The crypto markets have recently become a more popular location for day traders. Crypto markets, unlike traditional markets, never close. Day trading cryptocurrency does not require a brokerage or margin account, making it easier to engage in short-term trades than on the stock exchanges.

Cryptocurrency is a new and fascinating sector, but it comes with hazards for people who want to invest in it. With thousands of new cryptocurrencies appearing on exchanges and trading platforms every day, anyone thinking about investing in a cryptocurrency should be aware of the market’s volatility and speculative character.

A day trader should have a full understanding of crypto as well as trading concepts, regardless of the market. Only put your money where you’re willing to lose it. Here’s all you need to know to get started day trading crypto if you have immaculate risk management abilities and steely nerves.

What is Day Trading?

Day trading entails actively purchasing and selling assets on the same day in order to profit from price fluctuations. Day traders frequently borrow or leverage capital each day in order to purchase new assets, but this significantly increases their risk. This advanced level of investment necessitates constant market and news monitoring, is fast-paced, and involves a significant amount of speculation. Professional day traders are often highly skilled and knowledgeable about the markets, products, techniques, and hazards involved. It’s critical to recognize the significant dangers associated with any sort of day trading before getting started.

Things to Know About Crypto Day Trading

-

Think about why you’re investing in cryptocurrency in the first place. The most important question to ask oneself before investing in cryptocurrencies is why you’re doing so. Are you intrigued by the cryptocurrency mania merely because it’s popular? Is there a compelling reason to invest in one or more digital tokens in particular?

-

Get a feel for the industry. Before investing in digital currencies, it’s critical for novice investors to get a sense of how the industry works. Take the time to learn about at least top currencies available.

-

Join a cryptocurrency enthusiasts’ online community. Things move quickly in the digital currency market because it’s such a fashionable subject. Part of the reason for this is that there is a large and active community of digital currency investors and aficionados that communicate with one another 24 hours a day, seven days a week.

-

Read white papers on cryptocurrency. The characteristics of a digital currency are more crucial than word of mouth. Make the effort to find a white paper for any project you’re going to trade.

-

It’s all about the timing. You’ve probably developed a feel for the cryptocurrency sector as a result of your meticulous research, and you’ve decided on one or more projects in which to invest. The next step is to choose the best timing to make your trade. The world of digital currencies moves swiftly and is notoriously volatile.

Best Day Trading Cryptocurrency Strategy

Technical Analysis

The study of price changes using charts is known as technical analysis (TA). Traders utilize TA to profit from price fluctuations, even when a cryptocurrency is losing value.

Here are some of TA’s main assumptions:

- The price reflects all information.

- Human psychology has a tendency to replicate itself throughout time.

- Statistical analysis can assist in determining what the price will do in the future.

Not everyone is a good fit for TA.

Although some believe that big cryptocurrencies such as Bitcoin will eventually reach zero, many in the crypto community believe that the "secular trend"—which is comparable to "long-term direction"—of significant coins such as Bitcoin is upward. For this reason, as well as others such as taxes, they prefer to invest for the long term and simply hold on for dear life (HODL). Of course, no TA is required for HODLing.

News and Sentiment Analysis

Sentiment analysis is a technique for determining the sentiment strength of a textual source in order to make better decisions. The application of sentiment analysis in financial news is the focus of this research. The semantic orientation of documents is estimated initially by fine-tuning an existing financial domain technique. The current method has limitations in terms of picking representative phrases that effectively express the text’s sentiment. Two different strategies are tested: one uses noun-verb pairings, and the other is a hybrid. In a trial, the noun-verb method produced the best outcomes.

Investor sentiment analysis can be used to understand how people feel about a particular cryptocurrency or asset. Sentiment can sometimes be a good indicator of price movement in the future. This is also an example of how trading psychology can influence a market, acting as a forecasting tool for future price fluctuations in a certain asset.

News (economic, political, and industry-related) and social media are only a few of the factors that influence crypto opinion. These factors have an impact on cryptocurrency market volatility, trading volume, all of which help to influence crypto sentiment.

Range Trading

Range trading is widely used in forex trading and can be applied to day trading crypto. This approach identifies overbought and oversold currency pairs (also known as areas of support and resistance). Range traders buy when the market is oversold or at a support level, and sell when the market is overbought.

Range trading can be done at any time, but it works best when the currency market is devoid of direction and no obvious long-term trend is visible. During a trending market, range trading is at its weakest, particularly if market directional bias is not taken into account. 2017 was a terrific year for range traders, thanks to generally sideways-going currency markets.

Range Types:

1. Rectangular Range

You’ll witness horizontal price fluctuations between lower support and an upper resistance when you’re dealing with a rectangle range. This is typical in most market circumstances but less so than a continuation or channel ranges.

Notice how the currency pair’s price movement stays inside the upper and lower lines of resistance in the chart below, forming a distinct rectangle range that establishes clear criteria for finding potential purchase opportunities.

Horizontal ranges on a chart should be easy to see even without indicators. Clear support and resistance zones, a flattening of the moving average lines, and highs and lows within a horizontal band are all common features of these ranges.

✅ Advantage: Rectangular ranges signify a period of consolidation and have a shorter time span than other range types, allowing for speedier trade opportunities.

❌Disadvantage: These ranges can lead traders astray if they don’t look for long-term patterns that may be impacting the rectangle’s development.

2. Diagonal Range

Many range traders are fascinated by diagonal ranges in the form of price channels, which are frequent chart patterns.

A sloping trend channel lowers or raises the price in a diagonal range. This channel might be square, widening, or narrowing.

✅ Pros: Breakouts in diagonal ranges tend to occur on the opposite side of the current action, giving traders an advantage in anticipating breakouts and profiting.

❌ Cons: While many diagonal range breakouts happen fast, others can take months or even years to develop, making it difficult for traders to make judgments based on when they expect a breakout to happen.

3. Irregular Range

At first glance, most ranges don’t appear to have any discernible pattern. When a severely irregular range develops, it usually revolves around a central pivot line, which is surrounded by resistance and support lines.

It can be tough to determine support and resistance locations in an irregular range, but it will give opportunities for those who prefer to trade toward the central pivot axis rather than at the extremes.

✅ Pros: For traders who can spot the lines of resistance that make up these ranges, irregular ranges can be a terrific trading opportunity.

❌ Cons: Traders must often utilize extra analysis tools to spot irregular ranges and probable breakouts due to their intricacy.

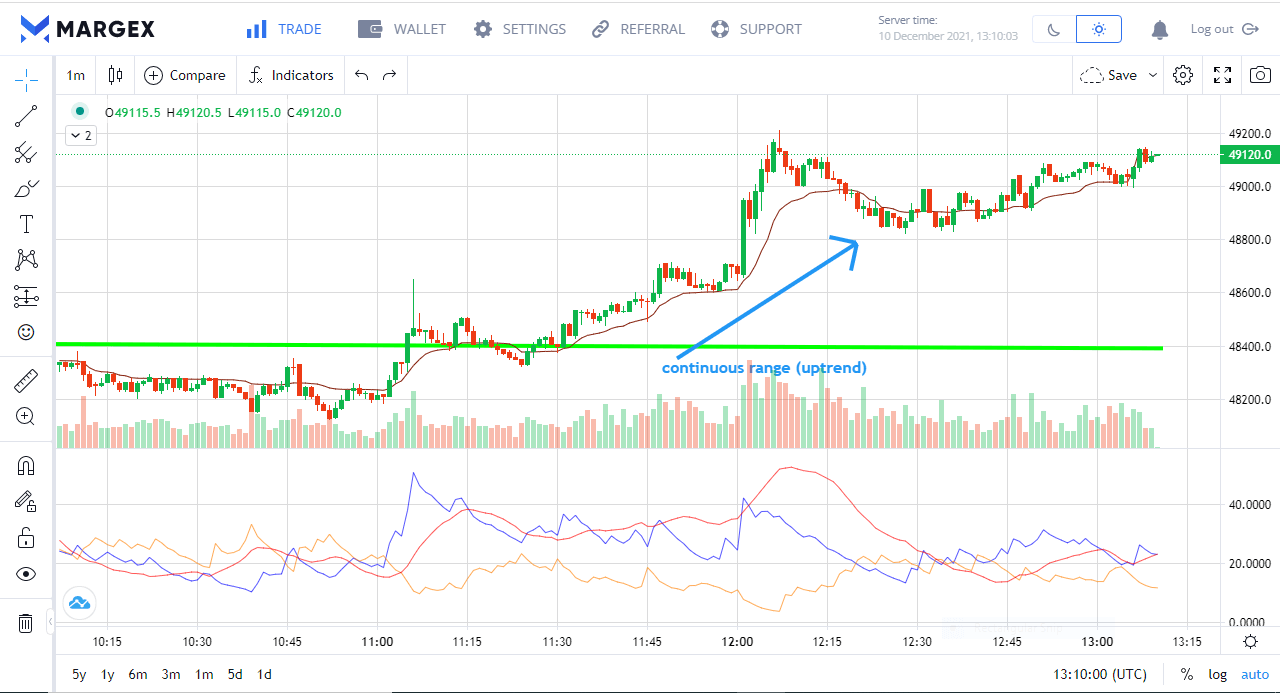

4. Continuation Range

A continuation range is a chart pattern that develops when a trend is in progress. Triangles, wedges, flags, and pennants are all examples of these ranges, which frequently arise as a reversal of a dominant trend. The chart below depicts the formation of a triangular pattern within an existing price trend, resulting in a period of consolidation within a narrow range:

Continuation ranges, whether bearish or bullish, can arise at any time.

✅ Pros: Continuation ranges can appear regularly in the middle of continuing trends or patterns, and they frequently culminate in a speedy breakout, which will appeal to traders looking to open a position and profit swiftly.

❌ Cons: Because continuation patterns occur within other trends, analyzing these trades and accounting for all of the variables at play is more difficult. For new traders, this can make continuation ranges a little more difficult.

Scalping

Scalping is a popular intraday trading method that focuses on profiting from minor price swings. The theory is that by accumulating small but frequent profits during the trading day, a significant profit will be generated by the conclusion of the day.

Scalpers, as opposed to day traders, place a greater emphasis on technical analysis rather than fundamental analysis. Candlestick chart patterns, support and resistance levels, and other technical indicators like Bollinger Bands and Fibonacci retracements will all be used prominently by cryptocurrency scalpers.

Which Cryptocurrency is Best For Day Trading?

Bitcoin is preferred by the vast majority of international traders. It’s notable for its lack of centralized control and server. There are no shared storage facilities. It’s a coin that can be purchased by anyone.

How to Day-Trade Bitcoin

Here are the steps to trading Bitcoin:

- Find out what influences Bitcoin’s price.

- Select a Bitcoin trading strategy and style.

- Choose how you want to get involved with Bitcoin.

- Make a decision about whether you want to go long or short.

- Set your boundaries.

- Make a trade and keep an eye on it.

- To take a profit or cut a loss, close your position.

Tips for a Beginner Day-Trader

- Ensure you have a vast knowledge of the cryptocurrency you want to day trade.

- Set money aside just in case you experience losses. Moreover, stay disciplined.

- Set aside time for day trading.

- Start small, with small trades.

- Time your crypto trades.

- Set your limit orders and avoid losses.

What are the Downsides of Day Trading Crypto?

- Scalability issues are one of the most serious concerns with cryptocurrencies.

- There are some issues with cybersecurity.

- The prices are volatile and cryptocurrencies lack intrinsic value.

Conclusion

Consider this your day trading cryptocurrency handbook, and you’ll be able to avoid the majority of the pitfalls that many traders face. Consider the simplicity of use, security, and pricing structure when selecting a broker and platform. One of the best trading platforms available is Margex. Cryptocurrencies can be traded using a variety of methods. Whatever option you choose, make sure technical analysis and news play a significant role. Finally, be mindful of regional variances in taxation and laws; you don’t want to lose money due to unforeseen requirements.

FAQ

Is it possible to day trade crypto?

Day trading cryptocurrency is a high-risk endeavor made possible by cryptocurrency markets’ unique volatility and liquidity.

Which cryptocurrency is best for day trading?

Most international traders favor Bitcoin since it is very liquid and well known all over the world.

Is Crypto good for day trading?

Day trading in cryptocurrency is a high-risk activity. Only put your money where you can afford to lose it. Consider asset liquidity, volatility, and trading volume when deciding what to invest in.

How much do Crypto day traders make?

Micro Coins with high volatility can increase in value by a factor of ten in a single day, giving lucky investors exponential gains. Because of the high volatility, those coins can move in the opposite direction just as quickly as they can move in the right direction. Risk rises in tandem with the potential payoff.