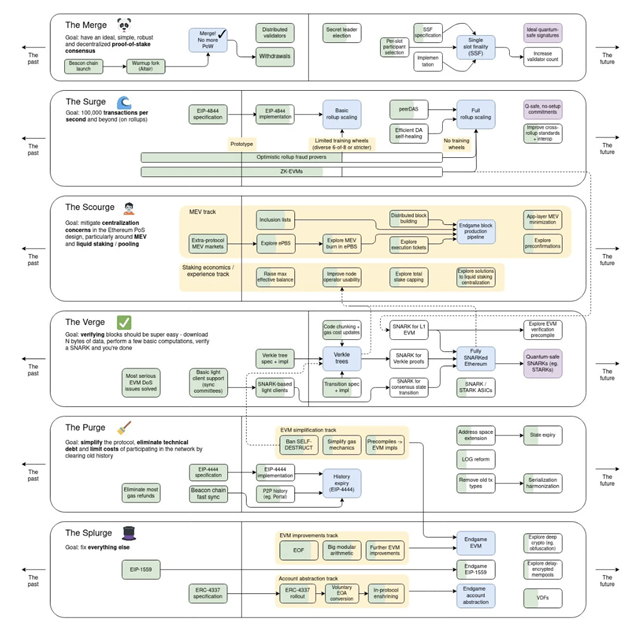

Ethereum Advancements Progress as Planned

Ethereum’s development keeps flowing naturally in line with its known road map. After major improvements and proposal execution, the blockchain is gradually approaching its next turning points.

The upcoming improvements of the Verge and Purge are expected to bring significant improvements. The Verge will incorporate Verkle trees to enable stateless client operation and greatly lower node running costs. This development is expected to reduce the layer-1 gas limit, lowering transaction fees.

Furthermore, the Ethereum Virtual Machine (EVM) is to be simplified by removing some elements, therefore improving its general efficiency.

Ethereum Price Sets Up for a Rally

Ethereum’s price tested the daily support level on July 25 at about $3,076 and rose 4.63% over the next four days. This support level corresponds with the past trendline resistance, which has now changed to support. Ethereum is trading slightly lower at $3,302, down 0.43%, Tuesday.

If the $3,076 support level holds, Ethereum may rise by 15%, approaching its 61.8% Fibonacci retracing barrier at $3,530.

On the daily chart, the Relative Strength Index (RSI) and the Awesome Oscillator (AO) both momentarily dropped below their neutral thresholds of 50 and zero, respectively. Both momentum indicators must hold above these levels for a sustained recovery rally to help generate positive bullish momentum.

If the bullish attitude continues and the general view of the crypto market stays favorable, Ethereum’s price can rise above $3,530. This could cause a further rise of 5.3%, approaching its daily peak of $3,721 on June 9.

On the other hand, if Ethereum’s daily candlestick were to close below $2,817 and show a lower bottom inside the daily period, it could point to a continuous bearish attitude. This might cause Ethereum’s price to drop 7%, maybe approaching its daily support level of $2,621.

Ethereum ETF Inflows and Outflows

Farside data shows that yesterday’s net sales of $98.3 million from spot Ethereum ETFs marked the start of the second trading week for these new types of investments.

As with the first week of trading in Ethereum ETFs, $210 million left Grayscale Ethereum Trust (ETHE), making it the only ETF to show withdrawals. The net outflows of ETHE since it started is $1.72 billion. On the other hand, BlackRock’s ETHA saw inflows of $58.2 million, taking its total inflows since its launch to around $500 million.

FESH from Fidelity, ETHV from VanEck, and ETHW from Bitwise saw double-digit inflows of $24.8 million, $10.9 million, and $10.4 million, respectively.

EZET from Franklin Templeton received $2.5 million in inflows, and Ethereum Mini Trust (ETF) from Grayscale, which has lower fees, received $4.9 million.

CoinGecko claims the difference in movement between spot Bitcoin and Ethereum ETFs is related to the 3.3% drop in the value of all cryptocurrencies worldwide over the last 24 hours.