Yield farming and staking continue to gain popularity in the crypto market. These two processes aim to generate profit for cryptocurrency holders. But while the end is profit, the processes differ, as you'll find in this staking vs. yield farming guide.

Staking involves committing crypto assets to secure a proof-of-stake blockchain network. On the other hand, yield farming is a process where crypto users provide liquidity to decentralized finance protocols.

These DeFi protocols include liquidity pools, borrowing, and lending services executed through smart contracts. Both methods are ideal for passive income. Keep reading the yield farming vs. staking details below to discover the pros and cons and more.

Yield Farming, What Is It?

Another name for yield farming is liquidity mining. It is a mechanism that generates more cryptocurrency from your assets. It is referred to as farming since the gains grow over time. The participators lend their crypto assets to a decentralized finance platform for interest.

The funds will remain in a select liquidity pool to ensure that the DeFi protocol will be liquid. On the platforms, the assets are used for lending, trading, and borrowing.

A platform providing liquidity collects fees distributed among investors depending on the size of their share in a liquidity pool.

Liquidity pools are vital to the operations of automated market makers (AMMs). These AMMs give users access to automatic and hassle-free trading through liquidity pools replacing traditional buying and selling methods.

Liquidity provider tokens are given to each contributor to measure their contributions to the pool.

For more information - on yield farming, visit Margex blogs.

Pros And Cons Of Yield Farming

Yield farming has its gains and potential downsides. Here are some of them.

Pros

Availability of apps

With more software and technological innovations, it is now easier to use yield farming apps. In addition, investors can monitor their farms using user-friendly apps.

On these apps, all available projects will be listed for investors to commit their crypto funds. It is one of the innovations in crypto trading, making the process faster.

Easy startup process

Yield farming is easy to start once a crypto holder possesses two required items. These items are Ethereum and a crypto wallet. Since the procedure is easy, it attracts numerous users hoping to bypass the hassles of investing through traditional banking.

More earning opportunities

It is easy to earn more income as a yield farmer. The earnings can come from transaction fees, price appreciation, token rewards, and interest. The focus of yield farming is maximizing profit for users transacting with a liquidity provider.

Other more advanced farming strategies are executed on the platforms using smart contracts.

Cons

High Ethereum gas fees

Gas fees are paid on every transaction on the Ethereum blockchain. It has been on the rise, which is detrimental to yield farmers. Paying high gas fees can create losses instead of gains for crypto holders.

Since most crypto assets rely on the Ethereum blockchain, it is difficult to avoid the fees. This aspect is one of the drawbacks of farming in the yield farming vs. staking debate.

Short-term rewards

There is the risk of unstable returns with farming. Also, since it is easy to start with many users engaged now, profitable strategies take time to figure out.

Now farmers constantly face hard decisions, such as identifying the right trading pair that will be profitable.

Own more, earn more

Crypto holders with smaller assets are disadvantaged on farming and lending platforms. On the other hand, it is much easier to earn more if you have a large volume of assets to commit to crypto transactions.

This aspect might discourage users who are just starting or cannot afford to purchase many crypto assets.

Understanding What Staking Is In Crypto?

Users operate individual nodes to validate transactions and add new blocks to a blockchain network. The network randomly chooses a validator node giving preference to those with higher stakes.

Staking is a process where users lock their crypto assets to secure a proof-of-stake network. Crypto holders that stake these assets earn rewards for their contribution to network security.

Users can also combine assets in a staking pool to increase their crypto stake. Rewards are distributed depending on how many assets a user has in a pool.

Staking was created to reward users while simultaneously conserving energy. Stakers replaced miners that consumed high energy validating crypto transactions.

A staking platform holds users’ crypto assets for a specified lock-up period. This aspect is one downside for staking in yield farming vs. staking debate.

Pros And Cons Of Staking

Staking has its benefits and drawbacks. Here is what you need to know.

Pros

Rewards

Crypto users earn rewards for contributing to the security of a blockchain through staking and verifying transactions. These rewards depend on how much crypto assets; are staked. The reward system can also be fixed or varied.

Staking rewards have more certainty than miners’ rewards. The platforms reward users at high-interest rates. The value of staked crypto can also increase in the market.

Access to security and governance tokens

Governance is now a big part of the crypto industry. Some platforms give stakers security and governance tokens enabling them to participate in on-chain governance.

These staking networks also adhere to strict policies to encourage good behavior from all member nodes. A node that engages in dubious activities; can be punished by losing some or all of its staked coins.

Low entry requirements

One of the reasons staking is popular is that it does not have extensive requirements for entry and participation. Most platforms require holders to have a minimal amount of a token to start the process.

Crypto stakes can be made online by individuals since the process is straightforward. This is why some users opt for staking vs. yield farming as an investment choice.

Cons

Volatility risk

Cryptocurrencies are generally volatile. Staked coins are also at risk of sharp price corrections and extreme volatility. Locked coins can lose value. The withdrawal process for staked coins is not easy and can hurt your investment.

Risk of punishment

When a node exhibits bad behavior, the network confiscates some or all of its stakes. This action drops the value of the staked coin punishing the entire pool for such behavior.

So, an entire staking pool can lose its stake due to one errant node violating the network policy.

Liquidity risks

Liquidity shows how much of an asset can be changed to spendable currency. But when an asset is staked, it becomes difficult to withdraw the assets. A user cannot access these assets until the lock-up period is complete.

Yield Farming Vs. Staking: Examining The Difference.

The debate of staking vs. yield farming, which is better, is prominent among investors. Here are some areas that set these two apart.

Difficulty levels

Although they are both easy to learn, yield farming is a bit more complex. Users have to come up with the right strategies for profitable investments. Also, liquidity providers must identify the right liquidity pools with affordable rates.

Next users must select the right token pair and choose from a DeFi platform that offers either a customized or equilibrium liquidity pool. The lenders, on their part, must align with a DeFi protocol with little or no collateral requirement for loans. This procedure can be tedious without proper guidance.

For staking vs. yield farming, the former is relatively easier to navigate. Users can simply select a staking pool and lock up their crypto assets. Once the asset is locked in, the process is passive and does not require additional effort.

Yield farming requires micro-management and tactics to yield better results.

Impermanent loss of assets

Yield farmers suffer from impermanent loss if there are price changes from when the tokens; were initially deposited. If a user withdraws crypto assets when the prices have deviated from the value of the initial deposit, the impermanent loss turns into a permanent one.

Staking does not expose users to impermanent loss. Liquidity pools help to maintain stability and adjust the price of tokens in volatile markets. Users can only lose in a bear market. But since the total value of assets in the liquidity pools doesn’t change, validators will not suffer impermanent loss.

So, when it comes to losses in a yield farming vs. staking debate, the latter wins.

Length Of deposit period

Flexibility is a key point to note when considering yield farming vs. staking for rewards. Yield farmers have the edge here as they do not need to lock their assets in a liquidity pool to earn rewards.

They can quickly provide liquidity to a pool of their choosing or withdraw their tokens if the yields are insufficient. If the pool is not a minimum lock-up pool, yield farmers can shuffle between different pools as an arbitrage opportunity.

But staking involves lengthy lock-up periods in which users cannot withdraw their assets. The smart contracts on a staking platform prevent withdrawals before the term is complete.

During bad market conditions, stakers are left as bystanders watching their stakes without doing anything.

This aspect gives farmers an edge in the staking vs. yield farming comparison.

How Do You Choose The Right Staking Platform?

In the staking vs. yield farming debate, some users choose the former due to personal preference and some rigors of yield farming.

But different actions can help when choosing a staking platform. Let’s consider some of them below.

Check the rewards

The aim of staking is for users to earn rewards. When choosing a staking pool, look out for the reward system and the transparency of the process. It is not ideal for your tokens not to yield enough returns.

So, do proper research and compare and contrast. If the return seems too good to be true, it might be a scam project.

Verify the authenticity

Some staking pools fleece users of their assets and disappear. Ensure that the platform is registered and licensed before committing to it. Some crypto users have fallen victim to infamous rug pulls.

Look out for user reviews from forums it might come in handy to verify the claims of such establishments. Users should not join staking platforms with no apparent structure.

Rules and policies

When it comes to investing, no detail should be overlooked. Users must understand the policies and rules of a staking platform to avoid breaking them. Rules vary across different platforms, and many platforms penalize defaulters. Some withhold all or some of a defaulter's staked asset, which may also hurt the pool.

So, a user must conduct detailed research before committing tokens to a particular pool. Also paying attention to details is vital if a user opts for staking in the staking vs. yield farming investment choice.

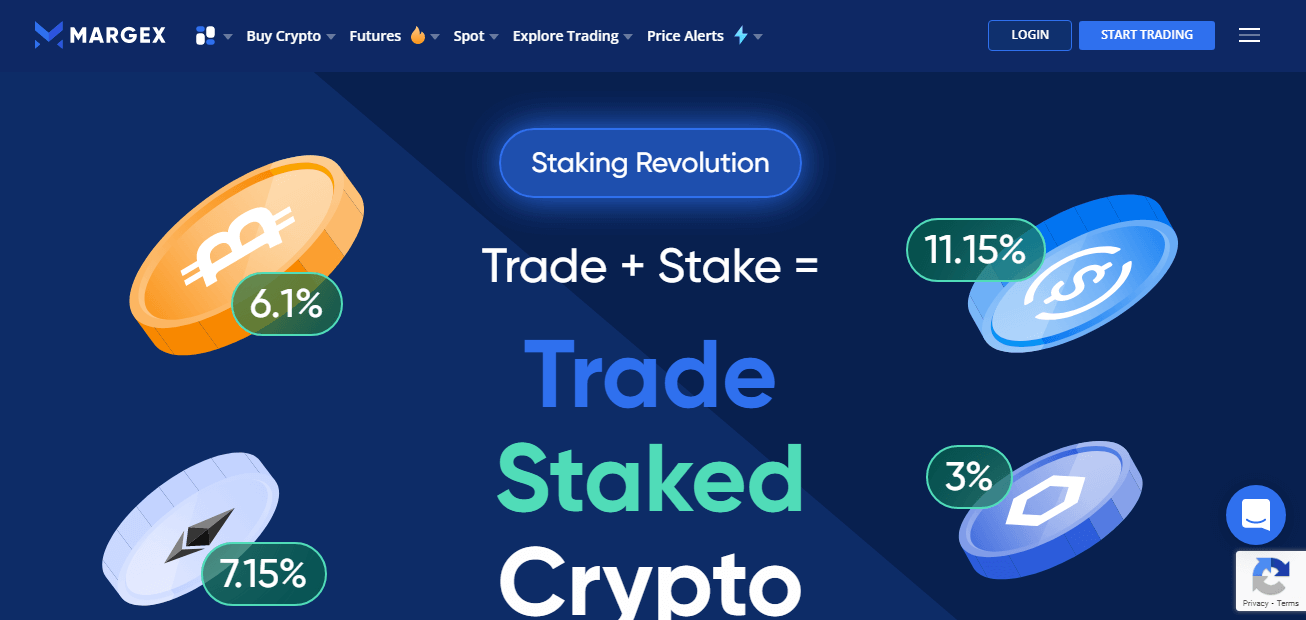

Why Stake On The Margex Platform?

Margex offers users unbelievable benefits for staking on its secure platform. Users registered on the platform can stake their cryptocurrencies with the staking feature.

Users are given access to stake USDC, Ethereum, Bitcoin, Tether, Chainlink, and much more.

The APY is as high as 11.15% on some crypto assets making it a worthwhile investment for users. This gives staking the upper hand in investors' staking vs. yield farming selection.

Staking generally on most renowned platforms involves lengthy lock-up periods where coins cannot be unstaked. It might also require advanced knowledge of staking mechanisms.

But Margex simplifies the process for users and makes it possible to stake coins with a few clicks on your mobile device. Margex advantages for users include the following:

Absence of lock-up period

In a groundbreaking innovation, Margex has made it possible to stake and unstake your coins as you wish. You do not have to wait for a lengthy period, especially in a bear market.

Trade staked coins

One disadvantage of staking is that it renders your asset passive on most platforms. But on Margex, you can trade with your staked tokens and earn more profits. So rather than earning just the APY, trading boosts your profit.

User-friendly Interface

The staking interface is not advanced or complicated. Users can easily understand and navigate their way around it.

A diverse list of projects

It only gets better with Margex offering an ever-improving project list. As a result, the platform facilitates higher APY% returns. It also maintains proper risk management and investor protection strategies.

Security

Margex is a registered and highly secured platform that uses modern cryptographic and innovative security techniques. As a result, your tokens are safe for staking and trading.

Sign up today and enjoy the benefits of modern staking.

FAQ – Questions And Answers About Staking Vs. Yield Farming

If you still have doubts about staking and yield farming, the answers below will provide more details.

What does yield farming mean in crypto?

This is a process where a user provides liquidity to decentralized finance protocols. The assets are used for borrowing, lending, and maintaining liquidity in the pool.

Yield farmers charge interest for the liquidity and are rewarded with a share of the transaction fees by the DeFi platform.

What is staking, and how does the process work?

Staking is a mechanism where users commit their crypto assets to secure a proof of stake blockchain network. Users that stake their tokens earn rewards for securing the blockchain from malicious attacks.

The blockchain network randomly chooses a validator node to validate transactions. Users with high-stake nodes have the upper hand during the selection process. Users earn governance tokens and a share of the staking platform fees when new blocks are added.

Yield farming vs. staking, which is riskier?

It depends on a trader's perception of risk in a yield farming vs. staking choice. However, both options carry sufficient risk.

Yield farmers have to come up with complex strategies to realize a profit. However, they can remove their tokens and move them to a more profitable pool.

Staking on the other hand gives users assurance of passive income. However, a staking pool can lose all its liquidity in a bear market since users cannot withdraw their stakes.

So, staking vs. yield farming analysis shows that a significant amount of risk exists for investors.

Farming and staking crypto assets, What is the difference?

There are several remarkable differences in yield farming vs. staking. The two options differ mainly by their mode of operation and reward system.

Farming involves providing liquidity to a pool for decentralized financial services to earn interest. Staking, on the other hand, provides security using crypto assets on a blockchain network for rewards. These assets are locked for a definite period in which owners cannot tamper with them.