The year 2022 has been notorious for crypto, with almost every crypto investor saying that it is a year that nobody wants to remember. While we do not wish to remember the nightmarish year as well, we nonetheless summarise below the three key shocks that shaped 2022 and hope readers could gain some insights that will empower them to make better investment decisions in the new year.

The Collapse of Terra-LUNA

With so much having happened in the crypto space in 2022, readers may be forgiven for not remembering the incident that kicked started all of the other negative chain effects - the collapse of Terra-LUNA.

The collapse of Terra-LUNA was inevitable because the operative model was poorly constructed. However, as the ecosystem was birthed in the thick of 2021’s bull market, many investors, even institutional ones, while chasing yields, forgot about common sense and poured money into the ecosystem. For readers who may have forgotten, the UST stablecoin was pegged to the USD while the LUNA token was the balancer to be sold to support the price of UST when it went off peg, and to be bought using UST when the demand of UST caused it to trade above $1. At the height of its glory, the UST stablecoin had a supply of around $15 billion.

In May, things started to go downhill as the bear market continued to bite deeper and a large holder of UST sold a large chunk of the stablecoin, causing it to go off peg. As news of the depeg spread, almost everyone tried to get out of UST, resulting in a downward spiral in UST’s price. In their attempt to salvage the stablecoin UST’s dollar peg, the LUNA Foundation issued an insane amount of the LUNA token and sold them, and even dumped around 80,000 Bitcoin from their reserve. This opened up opportunities for traders to short the market, resulting in both UST and LUNA crashing to zero within days.

LUNA’s collapse was a significant blow to crypto because it not only caused billions to be wiped out in less than a week, it caused the price of Bitcoin and all other cryptos to sink even deeper into the bear market.

Furthermore, the collapse of LUNA was instrumental to the other two significant bear market events that have plagued 2022. Shortly after LUNA collapsed, a once popular and highly regarded hedge fund known as Three Arrows Capital (3AC) folded.

The Liquidation of Three Arrows Capital

3AC, a cryptocurrency hedge fund founded by Su Zhu and Kyle Davies in 2012, had been highly respected for their out-spokenness and high profile investments in various blockchains like Solana and Avalanche.

In March 2022, its assets under management (AUM) reached $10 billion, making it one of the largest crypto investment firms within the industry, with a significant amount of investment backing budding projects such as Avalanche, Solana, Polkadot and Terra, all of which were darlings of the 2021 bull market. However, as it turned out, most of its AUM were borrowed money from different crypto lending firms.

Following Terra’s collapse, 3AC faced liquidity problems and could not repay back loans that it had taken from several crypto lending firms, causing some of them, like Voyager Digital, to file for bankruptcy and put up their assets for sale. Other notable lenders that suffered as a result of 3AC’s default are Genesis Global Trading and FTX. As part of its winding up procedure, 3AC had to liquidate its crypto investments, the bulk of which was Ethereum. This caused Ethereum to plunge from $1,200 to $800 within a week in early June. The collapse of 3AC subsequently led to the third shocking event.

The Bankruptcy of FTX

In November, FTX declared bankruptcy due to a run on its users that drained its liquidity to almost zero. It has to be clarified that had FTX not misappropriated user funds, the firm would not have run into problems with a bank run since the funds would have been ring-fenced and not impact the firm. This was the biggest incident of the year and its impact is still being felt at this point of time, and possibly for many more months to come as the incident only took place last month. While the collapse of FTX was a result of failed business practice, possible fraud and a misappropriation of customer funds, the repercussions cannot be amplified more. Other than causing a string of domino effects from the vaporisation of investor and customer funds, the more far-reaching consequence from this fallout is that it could give regulators an excuse to enforce more stringent controls on the crypto industry that could stifle its growth and adoption.

Furthermore, as a leading group of companies in crypto, FTX and its sister trading firm, Alameda, have been involved in numerous projects which could now suffer as a result of sale or clawbacks due to their bankruptcy proceedings.

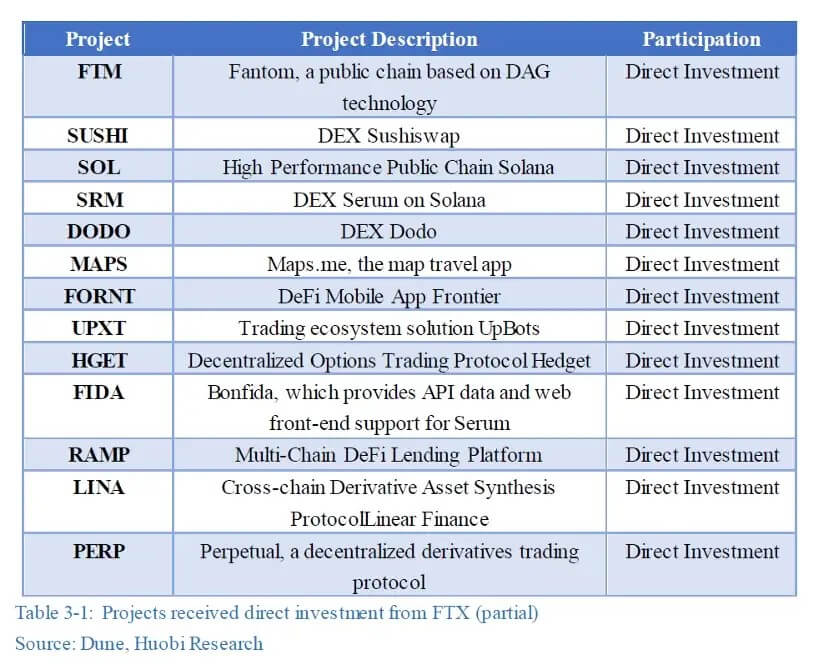

According to Dune Analytics and Huobi Research, FTX has participated in more than 110 projects in the form of direct investment, some of which are listed below:

In addition, the bankruptcy of FTX has also put a serious dent on the business of centralized exchanges (CEX). Users have begun to distrust CEXs and are beginning to embrace decentralized exchanges. This could speed up the adoption of decentralized platforms, which could fast track the adoption of web3 platforms, which is exactly what crypto is made for.

The above article is for informative purposes only and should not be taken as the official view of the Margex platform, nor is it a solicitation to trade.