This weekend, the crypto market faced yet another bloodbath as the primary cryptocurrency, Bitcoin, printed a sharp plummet below $61,500 per coin. The second biggest crypto in terms of market cap size, Ethereum, followed it, crashing below the $2,900 price tag. Altcoins did likewise.

It was not only the cryptocurrency market – all other financial markets also crashed on Friday and continued on Monday (nothing trades at weekends, except for crypto). This collapse was triggered by the significant negative development in the Middle East, which hardly anyone expected to see.

Bitcoin and Ethereum crashed along with traditional markets

The pioneer cryptocurrency was the first one to face the blow. Bitcoin, like the other financial markets, took a hit on Friday. Satoshi Nakamoto's invention collapsed by nearly 14% overnight - it plunged from the $$71,130 zone, where it was changing owners down to the $61,320 area.

Saturday through Sunday and Monday, Bitcoin attempted a recovery and succeeded in regaining 7.6%, rising to the $66,680 price tag. From Monday until now, it has been going severely down again, this time shedding almost 10%. At press time, Bitcoin is sitting at $60,200.

Venture investor Anthony Pompliano stated in an interview this week that on Friday, as the adverse situation in the Middle East expanded, market participants started exiting not only Bitcoin and other cryptocurrencies but also began selling gold, stocks, bonds, ETFs, etc, to secure themselves with good old US dollar. This is the ultimate store of value for now, for which everyone dashes once any military conflict pops up somewhere in the world.

Still, Pompliano reminded the interviewer that since 2020, when the previous BTC halving took place, the biggest cryptocurrency has soared 8 times – from $8,000 it was trading at in April-May 2020 to slightly below $64,000 at which Bitcoin is bought and sold now as the next halving is almost here.

The situation was even worse for BTC in March 2020, when the COVID-19 pandemic arrived, and cities and towns worldwide began shutting down for quarantines. Bitcoin then briefly nosedived below the $4,000 mark, and oil crashed below zero.

However, economist Peter Schiff, a long-term Bitcoin critic, believes that Wall Street is about to begin disposing of the Bitcoin it holds in an attempt to save the money invested in it.

The second biggest cryptocurrency, Ethereum, created by Vitalik Buterin and a company of other outstanding developers, followed in the footsteps of Bitcoin. ETH lost roughly 20% on Friday and Saturday and crashed from $3,530 to $2,850. ETH's attempt to restore its losses was successful as it regained close to 14.5% over the weekend and rose to $3,263. However, the second rebound pushed it 8.95% down, and at press time, ETH is trading at $2,976 per coin.

Spot Bitcoin ETFs have also been facing a lack of inflows. Besides, Grayscale is one of many ETFs that has been constantly hit with withdrawals. Several other ETFs have experienced them now, including Ark Invest under the leadership of the renowned investor and manager Cathie Wood.

However, there is some good news as well. Both retain, and institutional investors have been madly accumulating Bitcoin and moving it from centralized exchanges into their personal cold wallets or crypto custodial platforms. A CryptoQuant report revealed that BTC withdrawals have been very high and reached a peak that has yet to be around since January last year. The report authors believe this could indicate investors are preparing for the Bitcoin halving that is about to arrive.

Bitcoin halving is almost here

This crypto crash occurred less than a week before the Bitcoin community expected the halving. Many took this opportunity to add more coins to their investment portfolios. In contrast, others (they are called weak/paper hands by hardcore Bitcoiners) began selling, fearing that BTC would plummet even lower.

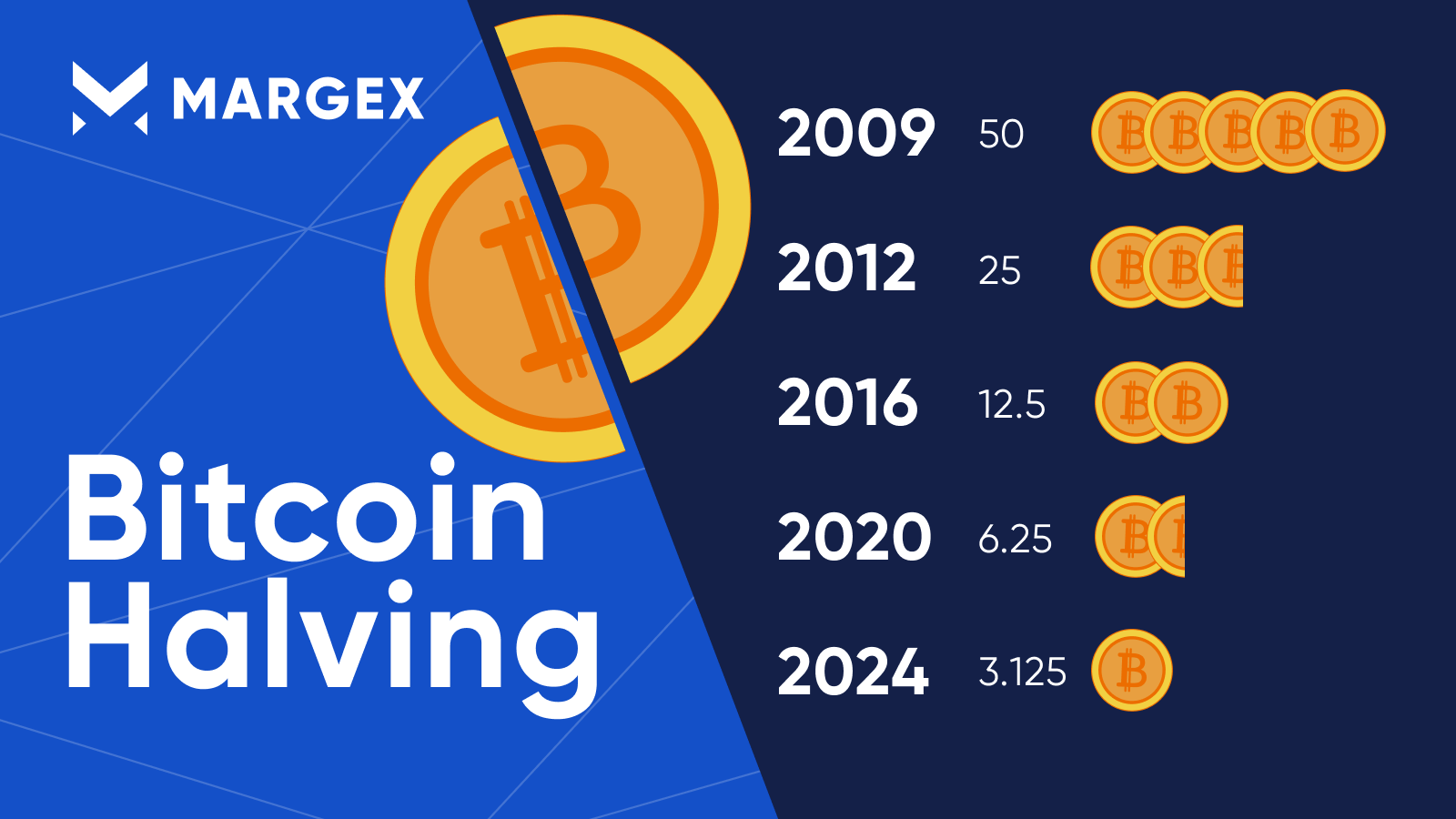

The halving event every four years since 2012 is fundamental and vital for BTC and its global community. Every halving cuts rewards miners get for each newly generated block of data by 50% (hence, a "halving"), thus making Bitcoin more deflationary and delaying the day when the last Bitcoin will be mined. A halving occurs once every four years. Three are already behind – the community went through them in 2012, 2016, and 2020.

Since the amount of Bitcoin produced sharply goes down after a halving, the price skyrockets within approximately a year, and then the market sees a significant pullback as many begin selling to capitalize on their investments. Miners also sell a lot of BTC to get cash to cover their expenses.

This week, the halving will reduce block rewards from 6.25 to 3.125 BTC respectively.