The cryptocurrency industry is expanding at an alarming rate, and it seems that nothing will be able to stop it for the time being. Every day, individuals trade billions of dollars worth of cryptocurrencies without the involvement of middlemen, governments, or centralized exchanges.

Since it is a new form of the financial industry, the cryptocurrency market is projected to experience price volatility as a result of the absence of a long track record. This price volatility, if not adequately accounted for, may have a negative impact on an investor’s earnings.

Slippage is one of the numerous drawbacks that come with the high level of volatility and the lack of liquidity in the cryptocurrency market. This is a term that is often used by experienced and professional traders, and it might be confusing to new and inexperienced traders.

What strategies do you use to deal with market volatility in the cryptocurrency industry? Obviously, nobody wants to lose their hard-earned money, thus this is a commonly asked question. This guide will assist you in understanding slippage in crypto trading and how to deal with it like an experienced trader.

What is slippage in crypto trading and why does it happen?

The growing popularity of cryptocurrency trading has also added new words to the general public’s financial language and slippage is one of these.

Due to the general unpredictability of cryptocurrencies, the price of an asset can change very fast. When this change has an impact on a trader’s ability to enter a trading position, it is referred to as slippage. Slippage is defined as the difference between the expected price of a trade and the actual executed price of the trade. In other words, it is the difference in price between when a trade is submitted and when the trade is executed by the trading platform. .

Slippage is a very common term in all types of markets due to the way it occurs, including the forex and the stock markets. However, due to the high level of price volatility in cryptocurrency markets, it happens significantly more frequently than in traditional markets, especially in altcoins with low trading volumes and a high likelihood of a sharp surge or decline in price.

Slippage can also occur as a result of low liquidity. The list of cryptocurrencies that are available for trading is quite large, and some are more liquid than others in terms of order book depth. Only a select few have a high enough liquidity to reduce slippage.

A crypto asset’s liquidity relates to how simple it is to convert it into cash within a short period of time, and if this can be done without slippage. High liquidity means there is a stable market with little price swings, and a crypto asset with high liquidity often trades at or around its market price, reducing slippage in the process.

Cryptocurrencies with low trading volumes most often also have low liquidity and high volatility, leading to drastic price fluctuations before the order is executed..

Example of slippage

Slippage will certainly happen to every trader, and it may manifest itself in two ways: either by increasing or decreasing your buying power, depending on the situation. More on that in a moment. Let’s first take a look at an example of slippage occuring..

For example, a cryptocurrency is currently trading at $42 on the open market. Suppose you want to open a long position on one unit of the crypto asset, you place your order at $42. There is always the possibility that something may happen or the price will change in the fraction of a second it takes for your order to be completed.

When it is executed, you realize that it has been executed at a price of $42.80. Your trade would be processed at a higher price than you had anticipated because of the $0.80 difference in execution price, which is known as slippage. If there was a higher price fluctuation in price, your slippage would be higher.

Positive and Negative slippage

Let’s look at the two types of slippage that can occur in crypto trading.

Positive slippage

This form of slippage is beneficial to the trader, which is why it is referred to as positive slippage. The term “positive slippage” refers to when the price of an order is executed at a lower price than the expected price. This implies that if the market moves in your favor, you may be able to boost your buying power.

Example: You open a long position for $40 but it is executed at $39.50 because of the quick change in price. The execution price was $0.50 lower than the projected price, resulting in a $0.50 positive slippage for your trade.

Negative slippage

When a trader experiences negative slippage, they lose money and have less buying power. In this type of slippage, the actual executed price of an order is higher than the price it is submitted.

Example: You open a long position for $40 but it is executed at $40.50 because of the quick change in price. The execution price was $0.50 higher than the expected price, resulting in a $0.50 negative slippage for your trade.

How to avoid slippage

Due to the volatility of the cryptocurrency market and the frequent fluctuations in crypto prices, it is impossible to completely eliminate slippage. Professional traders, on the other hand, use a number of strategies to keep slippage to a bare minimum. Here are a few examples of them that you can use as well.

1.Use limit orders instead of market orders

The most effective strategy to reduce slippage in crypto trading is to make use of limit orders instead of market orders. This is due to the fact that a limit order will only be executed at the price you set, helping you reduce slippage in the process. This is in contrast to market orders which are executed as fast as possible at the best possible market price.

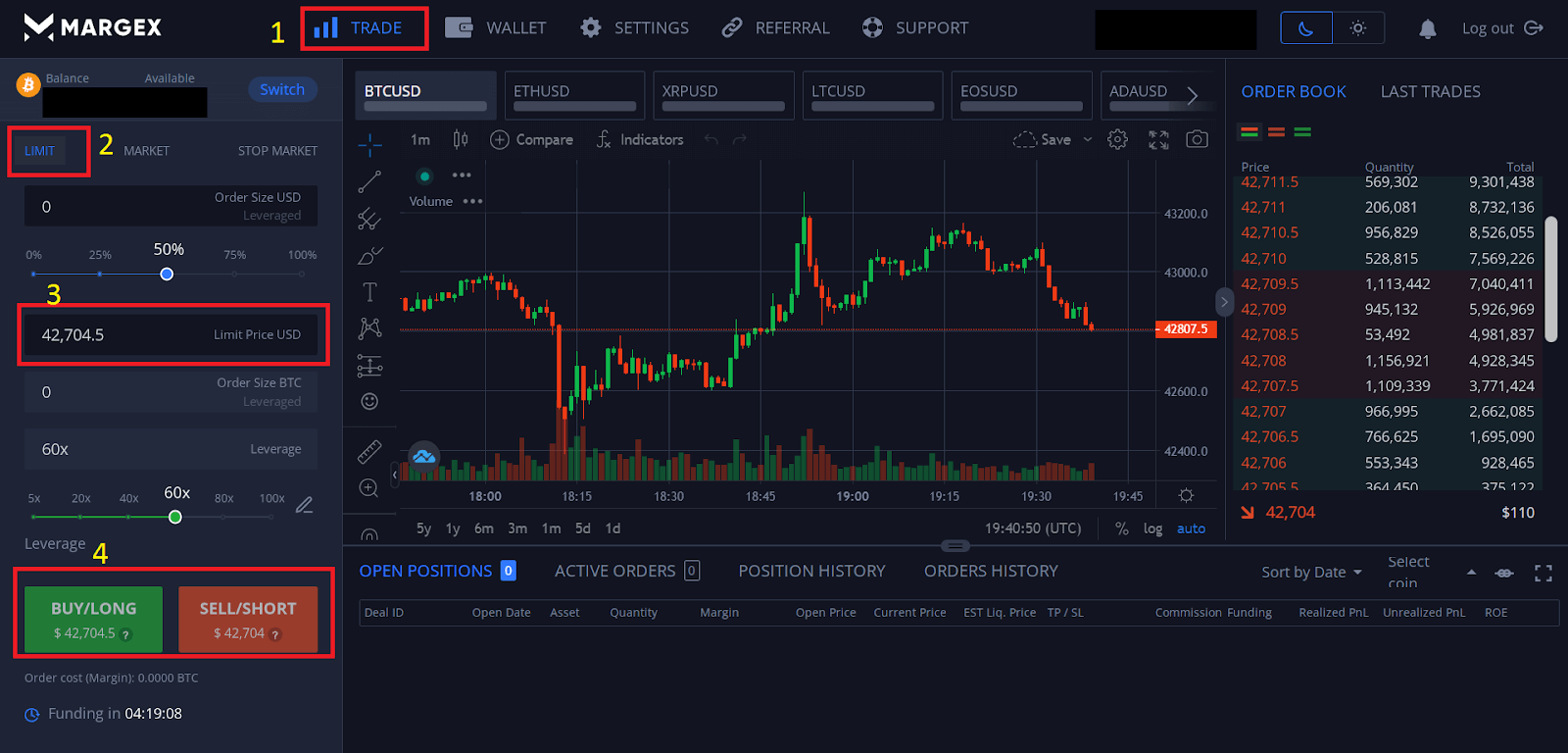

Margex is known for aggregating liquidity from multiple liquidity providers, instant execution of market orders and protective systems such as MP shield. By combining the order books of multiple liquidity providers into a single order book, Margex traders do not suffer drawdowns as the aggregated order book presents traders with the highest liquidity and best possible prices for all trade pairs, resulting in thin spreads and reduced slippage.

Opening limit orders is a very easy process on Margex. All you have to do is follow these simple steps.

Open an account: Go to Margex.com and click on “Start Trading” to open an account.

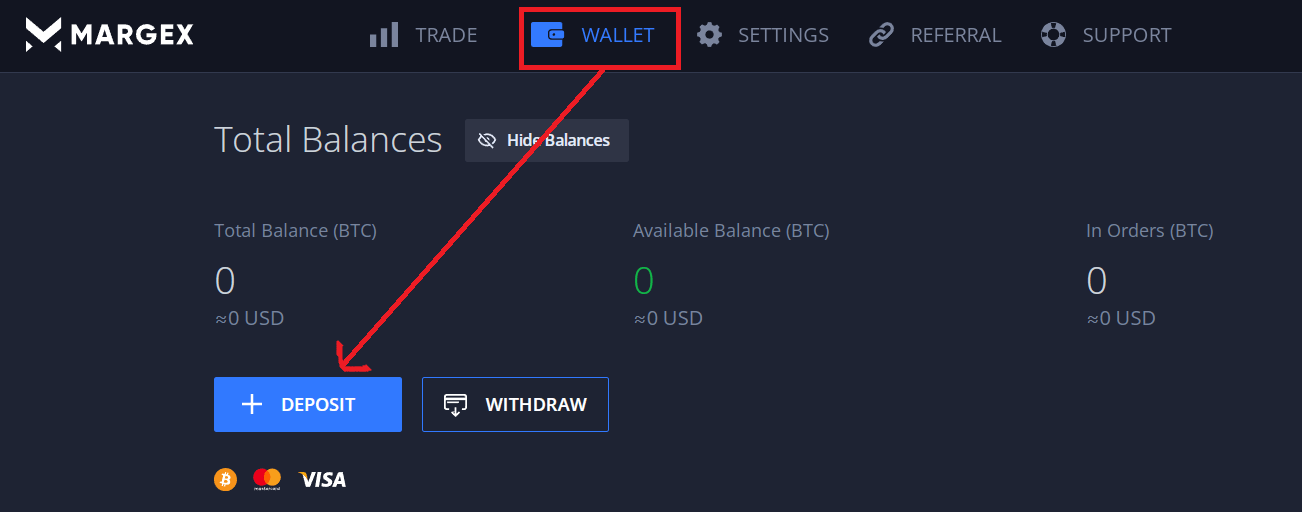

Deposit: Click on the “Wallet page” and click “+Deposit.” You can either deposit by transferring crypto to your Margex wallet or by buying crypto through Changelly or ChangeNow.

Start trading: After a successful deposit, navigate to the “Trade” page to begin trading. Here, you can open a limit order by selecting “Limit” as the order type and set the limit price to whatever you’re comfortable with. Don’t forget to set other things like the order size and leverage.

2. Be cautious when trading during high volatility hours

Another strategy to minimize slippage is to avoid cryptocurrencies that may face high volatility, especially altcoins with low trading volume. High volatility hours are essential for some trading strategies such as scalping. If you feel uncomfortable with rapid changes in cryptocurrency prices, opening positions during periods of high volatility, such as midnight hours, can be solved by using limit orders.

3. Avoid trading pairs with low liquidity

Always check the order book of any cryptocurrency pair you are going to trade. Make sure there are enough bids/asks in the order book for your target price that can accommodate your order size before initiating the trade.

Conclusion

Nobody wants to lose unnecessary money when trading. It is well-known that high slippage can cost traders a lot of money and can be frustrating to new and inexperienced traders. Slippage may have a significant impact on a trader’s profits and losses, therefore it is important for traders to understand what slippage is, how it affects their trades, how to calculate it, and what measures they can take to minimize slippage. Traders can also avoid slippage during volatile market conditions by placing limit orders instead of market orders.

FAQ

What does slippage mean?

In crypto trading, slippage is a word that refers to the difference in price between the expected price of a trade and that at which the trade is actually executed. Slippage is mostly caused by the high volatility of the crypto market.

Is high slippage good?

High slippage is definitely not good because it can lower your purchasing power. . It is the goal of every experienced trader to keep negative slippage to the lowest while opening a new trading position.

What is good slippage in crypto trading?

Slippage can be beneficial to a trader on certain occasions. In this case, it is known as positive slippage. Positive slippage is when the actual executed price is lower than the expected price for an order.

Is slippage a fee?

No, slippage is not a fee. Slippage is a result of the movement in price before a trade is executed on the market.

How much slippage is normal?

There is no definite amount of a normal slippage because slippage depends on volatility and volumes of the market. But it is important to note that high negative slippage will reduce your purchasing power drastically.

Can you lose money with slippage?

Slippage is unpredictable in the sense that it can cause you to lose some of your money or gain more purchasing power. Negative slippage can cause you to lose some of your money, whereas positive slippage can cause you to gain more purchasing power.

How can I increase my slippage tolerance?

Slippage tolerance is a percentage of the trade value that you’re ready to tolerate as slippage. You can increase your slippage tolerance by increasing the percentage of your trade you’re willing to accept as slippage.