Forex vs Crypto trading is a debate that has become popular in recent years due to the growing adoption of crypto globally. It also represents an ideological choice between trading the accepted fiat currency or the rebel currency in the form of cryptocurrencies.

What Are The Primary Distinctions Between Forex And Crypto?

Cryptocurrency and forex trading both entail the exchanging of currencies. On the other hand, the FX market is bigger and more established, while the cryptocurrency industry is a relative newcomer.

With the rush of new technology, almost every stage of the forex trading process includes intermediaries, brokers, and other entities collecting fees. On the other hand, crypto trading and Blockchain technology (DeFi) eliminate the need for a middleman, which is one of its primary appeals.

The market size and structure

By a considerable margin, the FX market is the world's most active market in terms of trade volume. According to the Bank for International Settlements' latest estimate from April 2016, the currency market was worth an average of $6.6 trillion daily in 2019. By May 2020, the crypto trading market will have a combined requirement of over $256 billion.

As a result of the forex market's size, it has a wide range of liquidity and volatility (concepts that will be discussed below). If you're new to the Forex market, you might begin by trading currencies from more stable nations that provide more protection against massive losses.

Make sure to keep in mind that currency pairings are new to you, even if they seem straightforward to professionals. It is possible, to begin with, an essential pairing, learn the ropes, and then gradually broaden your portfolio without running into something you can't handle.

Volatility

In crypto trading, BTC/USD pair is the most popularly traded in the market, followed by ethereum in ETH/USD pair. The bitcoin market is more volatile than the foreign exchange market. This element provides a window of opportunity for anyone hoping to earn significant gains in a short period. For instance, currencies with little trading volume shift quickly, while coins with a more substantial market capitalization and trading volume maintain short-term stability in the currency market. The benefits and drawbacks of a low currency volatility level are apparent. Risk is reduced by reducing the potential for significant returns.

The profit potential

The high volatility in crypto trading enhances the possibility of massive earnings. However, other variables, such as the quantity of investment, can influence profit potential. You must invest intelligently, diversify your investment, and remain up to date to trade cryptocurrencies.

Although forex trading has high-profit potential, it is more proportional to the amount invested.

Market hours

While the foreign exchange market is only open five days a week, the cryptocurrency market is open 24 hours a day, seven days a week. This is a significant shift in one's way of life. Weekends are off-limits for forex traders so that they may relax and unplug. Since crypto trading may undergo substantial changes over the weekend, traders' attention must always stay up to date with the markets.

Even though both market structures are open 24 hours a day, the forex trading market has a set pattern of activity due to the dominance of major institutions. Many currencies in the crypto trading markets are driven by individual traders or small crypto trading companies, who have just recently started interacting with more prominent institutions.

Security

There is still much room for growth in the crypto trading markets, and relevant regulations are being implemented in various countries. Cryptocurrency traders must deal with counterparty risk (unavoidable in rising markets) and hacker worries. Furthermore only a few crypto exchanges are regulated. The Defi market dominated by Dexs offer a huge security risk for traders with scams rampant due to lack of kyc.

The foreign exchange market, on the other hand, is strictly regulated. Because of this, forex traders have a lower risk. A trader's best bet is to look into their broker's background and applicable laws in the country where the broker is registered. Scams in the forex trading market have disappeared due to the industry's maturity.

Best Strategies To Implement For Crypto And Forex Trading

Forex and bitcoin (cryptocurrency) trading have various options for all skill levels. A basic plan is all that is needed to succeed.

Trading with the trend

In Crypto and Forex Trading, asset prices usually follow an upward or declining trend. A trader may open positions in the direction of the movement, for example, buying when the trend is up and selling when it is down. This strategy is beginner-friendly.

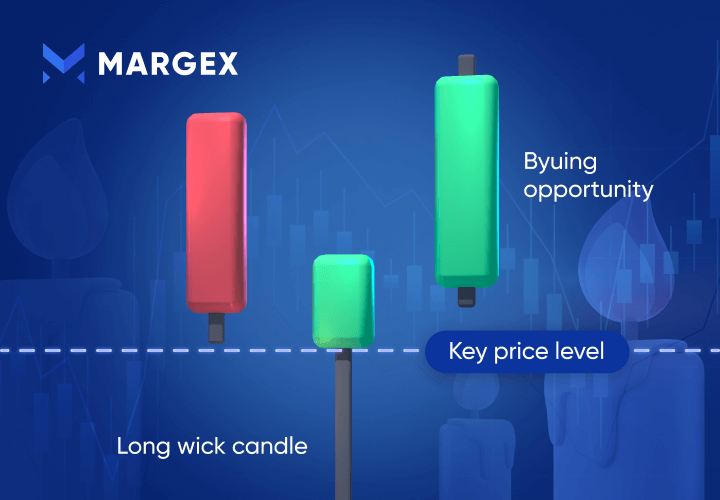

Following trend changes

This strategy is more sophisticated and requires a basic understanding of technical analysis. A trend reversal may be utilized to begin new trades. However, this method has the disadvantage of mistakenly identifying a prospective reversal.

Purchasing digital assets in equal parts

Long-term accumulation of digital coins with frequent purchases in equal portions, such as investing a predetermined sum in Bitcoin every month, is the most straightforward approach to investing in cryptocurrencies, stable coins like USDT and digital currencies such as non-fungible tokens (NFTs).

The benefit of this method is that it allows you to buy an asset regardless of the market scenario. If the cryptocurrency's price decreases, consecutive purchases at a lower cost might average the entry point.

This method is suitable for investors with a long-term view of asset growth and anticipating a significant gain later. Many individuals see this tendency with Satoshi Nakamoto’s prized jewel - Bitcoin.

When a beginner trader inquires about the most lucrative Forex trading techniques, it isn't easy to provide a clear response since each scenario is unique.

Proven Forex trading tactics, on the other hand, do exist. All you need to do is choose one for yourself.

The scalping strategy

Scalping is a trading strategy that benefits from tiny price movements and generates a quick profit from a resale in Crypto and Forex Trading. Scalping is a day trading method that prioritizes producing vast volumes of small gains.

Scalping requires a trader to have a precise exit plan since one significant loss might wipe out the trader's numerous little winnings. As a result, having the necessary tools—such as a live feed, a direct-access broker, and the endurance to conduct many trades—is essential for this approach to succeed.

Intraday trading model

Intraday is short for "inside the day." The word is shorthand in the financial industry for securities that trade on the exchanges during regular business hours. Stocks and exchange-traded funds are examples of these securities (ETFs). Intraday also refers to the asset's highs and lows during the day. Intraday price changes are significant for short-term or day traders who want to make many transactions in a single trading session. These frantic traders will close all of their positions when the market closes.

Intraday often refers to a security's new highs and lows. "A new intraday high," for example, signifies that the security attained a new high compared to all other prices during a trading session. An intraday high may sometimes match the closing price.

Traders use real-time charts to monitor intraday price changes to profit from short-term price swings. Short-term traders often employ one-, five-, fifteen-, thirty-, and sixty-minute intraday charts when trading inside the market day.

Consequently, scalping is a trading method that involves making many transactions daily to profit from small price swings in a stock. The intraday trader may maintain their positions for a more extended amount of time, but they still face substantial risks.

Swing trading model

If you are looking for short- to medium-term gains in the stock market (or any other financial asset), swing trading is your strategy. Technical analysis is the primary method used by swing traders to find trading opportunities.

A long or short position may be held for more than one trading session in swing trade, but no more than a few weeks or months. Swing trades may last anywhere from a few days to many months. Thus this is a significant time frame. In very turbulent markets, swing traders may also occur throughout a trading session; however, this is an infrequent event.

Swing trading's goal is to benefit from a price shift in the future. Some traders like volatile shares, while others prefer calmer ones. Swing trading is based on the assumption that an asset's price is likely to move in a specific direction, and if that move does occur, the trader takes a piece of the profit.

To be a successful swing trader, you must take advantage of at least a percentage of the anticipated price movement.

Positional trading model

Position trading entails holding a transaction open for an extended length of time. Position trading is more concerned with price fluctuations over weeks, months, or years than price swings in the near time, such as intraday.

Position trading may relate to either price speculation or investing using financial derivatives. Price speculation using financial results entails taking a stake with contracts for difference (CFDs). These products allow you to create a position without owning the asset, allowing you to bet on increasing prices by going long or decreasing costs by going short.

Trend trading model

Trading in the direction of a given asset's movement is known as trend trading. An upward or downward price trend is considered a trend.

A long position is taken by trend traders when an asset's price increases. An upswing is defined by swing lows and highs higher than the previous swing low. Trend traders may also take a short position in an asset that is losing value. A downward trend is characterized by lower swing lows and higher swing highs.

Assuming that the current trend will continue, trend trading strategies are built on this premise. A take-profit or stop-loss provision may be included in these strategies to ensure that gains are protected if the trend shifts. Trend trading may be used by short-term, intermediate-term, and long-term traders.

Is Forex Trading More Profitable Than Crypto Trading?

Both forex and crypto trading has grown in prominence in recent years as more individuals seek alternate methods to make passive income. Forex currency exchange (Forex) has been around for far longer, although it was once exclusively available to a privileged class of investors. Forex trading was not available to all investors until recently, mainly to the rise of internet brokers.

On the other hand, cryptocurrency trading grew in popularity after the remarkable 2017 market surge. Even though cryptocurrencies are speculative investments that might result in massive losses, volatile price fluctuations can result in substantial rewards.

The two markets each have distinct characteristics that make them appealing to various investors. At the same time, they have comparable supply and demand dynamics that determine the pricing of their respective assets. As a result, choosing which market gives the highest profits with the least risk may be challenging, particularly for rookie traders. On the other hand, a comprehensive investigation of numerous market factors might disclose which investment choice best fits your objectives as an investor.

Forex Trading Vs Crypto Trading: What Is A Safer Trade?

Forex trading may be regarded as a bit safer than cryptocurrency trading. Unlike Forex, the cryptocurrency market has no central authority and is very volatile; as a result, it is prone to violent market swings, but it also implies high risk and high reward.

Furthermore, the cryptocurrency market is less liquid and has smaller trading volumes, making it more challenging to enter and exit significant deals. Because of these factors, forex traders are often given additional leverage, enabling them to execute bigger bets.

Forex Vs Crypto: Which Is Easier To Trade?

This is a tricky issue since both provide difficulties to the inexperienced trader. Because the cryptocurrency market is so decentralized, it is straightforward to purchase and sell on platforms that generally do not require a minimum fee. Each transaction on a cryptocurrency trading platform will have a fee, which varies by site, and a trader will need a digital wallet and a verified account. Some brokers, although not all, provide platforms for trading cryptocurrency. Brokers will not charge a commission but profit from the spread, which is the difference between the buy and sell prices. Before creating an account with a trader, the trader must authenticate their identity.

The forex trading market has substantially greater liquidity, allowing traders to purchase and sell at affordable rates and enter and exit positions swiftly. The forex trading market is a relative winner when converting your trade into profit.

Given these characteristics, trading forex is more straightforward than trading crypto, but both benefit people wishing to earn despite the risk.

What Is Crypto Margin Trading?

Crypto margin trading is a method of conducting asset trades utilizing money supplied by a third party. Margin trading accounts, as opposed to standard trading accounts, enable traders to get extra cash and help them use positions.

How Do I Start Trading with Margex?

Create a user profile

Fill out the needed information on the Sign-up page. "Register" is the only option. You'll get an email to confirm your registration. To finish account registration, open this email and click on the confirmation link.

Deposit

Margex accepts the following payment options at this time:

- Directly transfer cryptocurrency to your Margex wallet from another address.

- Use Changelly or Changenow to buy cryptocurrency using a bank card.

- Making a deposit is as easy as the following:

Add a deposit to your Wallet by clicking +Deposit:

Select the currency you want to deposit from the drop-down menu:

Simply copy the Margex deposit address and paste it into the site/destination wallet's box.

Once you've clicked the "Buy Crypto" button, follow the steps given by Changelly to complete the transaction.

Navigate to the Trade page in order to begin trading

When placing an order, choose your preferred criteria;

- Collateral currency

- Trading pair

- Order type

- Order size

- Leverage

To make a Buy or Sell order, click the appropriate button.

FAQ

Here are some common questions about Forex and Crypto.

Forex vs Crypto: what's better?

Trading forex or cryptocurrencies is mainly determined by crucial characteristics, including risk vs return tolerance, a desire to speculate, and an understanding of how to trade both, since neither is simple for novices.

Whichever you go for essentially depends on the knowledge of it you have. However, a lot of forex traders are actively switching to crypto trading.

Is forex trading and crypto trading the same?

Forex and cryptocurrency trading are not the same, despite their similarities. On the other hand, foreign exchange trade has been around for far longer, dating back to the days when we had separate national currencies.

Forex vs Crypto: which is riskier?

Due to the absence of regulation in cryptocurrencies and the resulting volatility in percentage swings, crypto trading might be associated with a slightly higher risk than trading Forex. Contrary to the popular opinion on Forex and Crypto, it's feasible for a person to earn or build money by trading cryptocurrencies and Forex consistently.

Forex vs Crypto: which is harder to trade?

This is a tough call; as earlier discussed, both have their peculiarities and choosing which is easier depends on the individual's preference.

Forex vs Crypto: is the latter easier than the former?

This is a difficult decision since each has its unique advantages and disadvantages, and more straightforward picking is a matter of personal choice.