Cryptocurrency trading provides many great ways to make money, and one of these is scalp trading. Many experienced crypto traders use this popular trading strategy to make money, but it also comes with some risks. Therefore, to maximize your profits and cut down on your losses, it’s important to understand the ins and outs of the game. In this guide, we’re going to teach you all about crypto scalp trading. We’ll cover what scalp trading is, the most effective indicators and techniques for scalp trading, and ways to protect yourself from risks. Are you ready to learn? Let’s get started.

What is scalp trading?

With the crypto market being very volatile, trading newbies are often confused about ways to make a profit. If you are the type of person who can’t stop looking at the chart, then scalp trading is an effective technique for you to make money.

Scalp trading is a short-term trading strategy where traders profit from small market price changes. In fact, scalp trading is the shortest way to profit in all trading markets, including the Forex and stock markets. It requires a lot of skill, experience, and a deep understanding of how the markets move.

In crypto trading, scalping is a strategy that involves buying and reselling digital assets immediately after a small profit is made. Traders make a modest profit by buying and selling cryptocurrency numerous times each day.

How do traders make profit from crypto scalping?

So you want to start scalping cryptocurrencies? Great! But before we get started, let’s take a minute to discuss how scalpers make profit.

Scalpers open trade positions for a few seconds or minutes before closing them if the trade goes well or to minimize losses. They are like the speed of a jet engine when opening and closing trades.

However, scalping can be high-risk due to market volatility; hence, traders must analyze to understand current market conditions.

There are many ways to make profits from scalping, depending on the trader’s trading strategy. Some scalpers manually monitor market activity for entry opportunities, but this requires full attention, speed, and accuracy. They are like cheetahs waiting to pounce quickly on the next trading opportunity before it disappears.

Scalp trading can be time-consuming and requires a lot of speed, so some traders use trading bots to automate and speed up the process. Whatever the method, scalping can be a profitable way to trade cryptocurrencies.

How is scalp trading different from day trading?

Some experts say scalping is a form of day trading, but they are two completely different strategies. For one, a day trader is someone that opens and closes their trade position within the same day. That is, they don’t trade overnight.

The main difference between day trading and scalp trading is the timeframe. Scalpers open trading positions for a brief period of time, usually seconds to some minutes. Day traders open trading positions over a longer period of time, usually one hour to several hours but no longer than a day.

To make it easier, see it this way: Scalpers open more traders with lower risk and profits, while day traders open less trades with higher risk and profits.

How is crypto scalp trading different from Forex scalping?

Crypto scalping is similar to forex scalping in that traders hold trades for a short period of time and open and close several positions in a single day. The main distinction between them, though, is their level of volatility. Because the crypto market is smaller than the Forex markets, volatility is higher, particularly when dealing with altcoins.

Scalpers who trade cryptocurrencies open and close more positions than those who trade forex. They also prefer to use higher leverage, although this increases risks. Thus, they get their profits faster and close trades faster.

Crypto scalpers can also scalp at any time of the day, as the markets are always open. Forex markets, on the other hand, are closed after hours and on weekends.

Scalp trading techniques

Now that you know what crypto scalping is, it’s time to learn some techniques.

As mentioned earlier, there are different ways to profit from scalping. Some of these ways are riskier than others and it all depends on the trader’s technique. The idea is not to make a lot of money at once, but to make small profits repeatedly using market volatility. Let’s take a look at some of the most popular scalping strategies in the crypto markets.

Range trading

Range trading is one of the most popular crypto scalping techniques. It involves monitoring the support and resistance levels within a range of time to make profit if the trend continues. The bottom of the range acts as the support level while the top of the range acts as the resistance level. When the price hits the support, scalpers open a long (buy) position. When the price hits this resistance, scalpers open a short (sell) position.

It’s possible that the support and resistance levels will break every time the price approaches them. Hence, scalpers sometimes use stop-loss to avoid losses when a breakout happens. Limit orders are also occasionally used by scalpers to trade ranges.

Bid-ask spread

Scalpers also try to profit from the bid-ask spread, which is the difference between the price at which buyers are prepared to buy crypto, and the price sellers are willing to sell. Here are the two ways bid-ask spread can happen:

Wide Bid-Ask Spread: A wide bid-ask spread happens when there are more buyers than sellers. Consequently, the asking price will be higher than usual in relation to the bid price. Since there’s more demand than supply, scalpers can profit from this scenario by selling.

Narrow Bid-Ask Spread: A narrow bid-ask spread happens when the bid price and ask price are very close because there’s a lot of liquidity. When there is a high level of liquidity in an asset market, it is easier for buyers to acquire the asset. Hence, the asking price will be lower than usual in relation to the bid price.

Leverage

As mentioned earlier, traders also like to use leverage when scalping. Leverage is an important tool that increases buying or selling power, allowing you to trade larger amounts. Since scalpers are only in the market for a few seconds to minutes per trade, using leverage can help them make more money.

However, using leverage is high-risk as it also increases potential losses. Traders, especially newbies, are generally encouraged to exercise caution when using leverage.

Arbitrage

Arbitrage is a quick way to take advantage of price differences. Crypto arbitrage trading can be described in layman’s terms as the process of purchasing a digital asset on one exchange and then selling it at a higher price on another exchange or on the same exchange. There are two types of arbitrage in crypto trading:

Spatial arbitrage: Also called geographical arbitrage, happens when traders buy on one exchange and sell on the other. This type of arbitrage is not possible if the asset does not trade in both exchanges..

Pairing arbitrage: Pairing happens on the same exchange. Traders take advantage of changes in a trading pair.

A less popular way to trade crypto arbitrage is by selling through P2P (peer-to-peer) on crypto exchanges. In this type of arbitrage, traders buy crypto through the exchange’s fiat method and resellto other traders at a slightly higher price on the exchange’s P2P trading platform.

Price Action

Price action refers to the price movements of an asset over time plotted on a chart.

Many scalpers rely on this price action and the formation of trends to interpret and make trading decisions. Although it might sound easy, scalping with price action requires a great deal of skill and experience.

Margin Trading

Margin trading is a type of leverage trading. This approach requires you to commit some assets as collateral to borrow capital from your broker. Scalpers can get more capital through margin trading, which boosts their trading strength and allows them to generate profits quickly. Like leverage trading, margin trading can also amplify losses.

Indicators for crypto scalping

Many crypto traders use current price support and resistance levels to get a quick idea of how to go about scalping. However, performing technical analysis using indicators is an advantage when scalping. Technical analysis is a technique for predicting the future price movement of cryptocurrencies by identifying patterns in candlesticks and trends in charts. Since scalpers want to make as much profit as possible in a short period of time, they want to enter and exit trades at the right time. Therefore, good scalpers are proficient in technical analysis.

By using indicators, you can determine the direction the market is most likely to move, and capitalize on these movements to make quick profit. Here are some of the best indicators for crypto scalping:

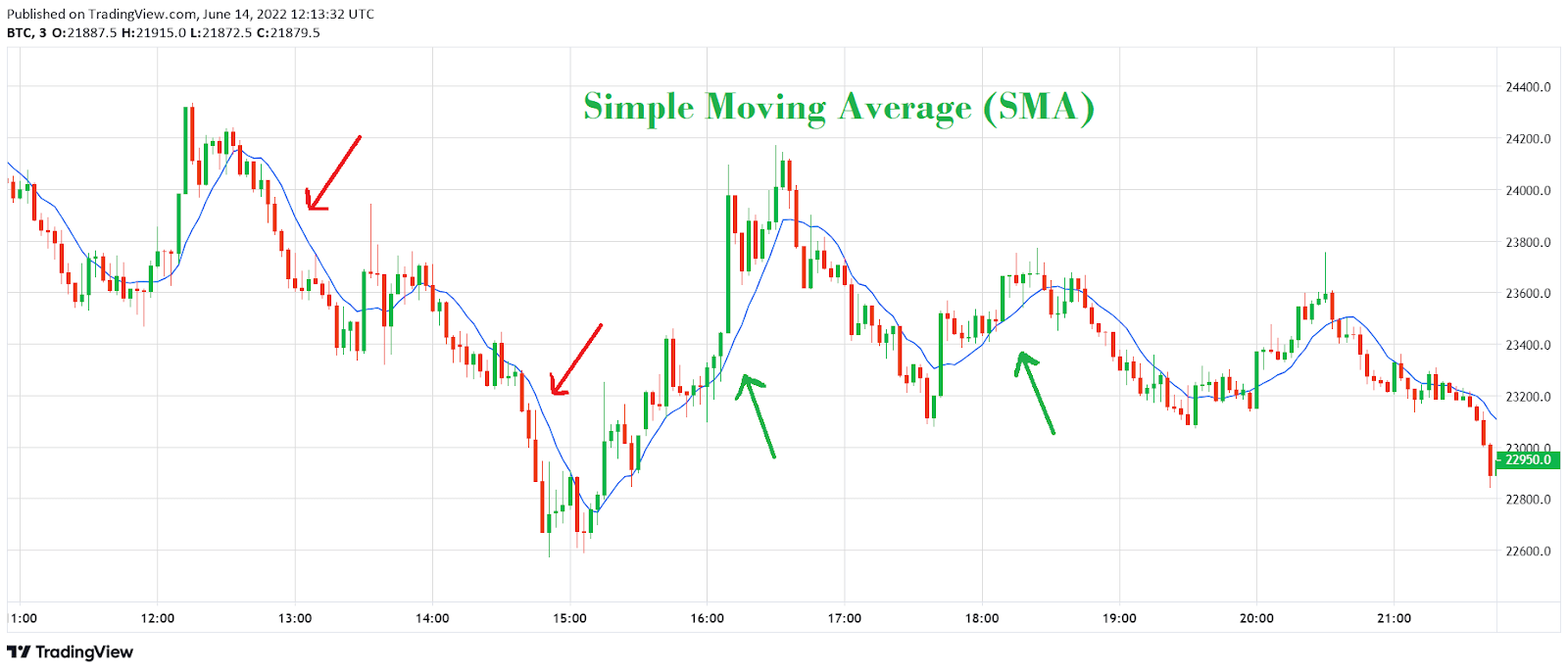

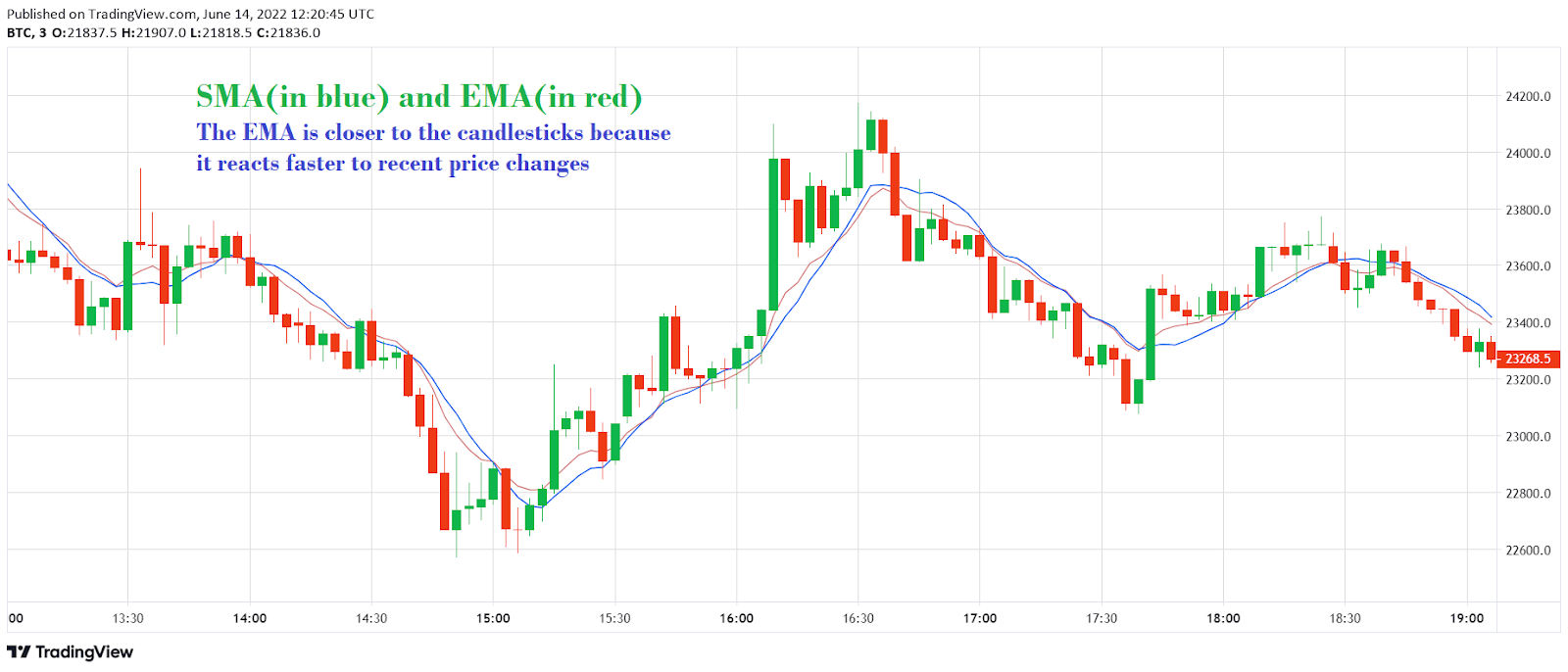

Moving Average (MA)

A moving average is a simple technical indicator that tracks price data by calculating the average price over a set time period. This helps you to more accurately predict future price movements.

There are different types of moving averages, but the most commonly used is the Exponential Moving Average (EMA) because it responds more quickly to recent price changes. Simple Moving Average (SMA) is another widely used moving average. The SMA calculates the average of the past N periods, where N is usually set to 10 or 20.

When using a moving average for scalping, you want to watch for the direction of the line for buy and sell signals.

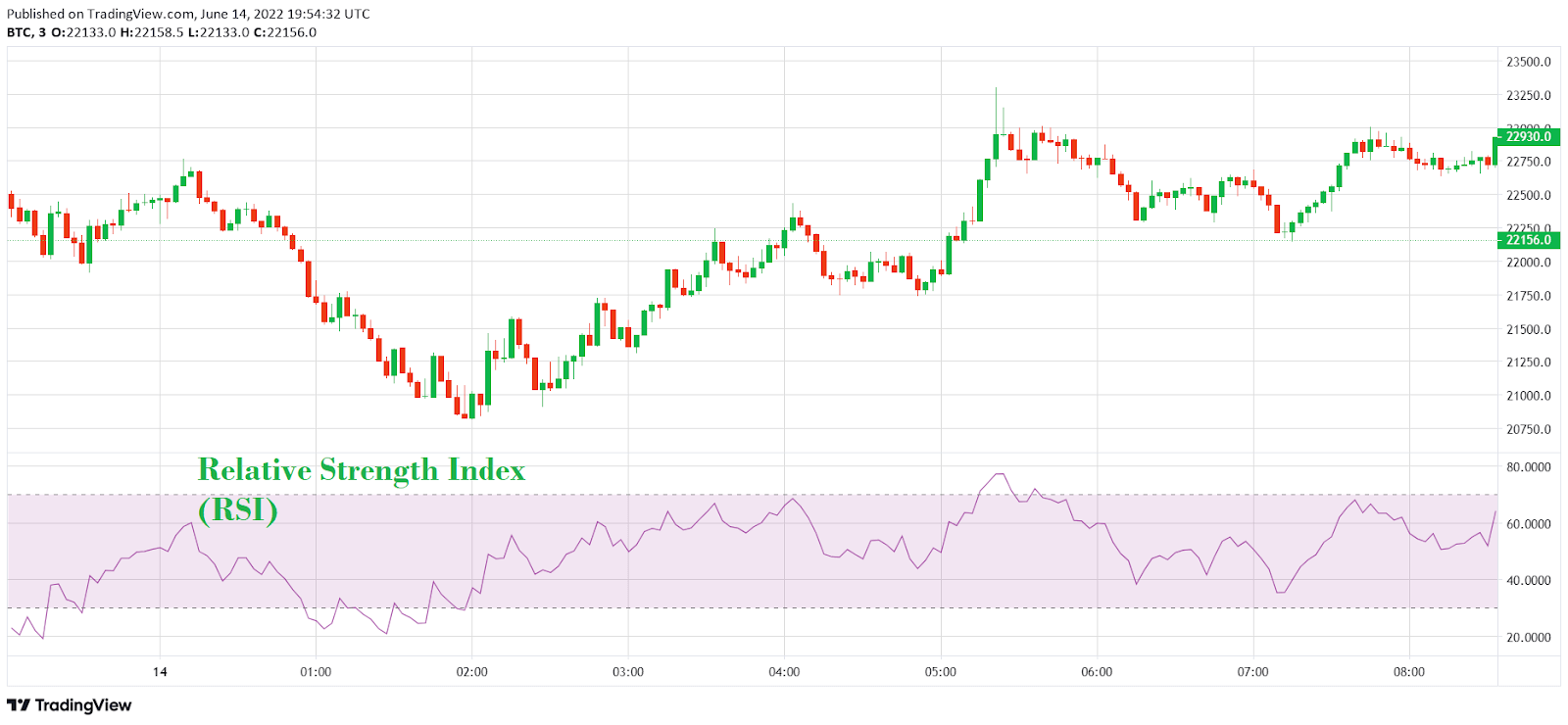

Relative Strength Index (RSI)

The Relative Strength Index is a momentum indicator which calculates the speed of the recent price change between two extremes. When scalping with the RSI, traders can assess the strength of market movements and calculate trade entry and exit points more precisely.

The RSI reading is always fluctuating between 0 and 100. When the reading is more than 70, scalpers will prepare to sell in anticipation of a reversal. When the indicator falls below 30, scalpers will prepare to buy in anticipation of a rebound.

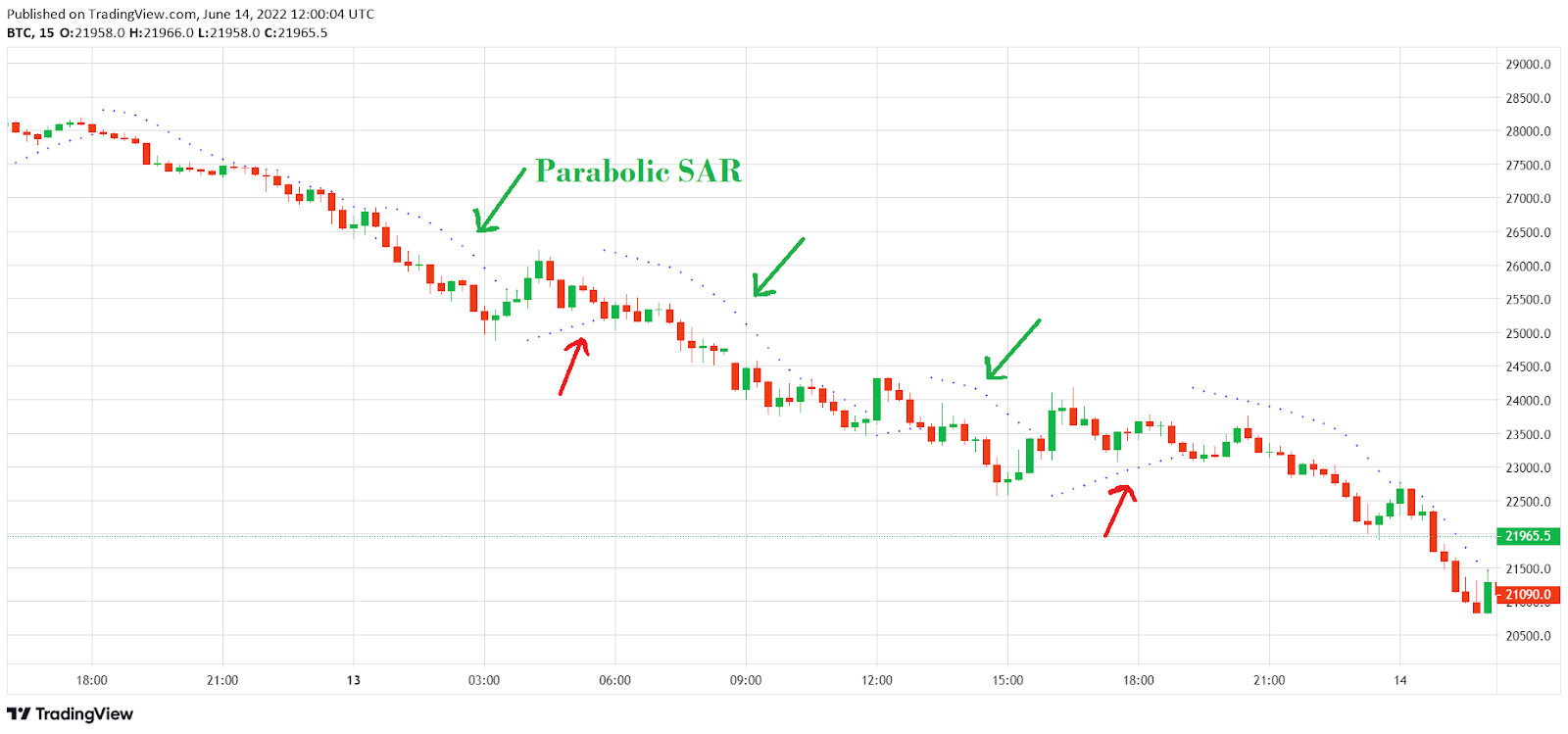

Parabolic SAR (Stop And Reverse)

The parabolic SAR (stop and reverse) indicator is a series of dots on charts used by technical traders to identify trends and reversals. During an upward trend, the dots are positioned below the price, whereas they are positioned above the price during a downward trend.

Tools for Scalping Cryptocurrencies

If you’re looking to get into scalping cryptocurrencies, it’s important to arm yourself with the best tools and resources possible. Now let’s take a look at some of the top tools for scalping cryptocurrencies.

Trading Bots

Scalping can be very strenuous and time consuming since it requires traders to always be ready to open and close trades multiple times during the day. This is where trading bots come in to automate the process.

Bots are computer programs that can automatically execute trades for you. They’re perfect for scalping, as they can enter and exit positions quickly and at the right price points. They can also go through a lot of data at once and they are free from human emotions.

There are different types of bots available, so it’s important to do your research before deciding which one is right for you. There are bots that can be programmed to trade based on specific indicators, bots that can copy the trades of other successful traders, and bots that use artificial intelligence to make decisions on their own.

Regardless of which type of bot you choose, make sure you test it out in a demo account first to ensure that it meets your expectations.

Signals

Another tool for scalpers is signal providers. These services provide traders with information on when to buy and sell cryptocurrencies, allowing you to make more profits in a shorter time frame. There are many free and paid signal providers out there, but it’s best not to depend on them too heavily and instead conduct your own technical analysis..

Technical Indicators

The most popular technical indicators for scalping are the MACD, RSI, and SMA. The MACD (Moving Average Convergence Divergence) is a trend-following indicator that helps you identify when a cryptocurrency is overbought or oversold. The RSI measures the momentum of a cryptocurrency and can help you determine when it’s time to sell or buy. Lastly, the SMA is a simple Moving Average that can be used to identify the trend of a cryptocurrency.

All three indicators are essential for scalping and should be used together to get the most accurate signals possible.

Trading Charts

Charts are your greatest friend when it comes to trading cryptocurrencies. It is impossible to track price fluctuations without the chart.

There are a few different types of charts you can use, but we recommend using line charts or candlestick charts.

With line charts, you’ll be able to see the average price of a cryptocurrency over a set period of time. This makes it easy to track overall trends and identify buying and selling opportunities.

Candlestick patterns, on the other hand, give you a more detailed view of price fluctuations. They show the open, high, low and close prices of a cryptocurrency over a given time period. This allows you to see price fluctuations in more detail and make calculated trades.

Whichever type of chart you choose, make sure you use it to your advantage by tracking price fluctuations and trends.

How to Set up a Crypto Scalping Trading Strategy

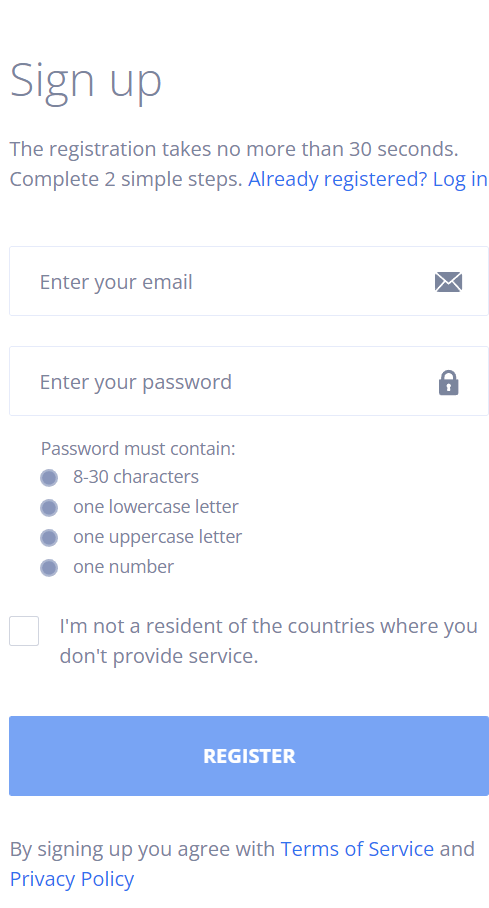

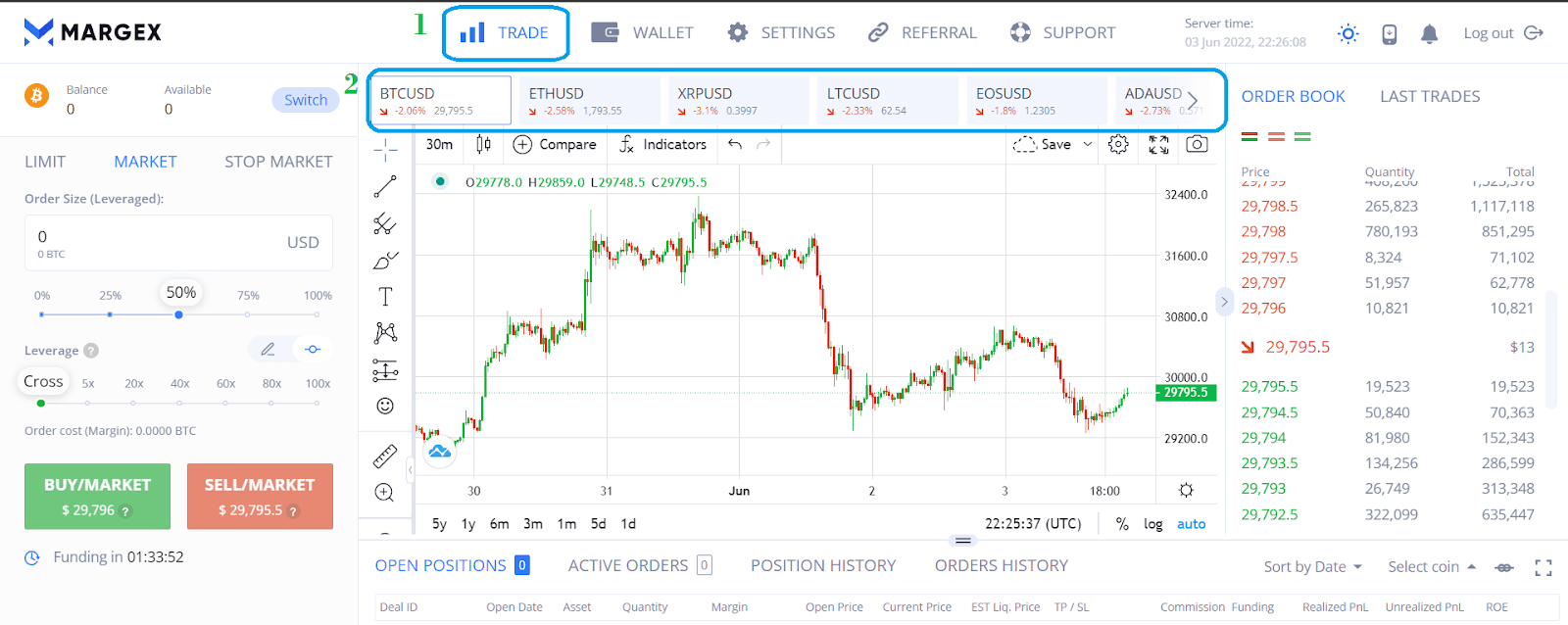

Step 1: Sign up for a live trading account at Margex.com. After clicking “Start Trading,” you’ll be sent to a Sign Up page where you’ll be asked to provide your information.

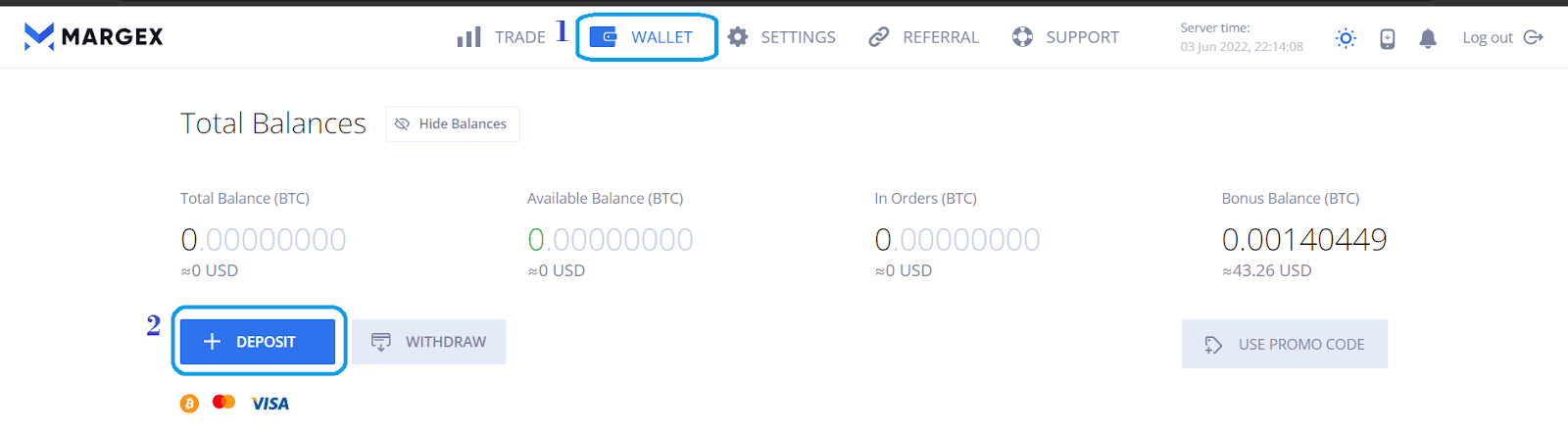

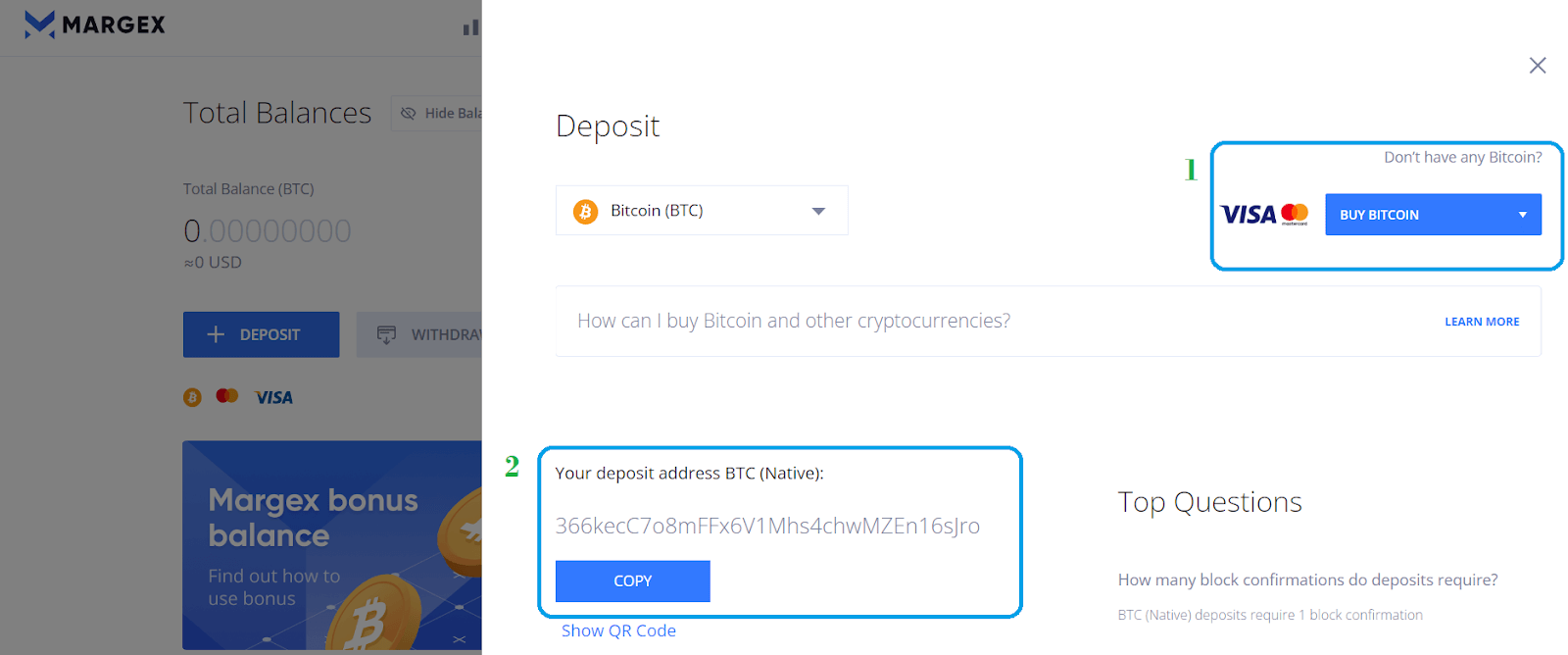

Step 2: Next, you need to deposit to begin trading. Click on the “Wallet page” and select “+Deposit.” You can fund your account by buying crypto through Changelly or ChangeNow. You can also deposit by copying your wallet address to transfer crypto to your Margex wallet.

Step 3: After a successful deposit, return to the “Trade” page to begin trading. Select the cryptocurrency you wish to trade from the list of different crypto pairs available. You have the choice to go ahead and start scalping from here using price action.

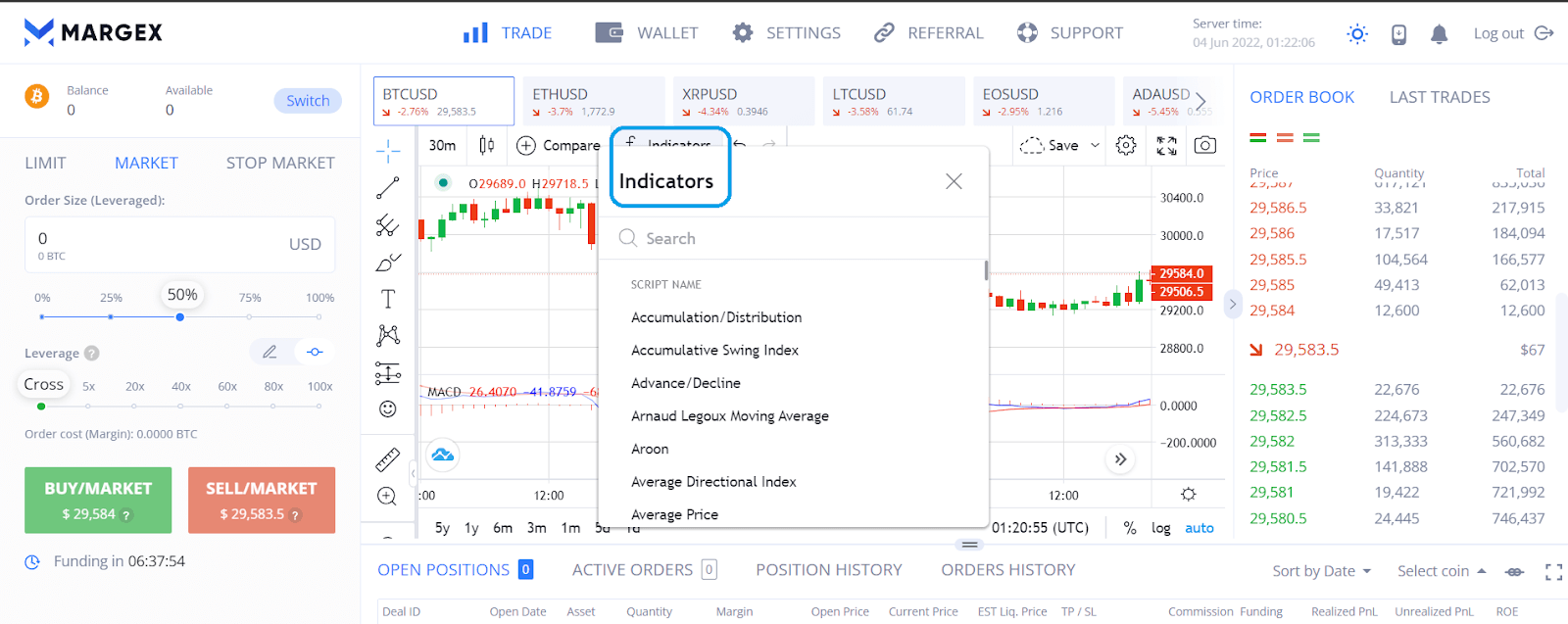

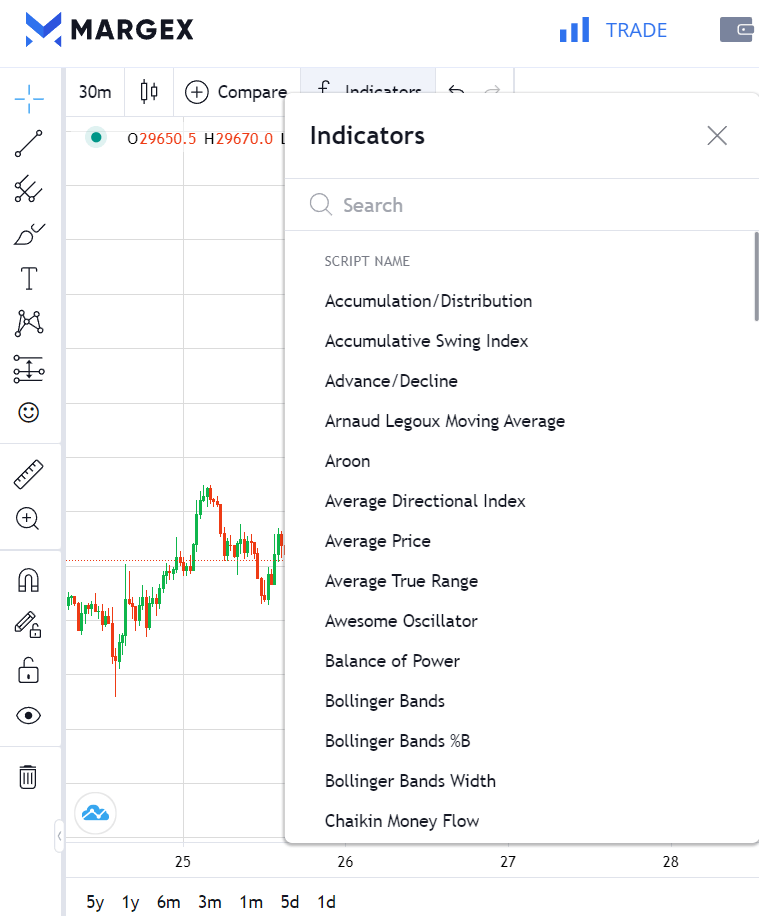

Step 4: If you wish to conduct technical analysis before scalping, click on the “Indicators” tab to select any of the various indicators available. For example, the Exponential Moving Average. You can also combine multiple indicators for your analysis.

The Pros and Cons of Crypto Scalping

Crypto scalping, like every aspect of crypto trading, comes with its own pros and cons. Here are some of them.

Pro Tips for Scalping

1. Always use stop losses to help you protect your profits and limit your losses.

2. Try to enter trades as close to the support and resistance levels as possible. This will give you the best chance of success.

3. Use indicators to help you identify trend reversals and enter trades at the right time.

4. If you’re new to scalping, start with a demo account to get a feel for it.

5. Be prepared to exit trades quickly if the market moves against you. Remember – scalp only when the odds are in your favor.

FAQ

Which cryptos are best for scalping?

It’s best to scalp cryptocurrencies with low volatility and high liquidity. Traders prefer Bitcoin and Ethereum over altcoins because of their low volatility.

Is scalping illegal?

Scalping is a legal trading strategy. Although some exchanges like to discourage scalping by setting the spread or commissions too high.

How do you scalp cryptocurrency?

Scalping cryptocurrency involves opening trading positions for brief lengths of time, typically seconds to minutes.

Is scalping better than day trading?

Depending on the trader’s intentions, both strategies are great ways of trading cryptocurrencies. Scalping might be less risky than day trading due to its shorter duration of open positions.

Which timeframe is best for scalping?

Scalpers usually use small timeframes of one minute to 15 minutes. Some can go up to 30 minutes timeframe, but no further.