One feature that characterizes payment services such as Apple Pay, PayPal, and others is transaction speed. Customers of these services often prefer them to the traditional banking systems to avoid delays and complicated processes during transactions.

But the tides might turn soon, as major banks have taken actions to bridge the gap. In a new development, leading US banks such as Wells Fargo, Bank of America, JPMorgan Chase, etc., have disclosed plans to roll out a digital wallet for their customers. The banks will start operating with the new system by the second of this year.

EWS, the FinTech company behind the wallet, will first roll out the digital wallet to support Visa cards and Mastercard for the bank's retail customers. Later it will expand the wallet to support banks to merchant payments.

With this new system, banks aim at reducing their customer's preference to the top payment service already offering diverse products, including credit cards, to their customers.

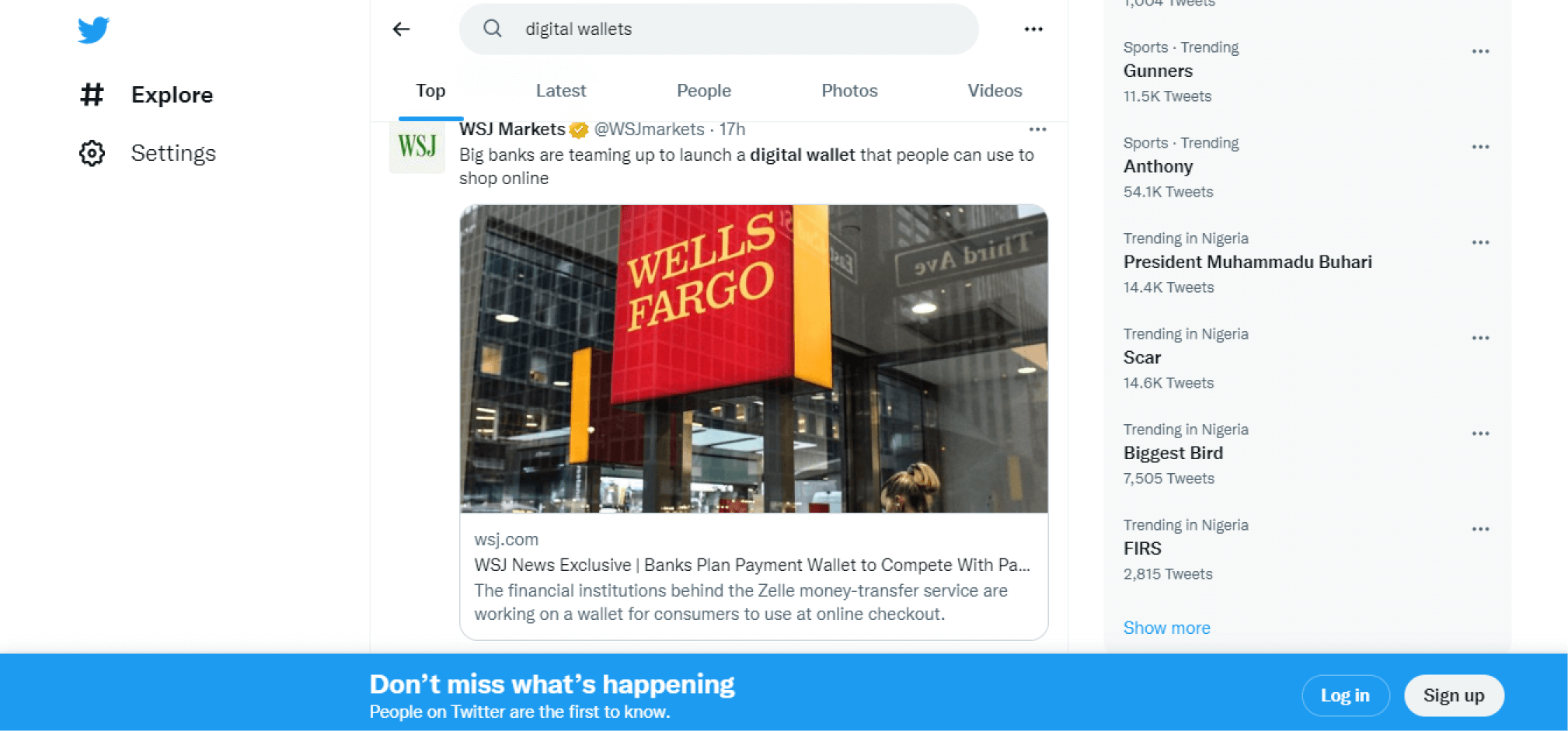

Banks Collaborate With Zelle To Facilitate Online Shopping

According to the available details, the banks will link the digital wallet to their customers' debit and credit cards. Wall Street Journal revealed that customers can use this digital wallet to shop online, just as they do with Apple Pay and PayPal. The money-transfer service Zelle is facilitating this digital wallet, while Early Warning Services (EWS) will operate it.

Zelle is a payment solution online that facilitates bank-to-bank money transfers. Early Warning Service (EWS) is the Fintech company behind Zelle, while several banks, such as Capital One, Wells Fargo, JPMorgan Chase, etc., jointly own EWS. For now, the EWS hasn't released the new wallet's name, but disclosed that it would be independent of Zelle.

According to unnamed sources, the wallet launch ensures that the bank's customers stay on the system and reduce interactions with PayPal, Apple Pay, and other services. This goal is not surprising, given the recent big moves that these independent payment services have made.

Recall that PayPal and Apple Pay offer credit cards to customers and have integrated cryptocurrencies, such as Bitcoin, Ethereum, etc., in their payment options. These services allow millions of users to hold multiple currencies in their digital wallets.

Moreover, sending money with PayPal in an urgent situation or cross-border transactions is usually the best option due to the speed and ease of completion. Also, by integrating cryptocurrencies, customers now have a more comprehensive range of options for diverse transactions.

Will The New Wallet Support Crypto Payments?

There hasn't been any mention of supporting crypto payments through the new digital wallet. For now, the goal is to enable bank customers to use their wallets at online checkout. But given the increase in using digital payment apps, sources anticipate a time when these banks will also consider it.

Data shows that digital wallets are increasing in recognition and adoption. Also, many of the available ones support cryptocurrencies, enabling their customers to store diverse currencies. For instance, a 2021 McKinsey survey disclosed that above 80% of Americans completed transactions using a digital payment app. The researchers also discovered that 1 out of every 5 had held one form of crypto or the other at one time.

With such a trend, it's not surprising that crypto enthusiasts will speculate a time when these banks will allow their digital wallets to hold crypto. Since their competitors, Apple Pay, PayPal, etc., already does that, the banks may likely follow to bridge the gap and protect their customer base and maintain profitability.

Some banks, such as Goldman Sachs, JP Morgan, Wells Fargo, etc., already support crypto. According to Reuters, many of these banks are already dipping their toes into cryptos allowing users to deposit creative digital assets for investment or transactions.

The Rising Need For Digital Wallets

Many digital wallets emerge almost every day, including those supporting NFTs. Apart from the ease at which users can make online payments, there are many benefits of using these digital wallets in this era.

Digital wallets allow users to view their sub-balances and total balances in all the currencies they hold, whether fiat or crypto. Users don't have to visit the banks for such but can view everything in real time and on the go.

Secondly, losing a device doesn't translate to reloading your personal information and payment credentials into the digital wallet. These details are stored in the cloud, independent of any device you're using at any particular time. This is why using noncustodial wallets for crypto-specific service is better to avoid losing your assets alongside the device.

Another important benefit of digital wallets is that they facilitate cross-border payments. You can easily send and receive fiat or crypto money transfers from different countries. Users can send money to their families or even pay bills from anywhere in the world quickly and without being present.

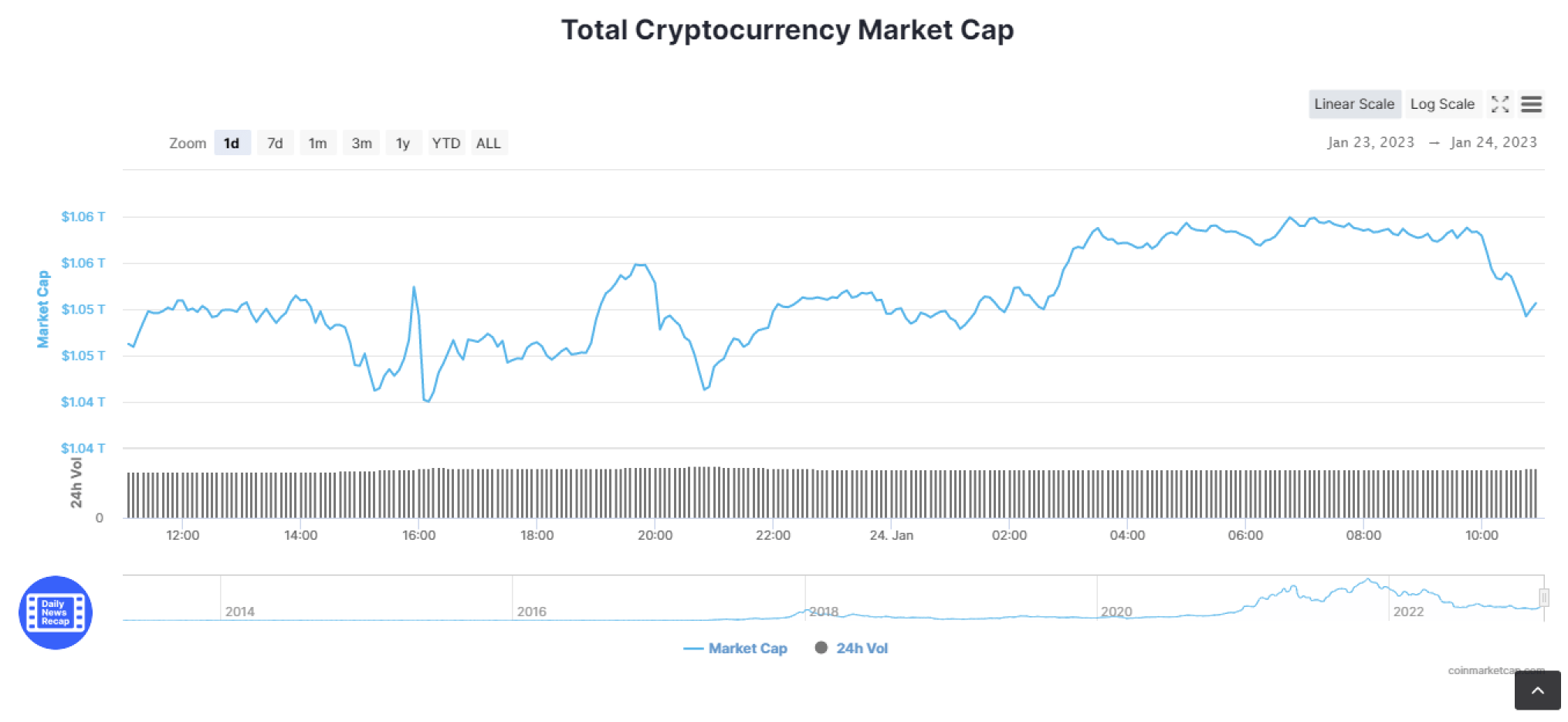

Latest On Crypto Prices And Market Cap

Last year saw many crypto assets and firms falling out in prices and operations. But 2023 kicked off-off with some rallies and minimal dips. As of today, January 24, the overall crypto market is greener than red, including the global crypto market cap.

Many asset prices, including Bitcoin, have increased in the past 24 hours. Also, their weekly gains are impressive, pushing the overall crypto market cap $1.05 trillion, a welcome development for the industry. Top cryptos such as Bitcoin and Ethereum have maintained impressive weekly gains, which saw BTC price stand at $22,902.82 today, indicating a 0.51% gain in 24 hours and an 8.17% gain in 7 days. ETH is also boosting a 3.58% gain in 7 days and is currently trading at $1,621.42.