The law of gravity suggests that whatever goes up must come down. Looking further into the law suggests that energy has to be applied for an object to go up, likewise(a gravitational pull) for an object to come down. This law of rising and falling doesn't just apply to physical objects. We can also see it expressed in commodities, stocks, bonds, physical goods, and cryptocurrencies.

Since assets like cryptocurrencies are intangible assets, and we cannot suggest a physical movement up and pull down, the question, "what makes crypto go up and down?" becomes an interesting topic to consider. What are the "factors" responsible for the sharp rise and drop in prices? Why do cryptocurrencies have to experience much volatility?

This article has been moulded to address these questions as we uncover various factors responsible for sharp increments and decrements in this digital asset class.

What Determines The Value Of A Cryptocurrency?

It is impossible to give a single, wholesome response to this question, as many factors come together under the umbrella of value for any cryptocurrency at any given time. Cryptocurrencies are decentralized entities, meaning there are no central authorities or intermediaries in their operations. This elimination of central authorities also eliminates a central factor that could have been responsible for the value of cryptocurrencies and spreads it across multiple factors. Let's consider some of them below:

Cryptocurrencies are assets even though they are intangible, meaning they are affected by supply and demand.

Another thing is that you won't have to look too far before realizing that cryptocurrencies are built on communities, and communities are made up of people. Therefore, greed and fear also make up the list of factors affecting the rise and fall of cryptocurrencies.

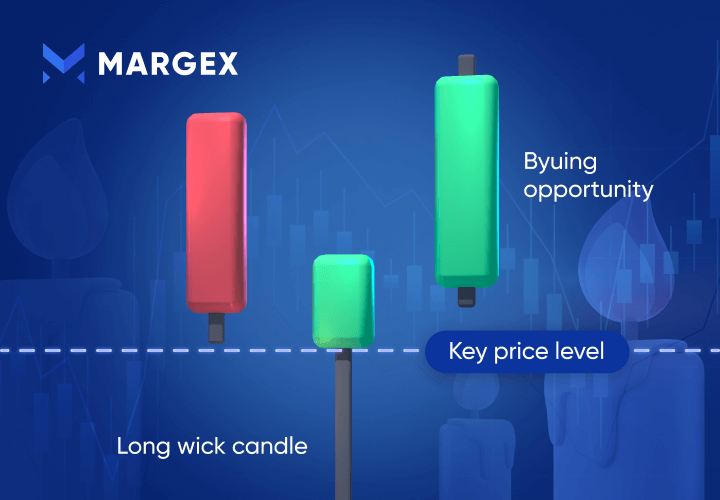

The financial markets are generally made up of three analyses; there's Fundamental Analysis(FA), Technical Analysis(TA), and Sentimental Analysis(SA). Fundamental analysis is an analysis of market price movements made from press releases, news and events regarding a digital currency. This means that what the media broadcasts also feature on the list.

You would think that the above is enough reason for crypto going up and down, but we also have to consider the cost of production for cryptocurrencies as a factor.

Cryptocurrencies are digital entities, which means they are not restricted by borders and can find their way into any country with internet access. This borderless feature subjects it to the rules and regulations of the land, contributing to the value of a currency falling or rising.

Other factors include internal governance of the cryptocurrency, market competition, and availability on crypto exchanges.

Factor 1: The Law Of Supply And Demand

The law of supply and demand is one of the oldest economic principles that contribute to and explains the rise and fall in prices of goods in the market. This economic theory shows the connection between the buyers and sellers of a particular product, the price of a product and people's willingness to either sell or buy it.

The law is a combination of two laws; the law of demand and the law of supply. The law of demand states that people will reduce their demand for a good if the price is high. While the law of supply states that sellers will supply more when the price of a good is high. Some laws state that when the demand for a good surpasses the supply of a good, the price goes up. And when the supply of a good exceeds the demand of a good, the price goes down.

Understanding the above will provide insight into why cryptocurrencies go up and down. The price of Bitcoin went through the roof because the demand for BTC was greater than Bitcoin’s supply.

Different factors can be responsible for increased demand for a certain cryptocurrency. It could be more awareness, increased utility, etc. For Bitcoin, it blew up because it went beyond being a medium of exchange to serving as a store of value. In Ethereum's case, it blew up because it could accommodate decentralized applications and financial services(utility).

The bottom line is that when the demand for a cryptocurrency is higher than its supply, its price goes up, and when the supply of a cryptocurrency is greater than the demand for it, the price drops.

Factor 2: Government Regulations And Restrictions

The arrival of cryptocurrencies in the market has constantly threatened traditional financial systems. While some governments embraced digital currencies' innovation and possibilities, others have not taken the threat lightly. The Library of Congress(LOC) highlights that over 40 countries have outrightly banned the use of Bitcoin or added restrictions to it. In contrast, over 100 have authorized their financial regulatory bodies to develop regulations for using cryptocurrencies within their jurisdiction.

The rate at which cryptocurrencies are growing strongly suggests that they will be regulated, leading to centralization. Which many believe will be bad for the health of the crypto market. These restrictions, bans, regulations, and so on also contribute to the rise and fall in the price of cryptocurrencies.

A quick flashback to establish this point will be recalling the year China banned cryptocurrencies despite having over 80% of the hashing power for Bitcoin. The news of the ban and the government's clampdown on Bitcoin mining farms within the country affected the price of Bitcoin globally. One country's restriction had a global effect; imagine multiple countries.

Factor 3: Effects Of Supply On Crypto And Altcoins Price

Every cryptocurrency releases its own token economics, which is also called tokenomics. This includes data on the total supply of that currency, the circulating supply, and the rate at which it will be supplied to the market.

For Bitcoin, we know its supply is capped at 21 million, and the rate at which it is supplied to the market is halved every four years. This is done as an anti-inflationary measure for the cryptocurrency. Currently, over 19 million of Bitcoin's total supply is in the market, you would think that the remaining 2 million will be mined quickly, but it's not until 2130 that the last Bitcoin will be mined.

This tokenomics of a fixed supply, a quadrennial halving, and the introduction of scarcity contributes to the massive potential Bitcoin's price could attain — that's asides from massive adoption and utility, which has made the demand for Bitcoin outweigh its supply. But, of course, the same goes for every other alternative coin; the nature of their tokenomics contributes to their rise and fall in price.

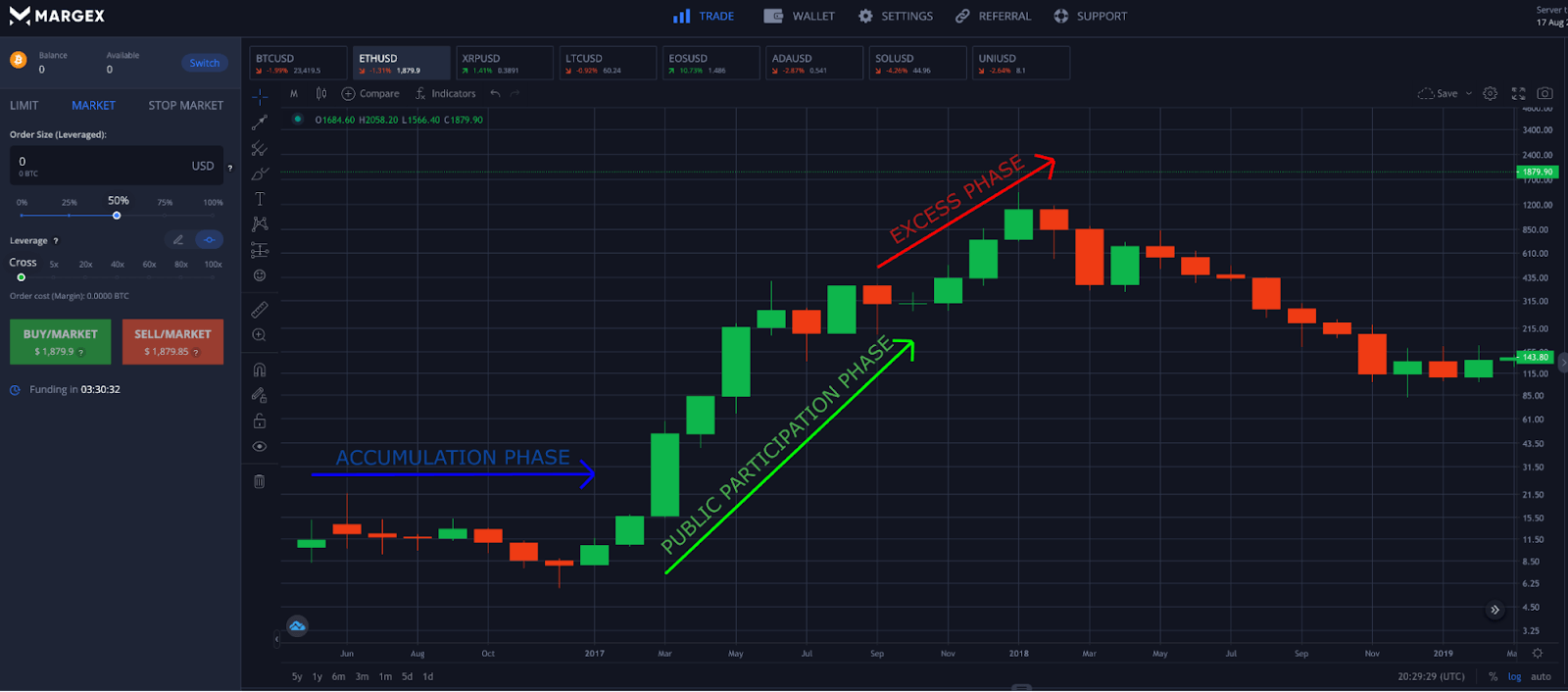

Factor 4: Rising Demand

There was a time you didn't know about Bitcoin and other cryptocurrencies, but now you do — and if you had your way and the capital, you would like to get some for yourself and hodl long-term. That's another reason right there why the price of cryptocurrencies shoots up. The more people become aware of cryptocurrencies, the higher the demand for cryptocurrencies.

The tremendous increase in volumes traded on crypto exchanges between 2020 and 2021 was simply due to the massive adoption of blockchain technology. As a result, industries are constantly looking for ways to integrate stellar innovation into their day-to-day activities. Furthermore, countries are looking for ways to adopt it and tap into the over $2 trillion rising market, while investors are seeking more projects to invest in and profit from long-term, etc.

All of this contributes to the bull run you see many cryptocurrencies experience when they do. Also, more people are mining Bitcoin and other Proof-of-Work cryptocurrencies at a higher rate than ever, contributing to the circulating supply of these coins.

Factor 5: Mass Adoption

It might be easy to conclude that cryptocurrencies are already mainstream because of the buzz everywhere. But when you consider the statistics by BuyBitcoinWorldwide that show just over 300 million people and a little over 18,000 businesses use cryptocurrencies worldwide, you see massive room for more adoption.

An increase in adoption causes an increase in demand which is very healthy for cryptocurrencies with limited supply. One of the things that drive adoption is real-life applications. The more Bitcoin and alternative coins grow in day-to-day applications, the more adoption it records, which in turn sends its price up. Exchanges have also begun to offer options for institutional traders like ETF and other crypto-backed commodities leading to higher trading in financial instruments.

Factor 6: Inflation Of Fiat Currencies

This factor is not a general one, but inflation also affects the increase in the price of Bitcoin and other currencies. This is because most cryptocurrencies are pegged to the stability of U.S. dollars. Therefore, if a country's fiat currency falls in value to the dollar, it typically increases the value of Bitcoin and other currencies in that country.

Factor 7: Market Competition

Like any other market, the crypto market is not loyal to anyone. A quick shift happens immediately if another crypto project has a better proposition, functionality, and price point. This constant competition keeps crypto projects innovating to retain and gain more market share. For example, when Bitcoin was still the biggest deal without solid competition, it had over 70% of the crypto market dominance, giving it a far higher price.

However, the introduction of cryptocurrencies like Ether and the Ethereum platform brought stiff competition and wider functionalities such as collectibles (NFTs) and decentralized finance (DeFi), which caused the total market capitalization of the crypto market to increase within a five-year period.

Bitcoin's market dominance has reduced while its market share (synonymous with its price increase) has increased. Now, Bitcoin has over 40% market dominance because numerous cryptocurrencies have been introduced with various offerings that appeal to the crypto market.

The bottom line is that a cryptocurrency will experience an increase or decrease in price if a new competitor offers something better to the market. This constant toggle for market share by competing cryptocurrencies contributes to the rise and fall in crypto prices.

Factor 8: Cryptocurrency Price And The Media

Greed and fear rule the cryptocurrency market. At one point in the market, there will always be a greedy set of people buying more and a fearful set of people selling their assets to "secure" profit or mitigate losses. Much of this fear and greed is controlled by what we hear and see. This is where the media comes in.

The good news in the media about a particular cryptocurrency can improve its value and perception driving its price up. Unfortunately, the reverse is also the case. News like scandals, scams, hacking, restrictions, expensive mining limitations, etc., can hurt a cryptocurrency's price. This is because it spreads fear into the hearts of investors that their investment isn't safe.

Bottom Line

Volatility is not a new thing in the financial markets. The extremity of volatility in the cryptocurrency market can be attributed to its relatively new presence compared to the traditional financial market. However, cryptocurrencies are considered a good asset class to invest in for both the short-term and long-term to generate active and passive income.

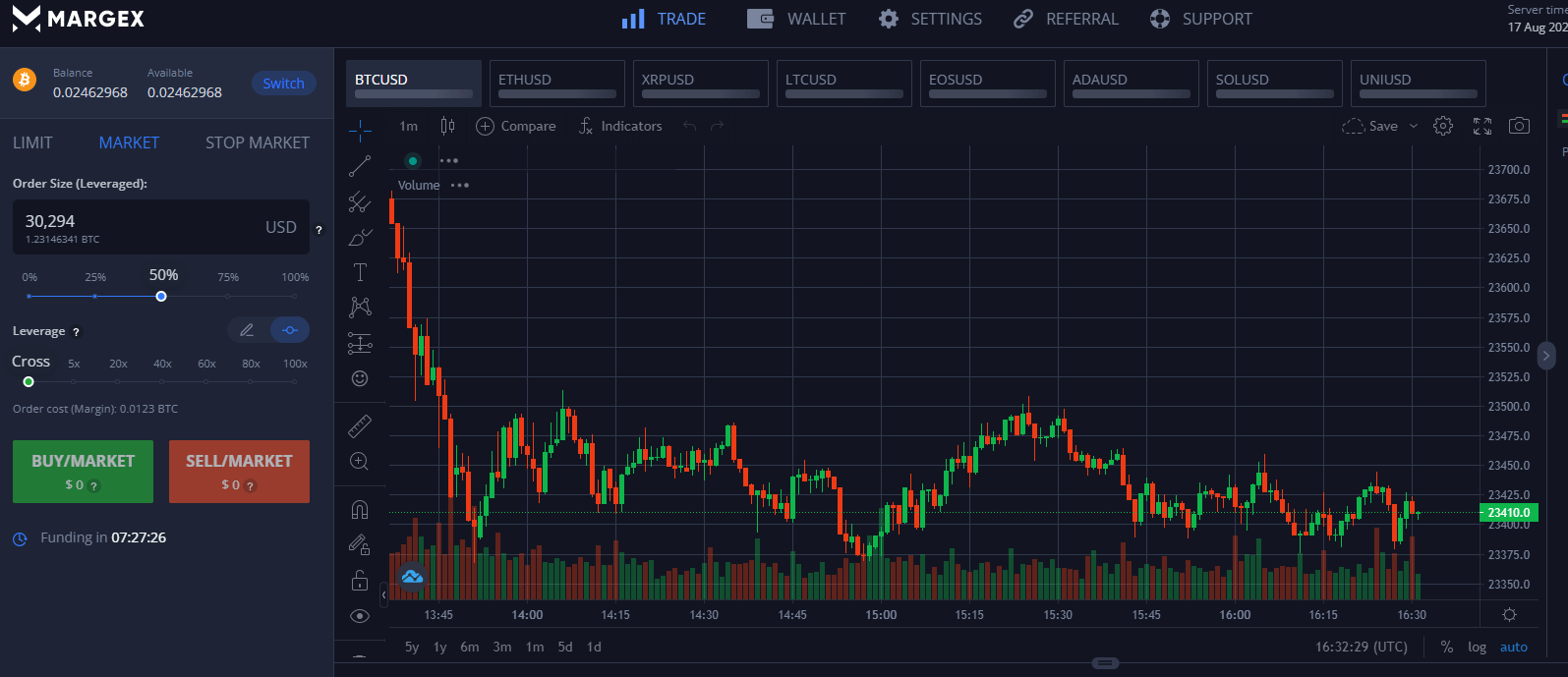

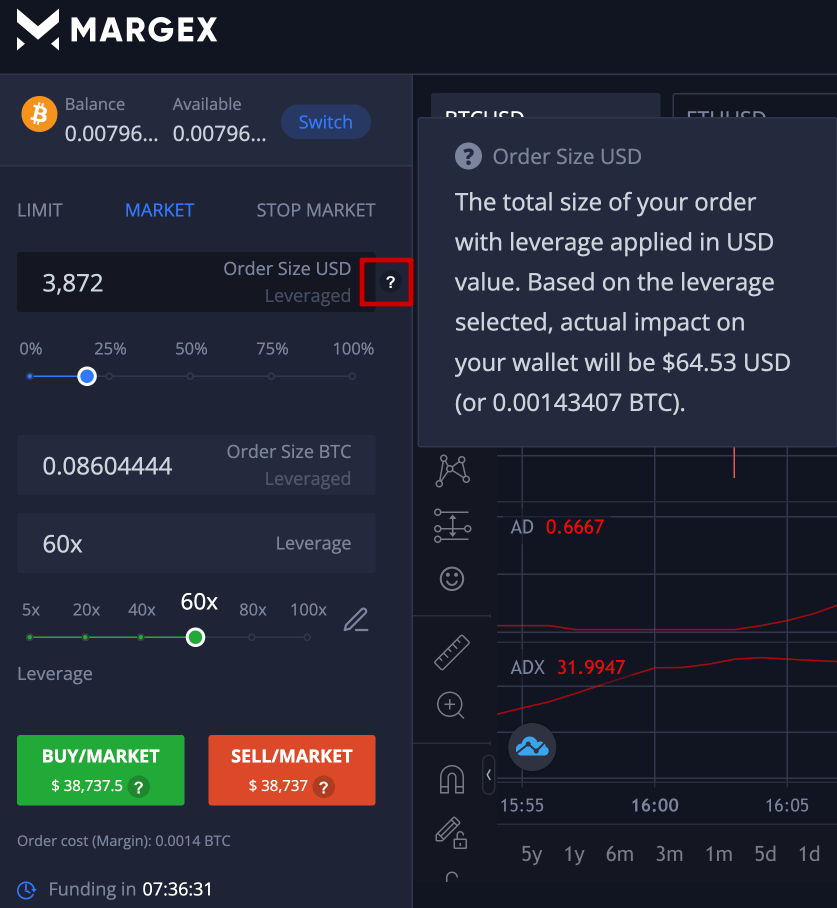

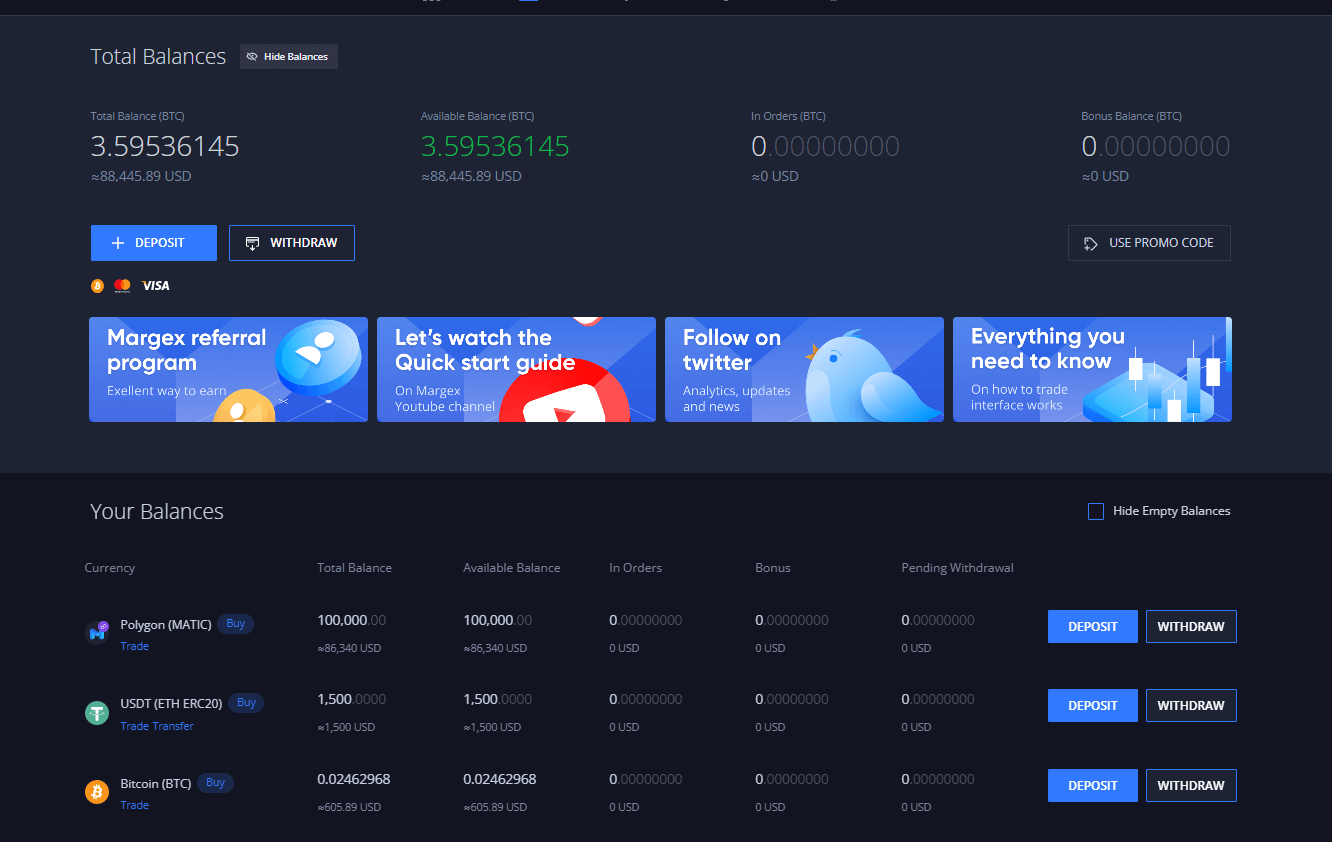

There are numerous platforms out there to get started with trading cryptocurrencies. However, Margex provides the best opportunity to begin your crypto journey. It offers simplicity and a great user interface where you can access the best tools and features to help you profit from your trades.

Users can trade multiple crypto pairs and deposit as many as 14 cryptocurrencies without restrictions. Furthermore, Margex offers the best leverage up to (100%) and margin trading (5%).

Unlike other trading platforms where to trade a particular pair with different collateral, you either need to open a new account or the collateral needs to be deposited in your account as one -sided part of the pair, etc, Margex allows you to trade all the pairs available on the platform and settle the outcome of your trade in your preferred cryptocurrency or stablecoin.

FAQ

Here are some common questions about Bitcoin and why crypto prices are volatile.

Is Bitcoin a good investment?

Bitcoin has been around for over a decade. Data shows that from 2012 to 2021, Bitcoin has done over 540,000% increment. Bitcoin has experienced a lot of valley moments in its run but has also given investors peak moments that made them happily journey to the bank. Of course, you still have to decide for yourself after doing your research, but everything so far points to Bitcoin being a good investment in the long run.

Is Bitcoin illegal?

Whether Bitcoin is legal or illegal is primarily determined by the government of the land. In countries where Bitcoin has been banned, then it is illegal. However, in countries like EL Salvador, where Bitcoin is a legal tender or the use of cryptocurrencies is allowed, it is legal.

What causes Bitcoin and Ethereum prices to go up?

Several factors are responsible for the increase in the price of Bitcoin, Ether, and other cryptocurrencies. Two major factors are mass adoption and utility. Some other factors have been discussed in this article to address what makes crypto go up and down, which you can scroll back to read again.