How to short cryptocurrency

Crypto shorting

For example

Longing crypto

What does shorting crypto mean and how does it work?

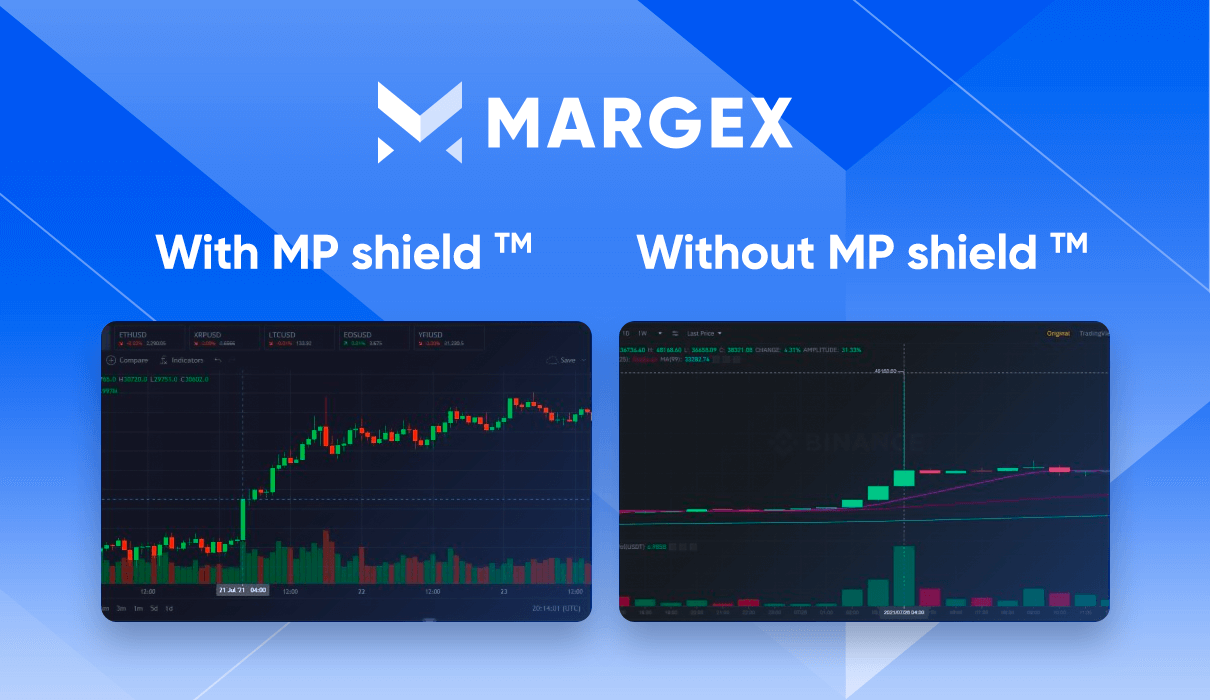

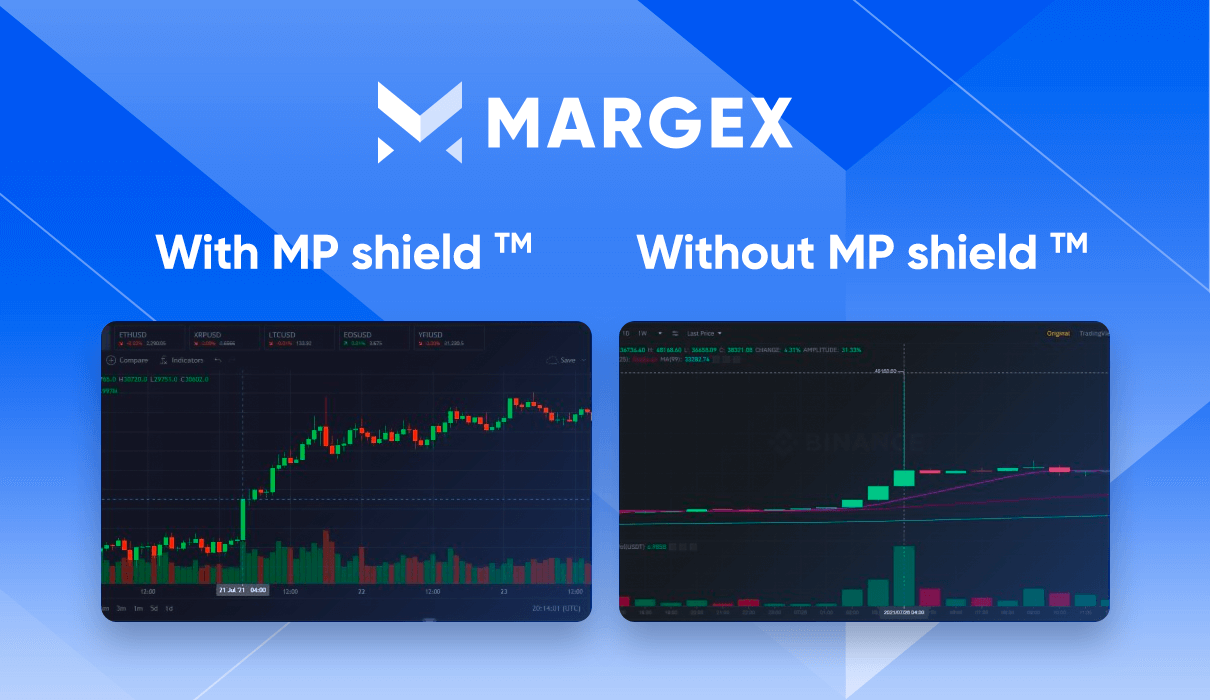

Balance Protection

Price Manipulation Protection

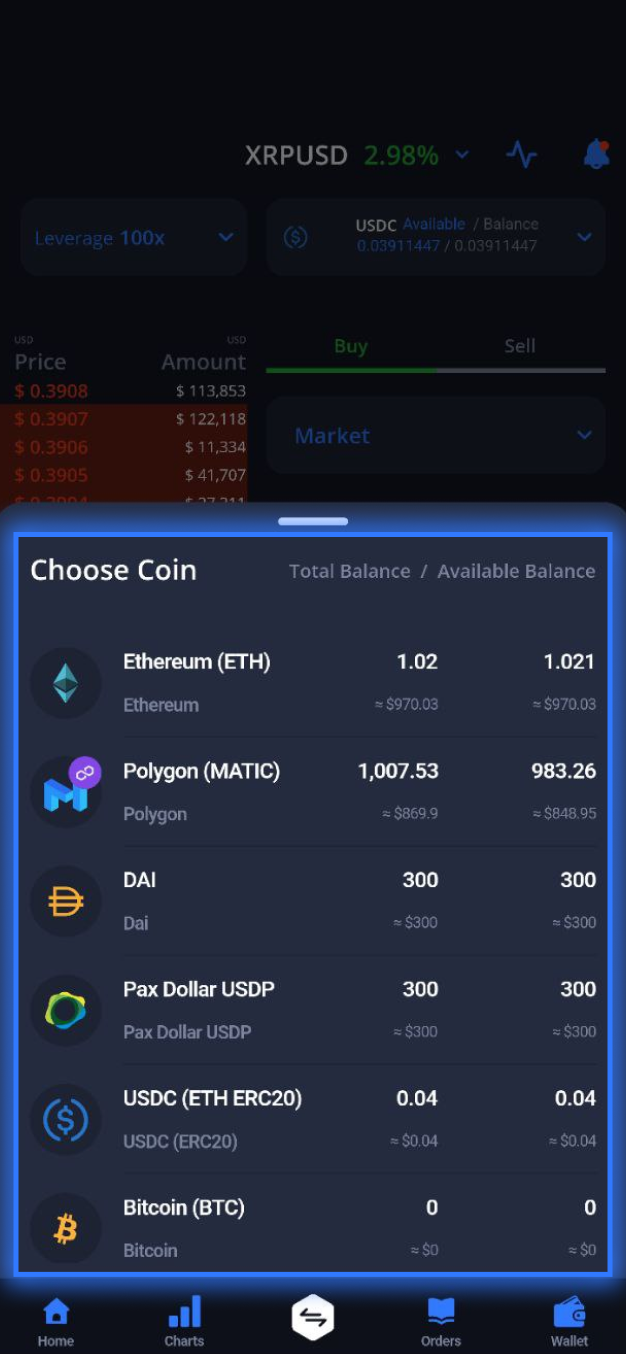

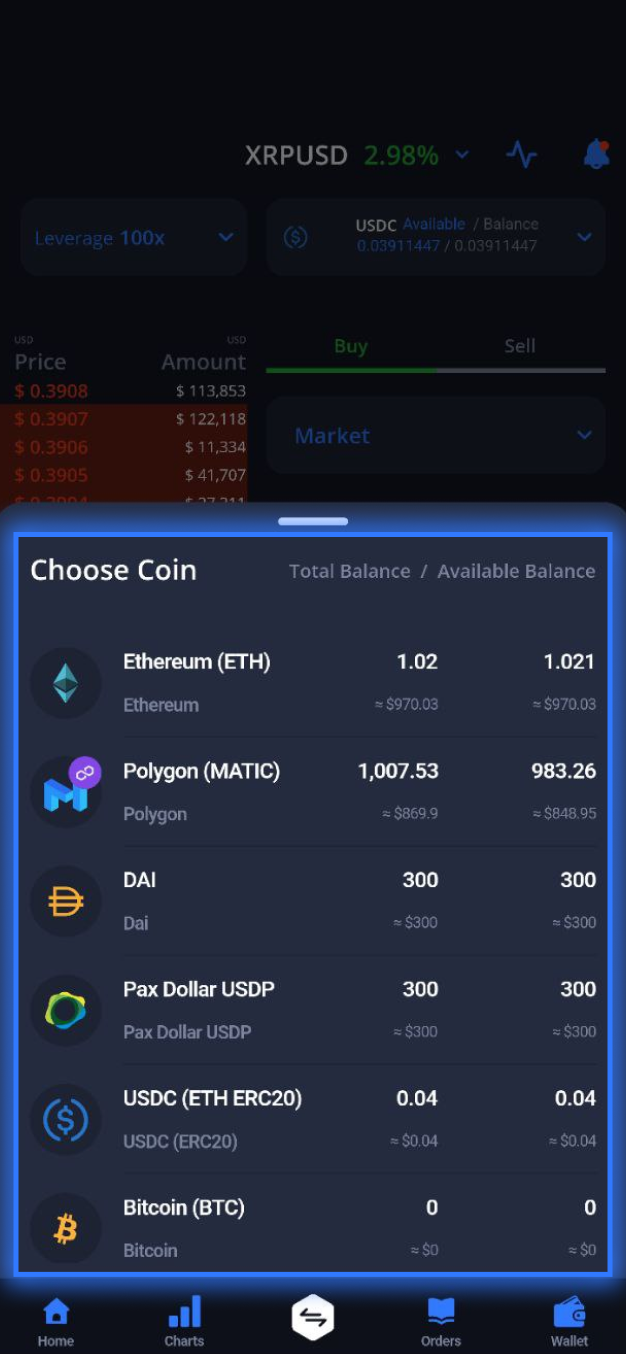

Cross Collaterals

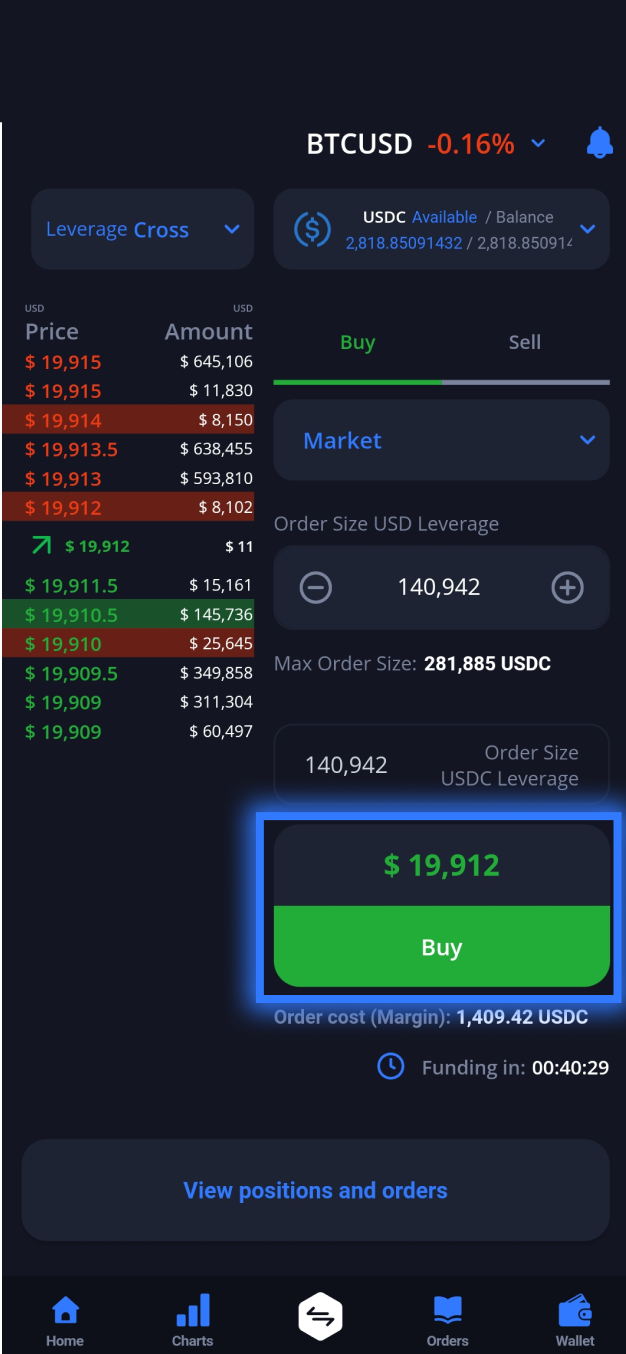

No Entry Barrier

No hidden commissions

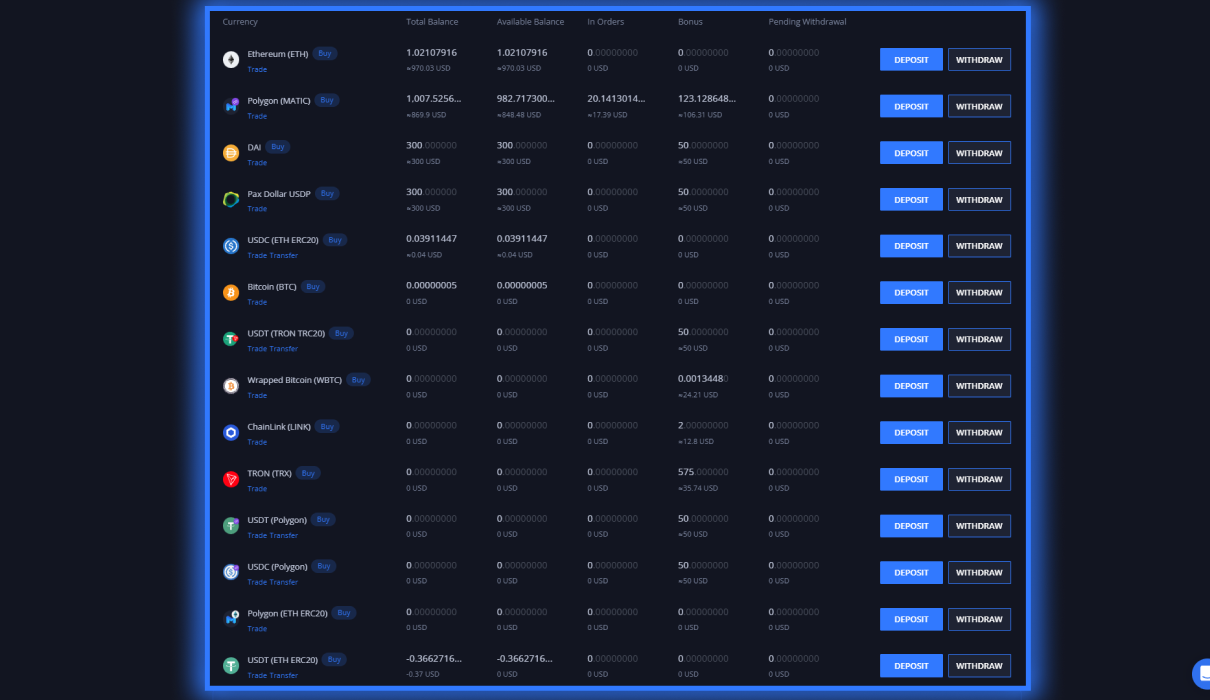

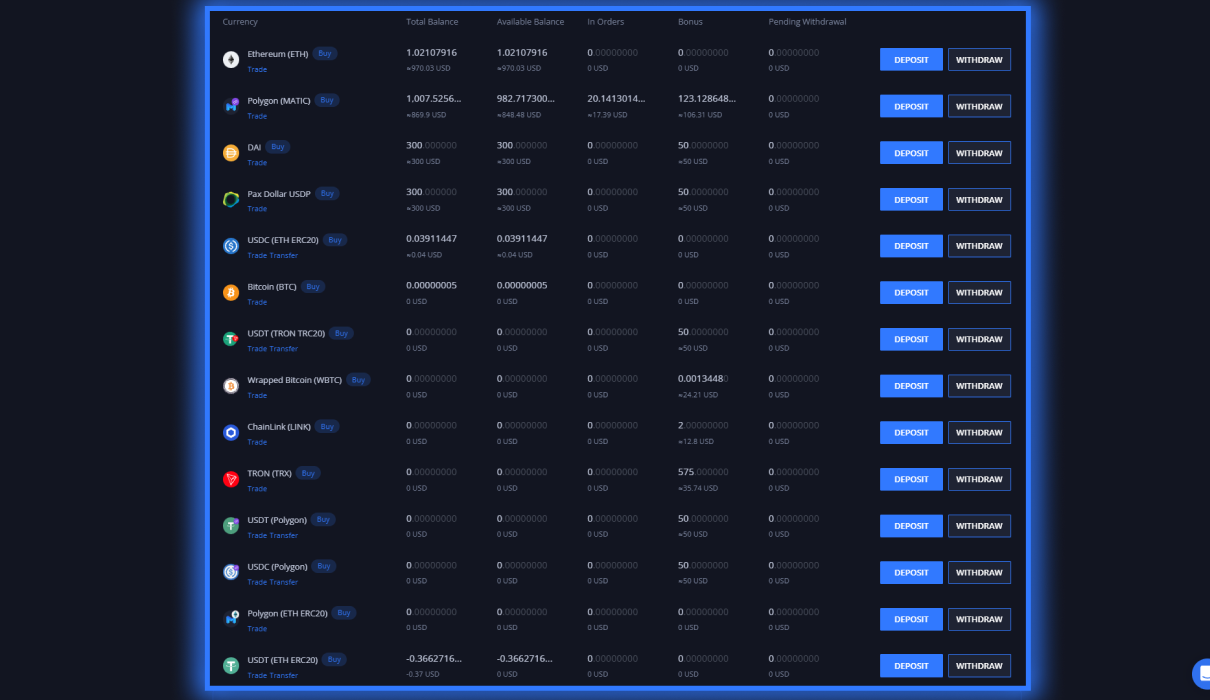

Variety of Deposit Options

Why should you short crypto with Margex?

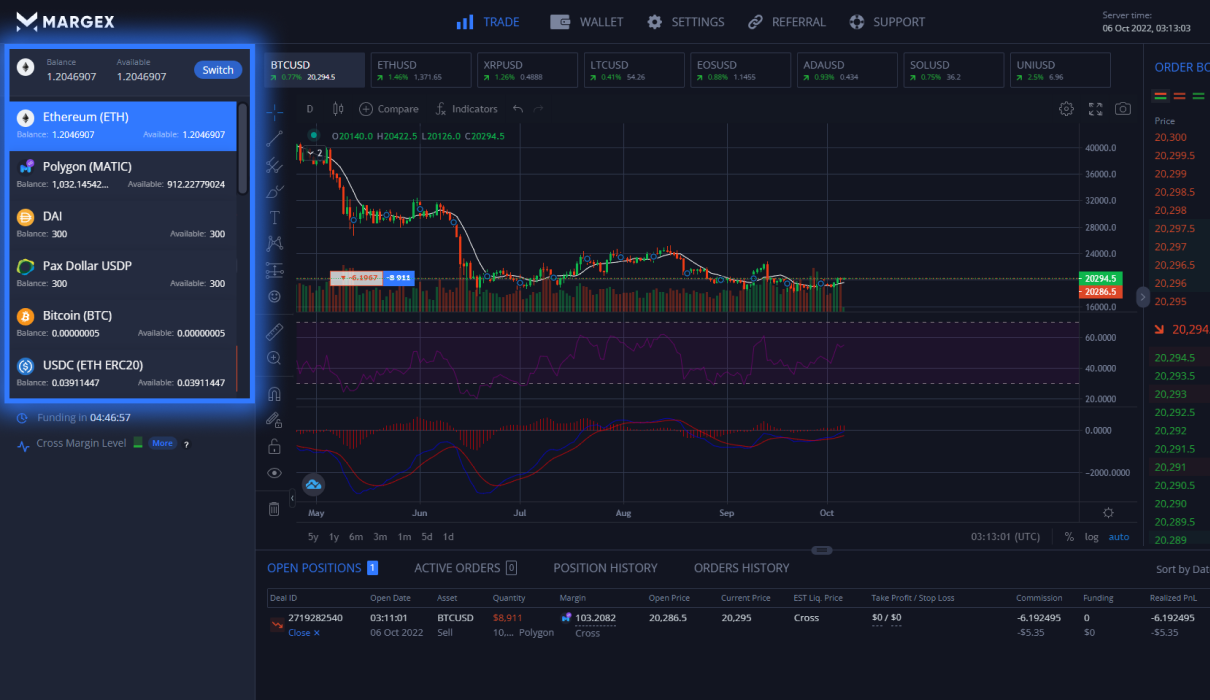

With the easiest-to-use UI in the industry, Margex offers a broad range of powerful tools to harness your trading and boost profits. This is why the trading platform has been nominated by Finance Magnates as one of the top crypto margin trading exchanges. According to Finance Magnates, Margex is the easiest platform for trading derivatives. Some key advantages of Margex include

Ways to short crypto

Margin Trading

Short-Selling

Perpetual Swaps

How to Deposit

Learn how to deposit directly or purchase crypto with a bank card

How to short crypto on Margex

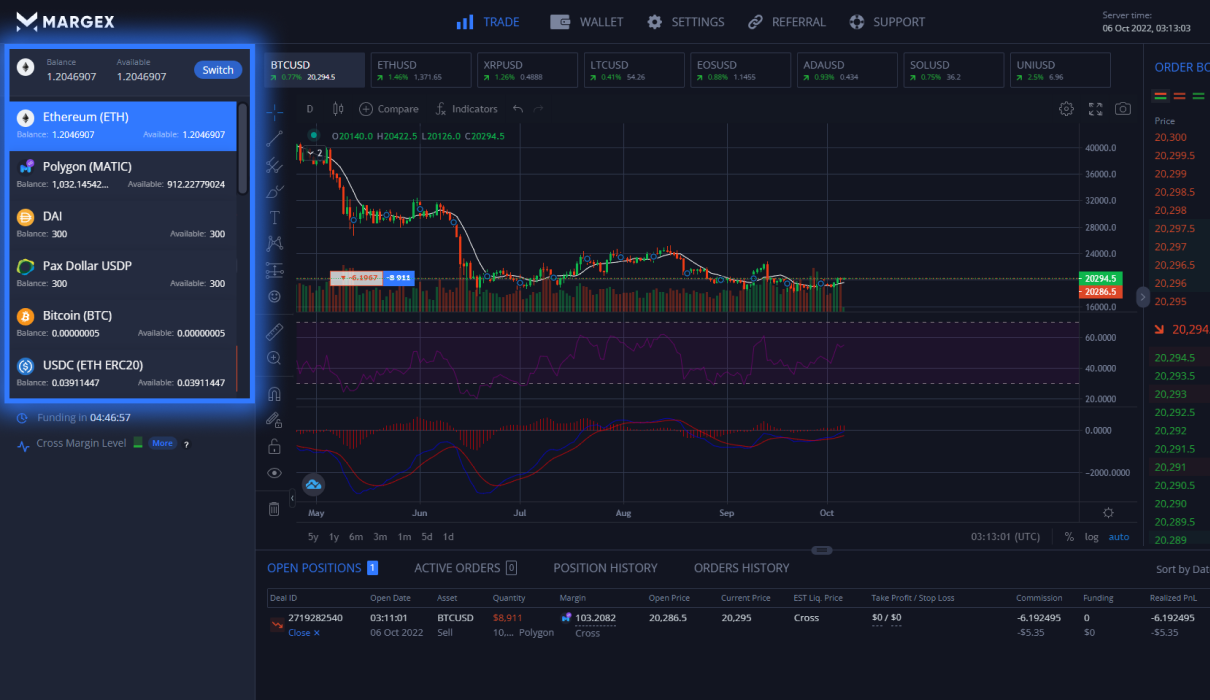

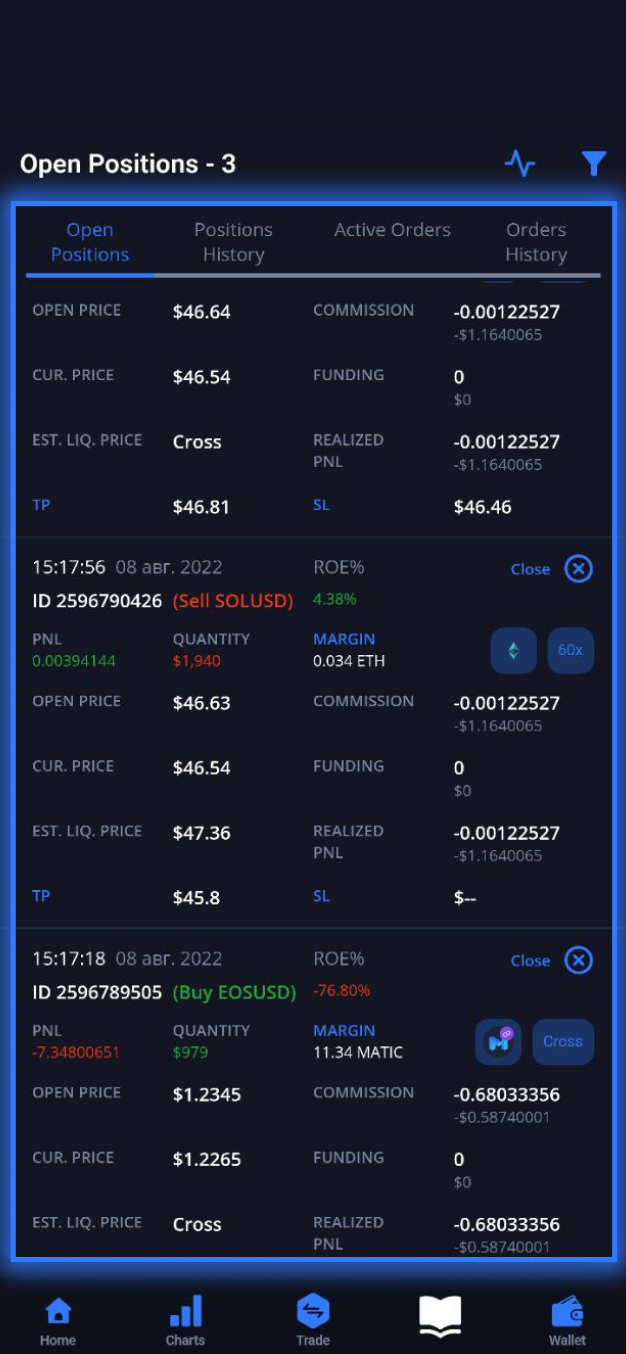

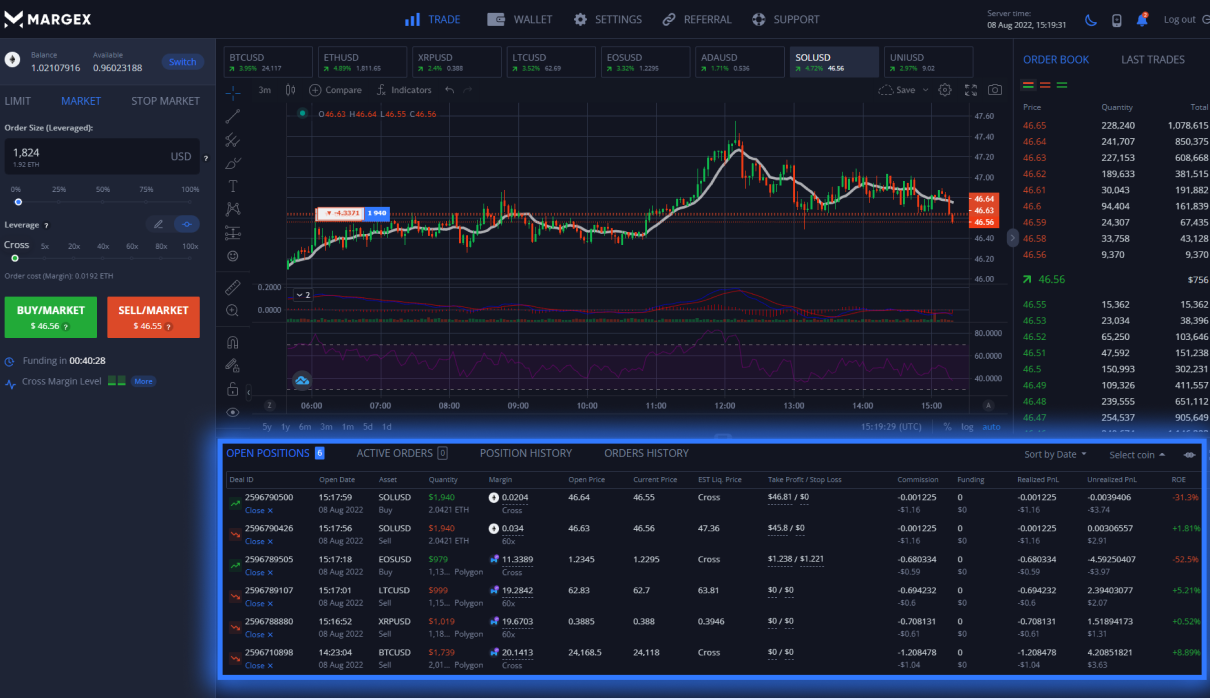

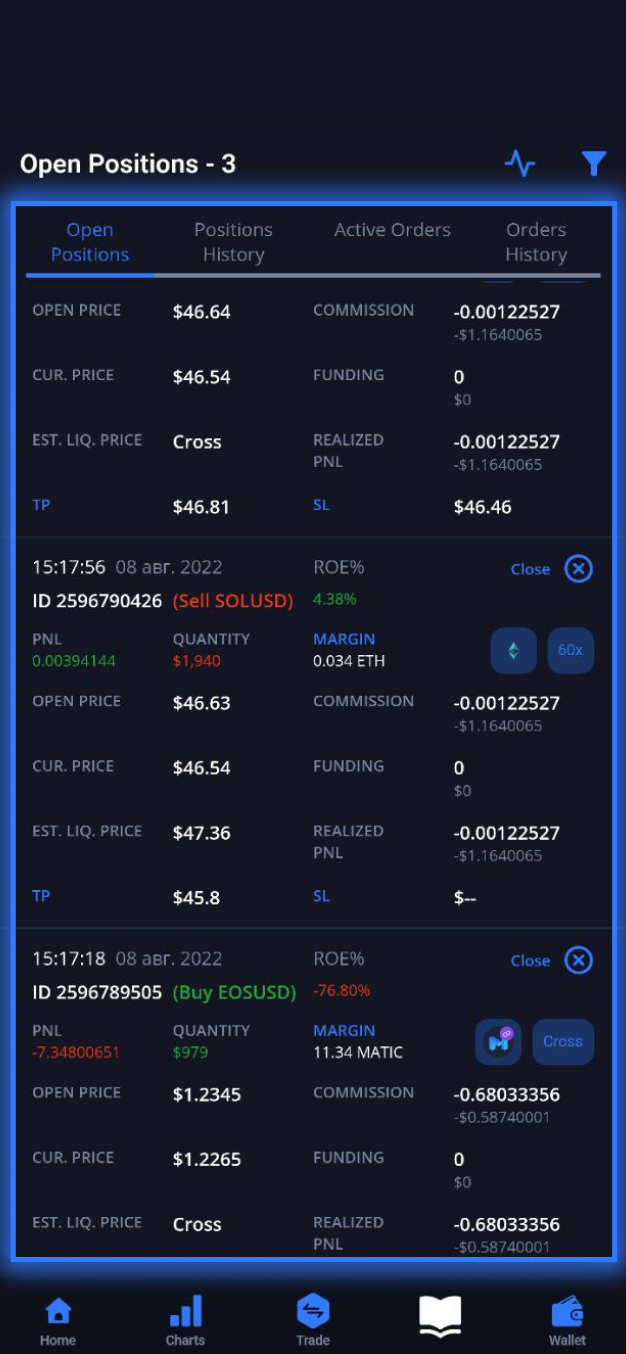

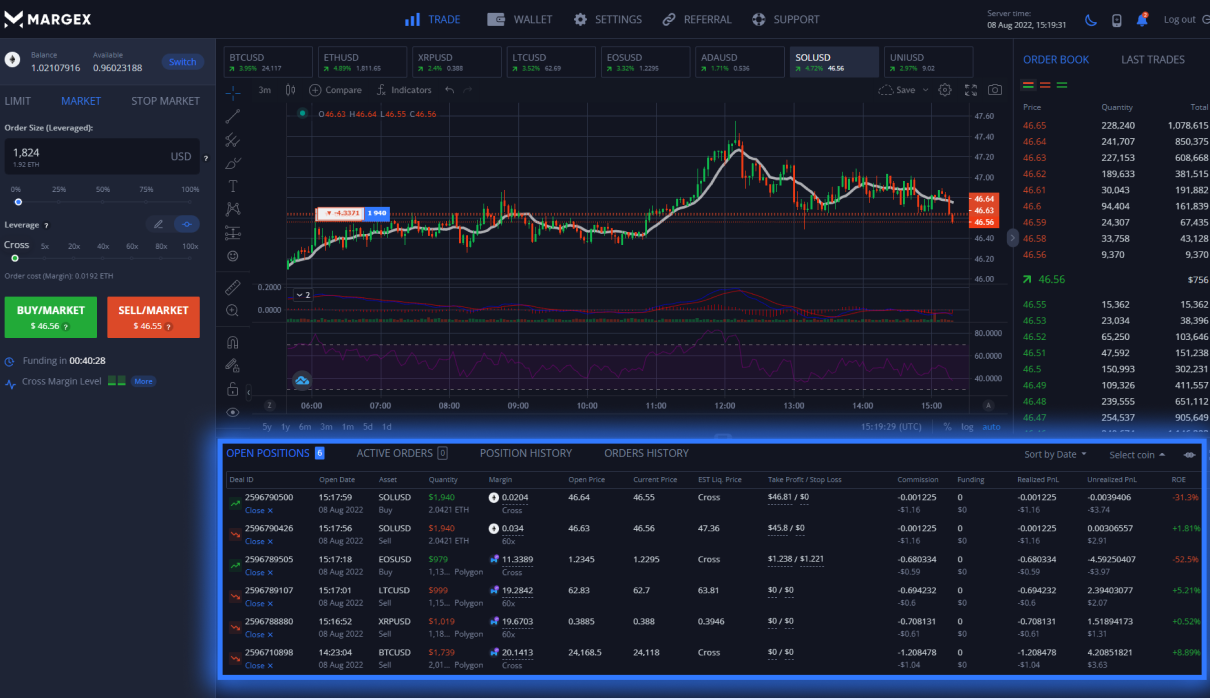

Shorting cryptocurrency on Margex is a quick and straightforward process, thanks to the available user-friendly interface. These are the steps to take to short cryptocurrencies on Margex:

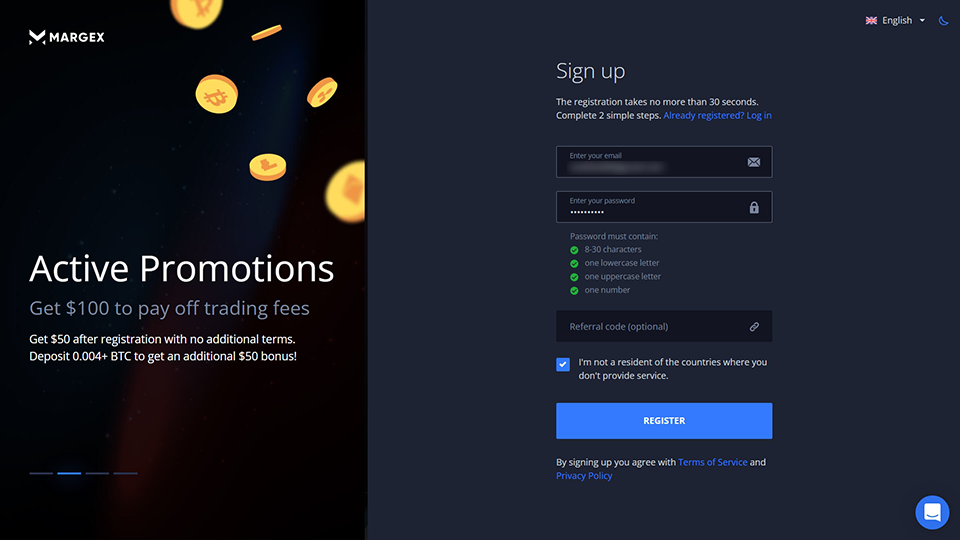

Register an account

To register an account, go to Margex.com and click on “Start Trading.” This will take you to a sign-up page where you will be prompted to fill in the required information.

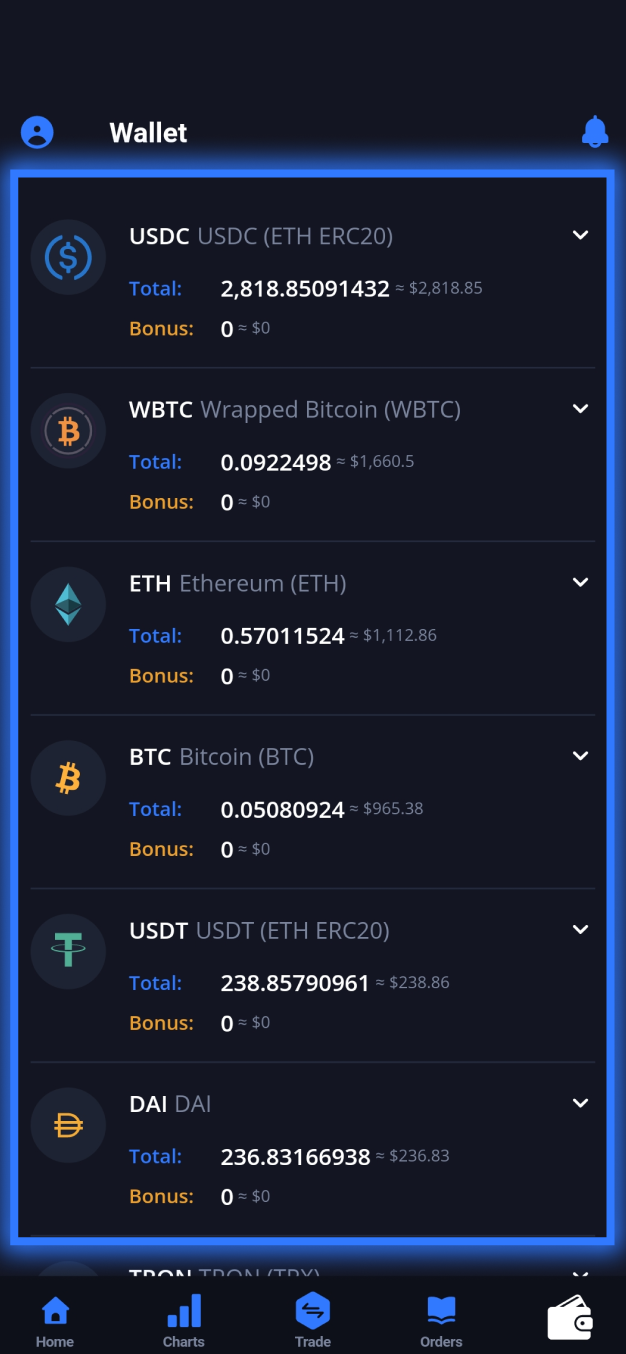

Deposit

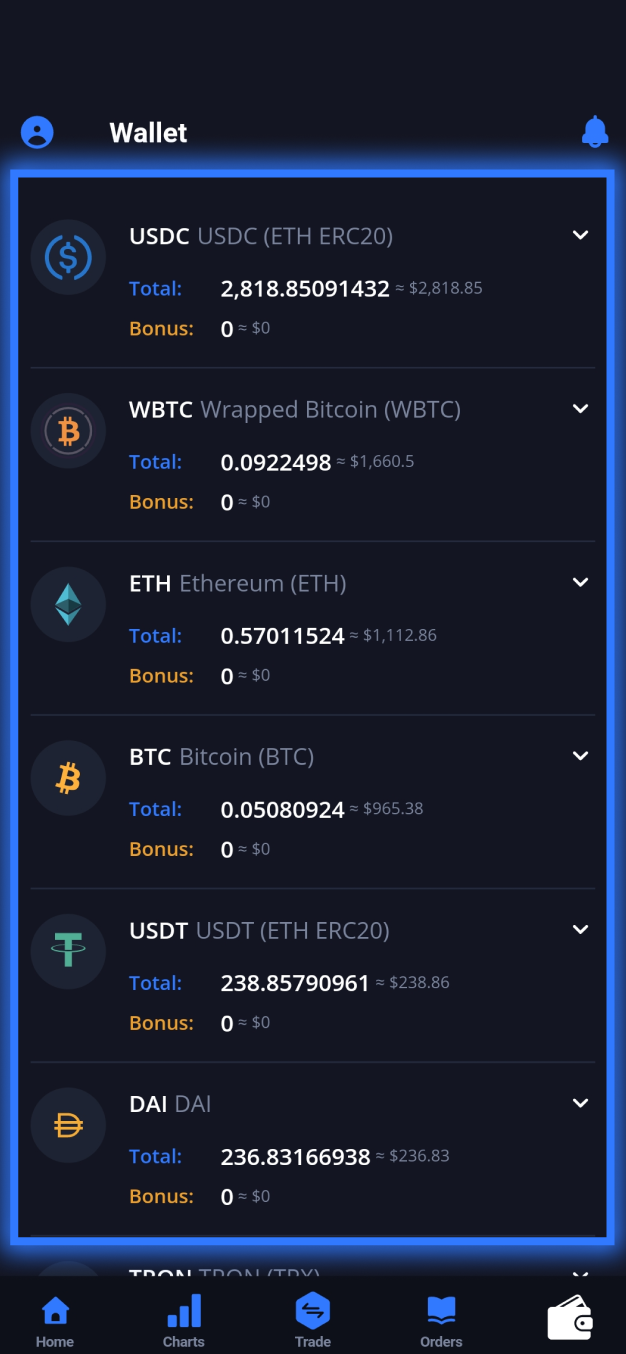

To make a deposit, go to the "Wallet page" and click "+Deposit." You can deposit with a list of cryptocurrencies available by transferring from another wallet to your Margex account wallet. If you don't have any of these cryptos, click on "Buy Bitcoin" to buy bitcoin through direct integration of Changelly.

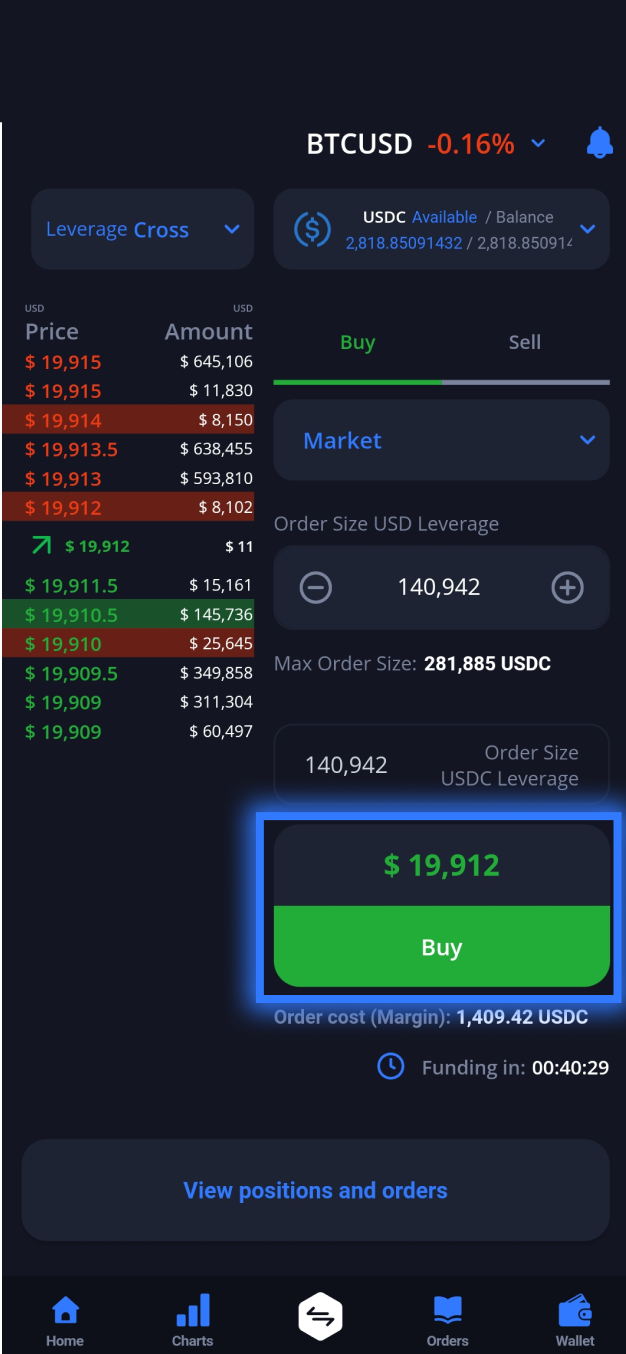

Start Trading

After making a successful deposit, the next step is to start trading. To enter a short position, navigate to the "Trade page." Select the desired order parameters such as the cryptocurrency you wish to trade and your preferred order type (limit order, market order, stop market order, stop loss and take profit), size, leverage, and click SELL/SHORT. Since you are shorting, you are interested in the price of the asset falling. Once the asset has declined in price, monitor the percentage next to RoE (return on equity) and when you are satisfied with the profit on the trade, close the position to book the profit.

Advantages and risks of shorting crypto

Like everything that has to do with cryptocurrencies, crypto shorting has its rewards but it also comes with some risks. Some of these are:

| Advantages | Risks |

|---|---|

You only need a small amount of money to get started | Crypto prices are volatile |

Shorting allows traders to leverage their assets | Losses can be incurred if trades are not properly managed. |

Leverage can be beneficial if properly managed | Increasing leverage can lead to bigger losses. |

Crypto shorting allows traders to make profits from falling markets | You need a margin account to short crypto. |

| Advantages |

|---|

You only need a small amount of money to get started |

Shorting allows traders to leverage their assets |

Leverage can be beneficial if properly managed |

Crypto shorting allows traders to make profits from falling markets |

| Risks |

|---|

Crypto prices are volatile |

Losses can be incurred if trades are not properly managed. |

Increasing leverage can lead to bigger losses. |

You need a margin account to short crypto. |

How much does it cost to short crypto on Margex?

Margex offers the most competitive fees and the best conditions for trading. There are two types of fees charged by Margex: trade fees incurred when performing a trade and funding fees when your position is held open during the funding rollover . The table below shows Margex's fee structure.

| Maker fee | Taker fee |

|---|---|

0.019% (for LIMIT orders) | 0.060% (for MARKET orders) |

| Maker fee |

|---|

0.019% (for LIMIT orders) |

| Taker fee |

|---|

0.060% (for MARKET orders) |

How to short crypto for free on Margex.

Margex offers a bonus program to new users. To take advantage of this bonus program, go to Margex.com and sign up to receive a $50 bonus to pay trading fees. You can also get an additional $50 bonus by depositing 0.004 BTC or more. There is also a referral program that pays 40% commissions to everyone.