Crypto Futures Trading

Crypto Futures 101: What is and how does it work?

A trader benefits if the underlying asset, in this case, Bitcoin or any other virtual currency, either appreciates (if you are long) or depreciates (if you are short). Some futures contracts have an expiration date while others can be traded in perpetuity.

Enter Crypto Markets

User Convenience in Every Aspect

Skill Gap is No More

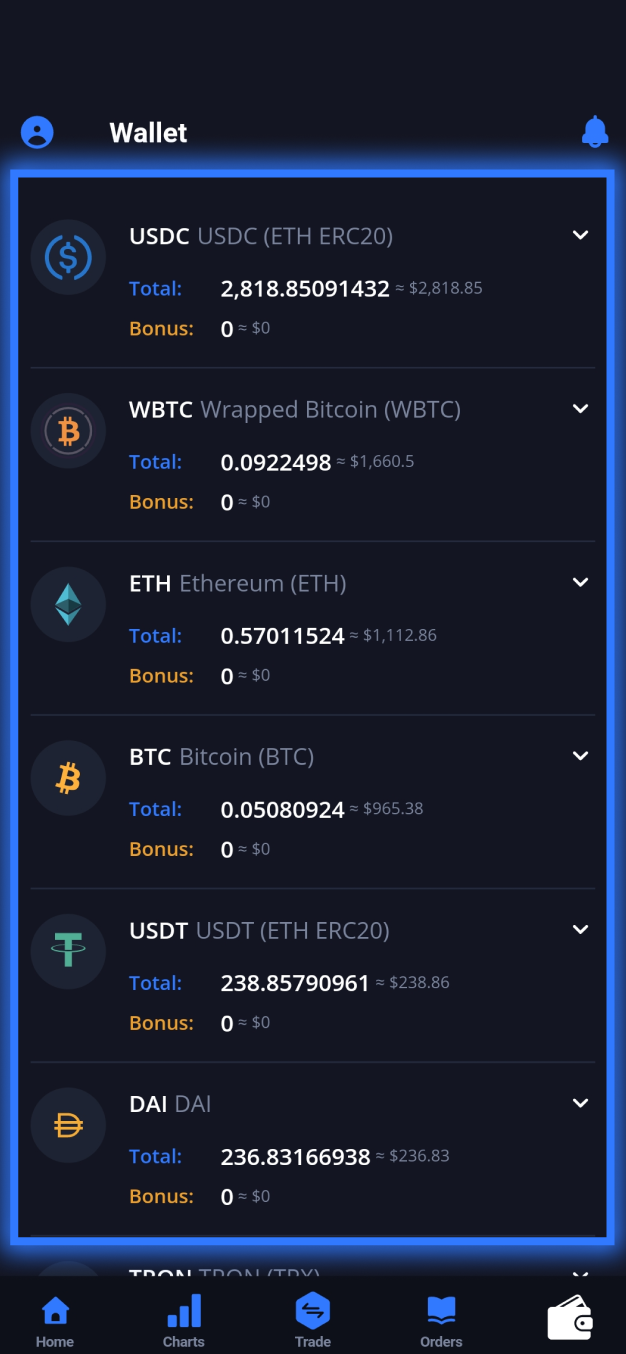

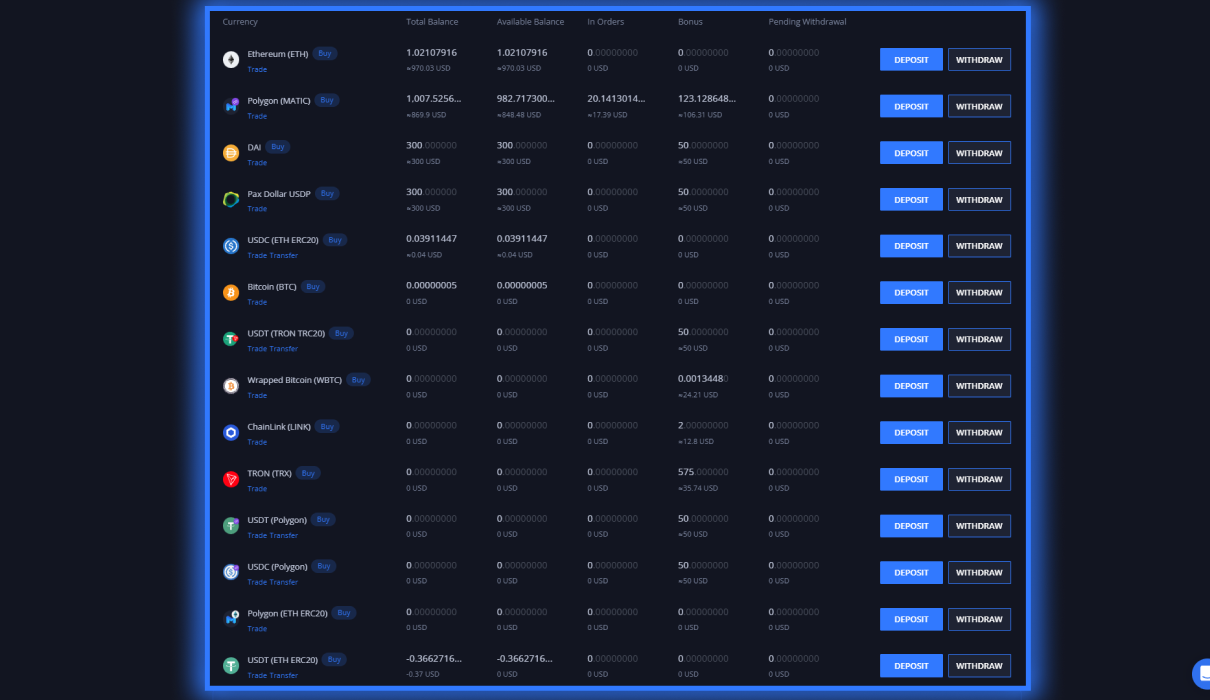

Broad range of deposit options

Privacy Oriented

Everything at a Glance

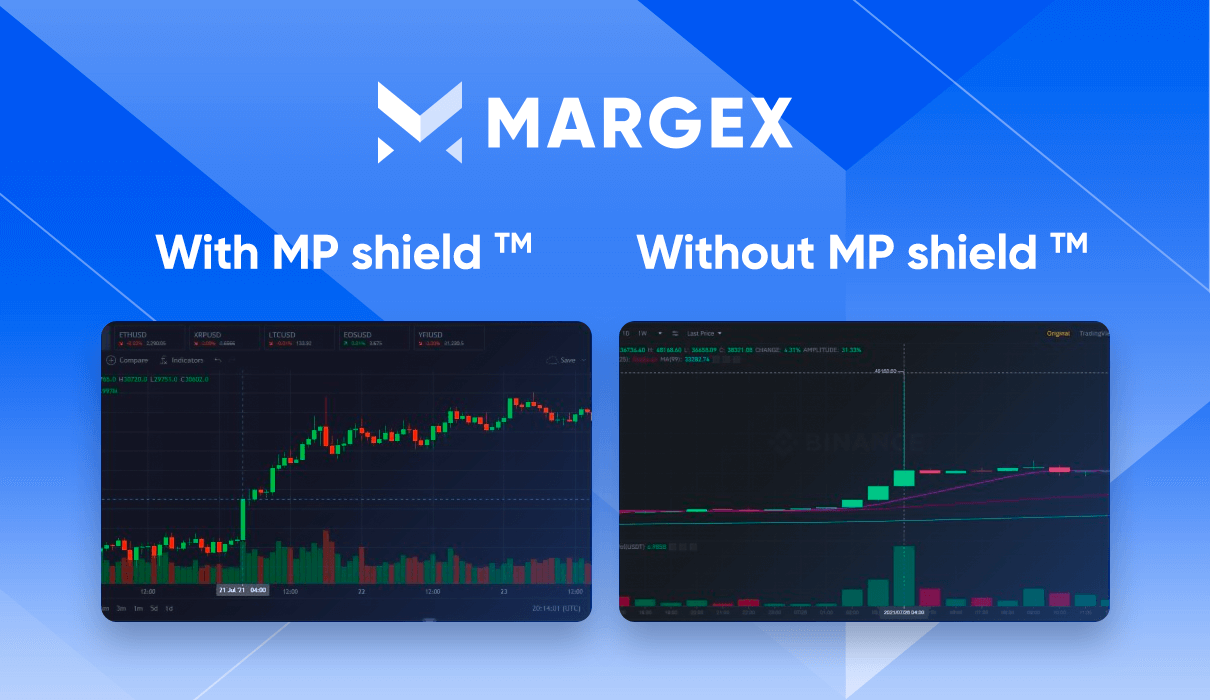

Masters of Risk Management

Why is Margex the best choice to trade crypto futures?

How many types of crypto futures trading contracts exist?

Standard Bitcoin Futures Contracts

The most common type of futures contract. This type of contract provides traders with a timeframe or period of expiration upon which one of the parties must buy the underlying asset. These can be virtual currencies, precious metal, securities such as stock, or commodities, like gold.

These futures contracts are better suited for traders operating with low-volatility assets aiming at specific targets or for long term traders, depending on their expiration date.

Futures with physical delivery

Unlike standard and perpetual, futures backed contracts demand one of the parties involved in the transaction to physically receive the underlying asset. These types of contracts mainly operate as a hedge or for investors with a bullish stand on a sector to purchase an asset on sale today and selling for a profit tomorrow.

These futures products are best designed for investors or speculators with a private agreement with a second party, with the proper infrastructure to hold the underlying asset. The contract has expensive fees, such as carrying and delivery costs.

Perpetual Bitcoin Futures Contracts

Perpetual futures or perpetual swaps are the most common contracts in the crypto industry. Offered by Margex traders can long or short Bitcoin or other digital assets and benefit from bullish or bearish trends.

A perpetual futures contract lacks the trade-offs of other types of contracts and is more cost-efficient for the trader but can be risky depending on the amount of leverage and margin used to place the long/short order. In turn, they allow you to make relatively fast gains or losses.

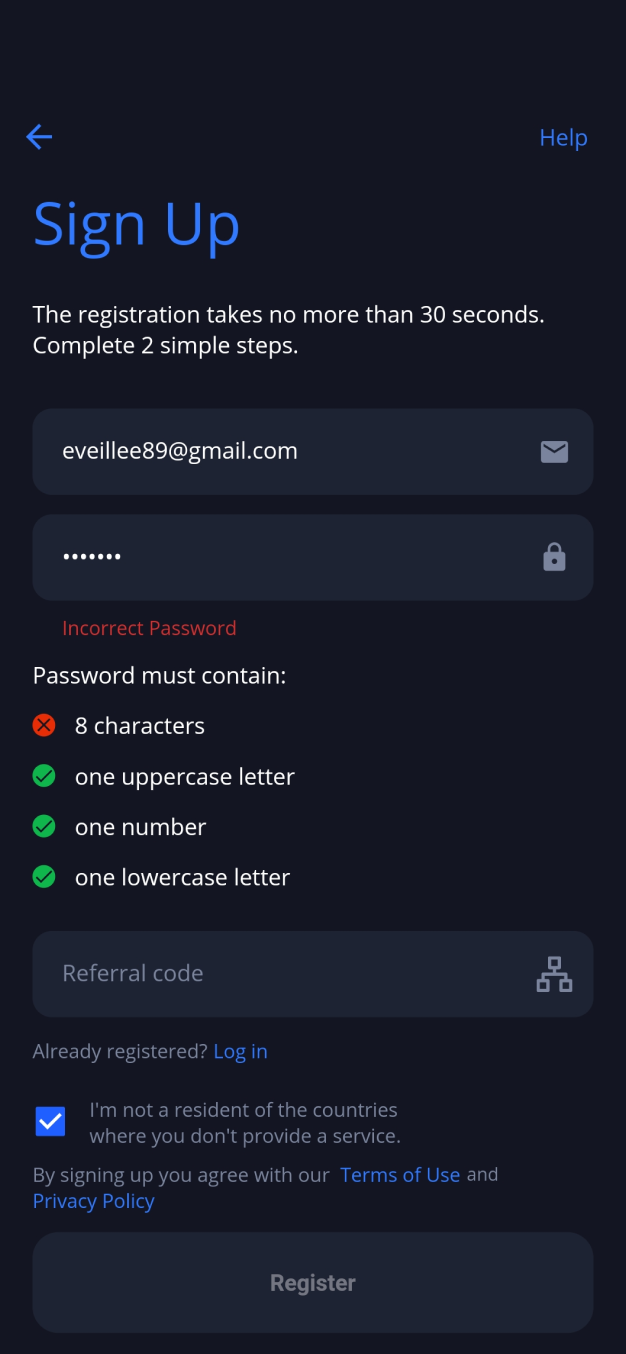

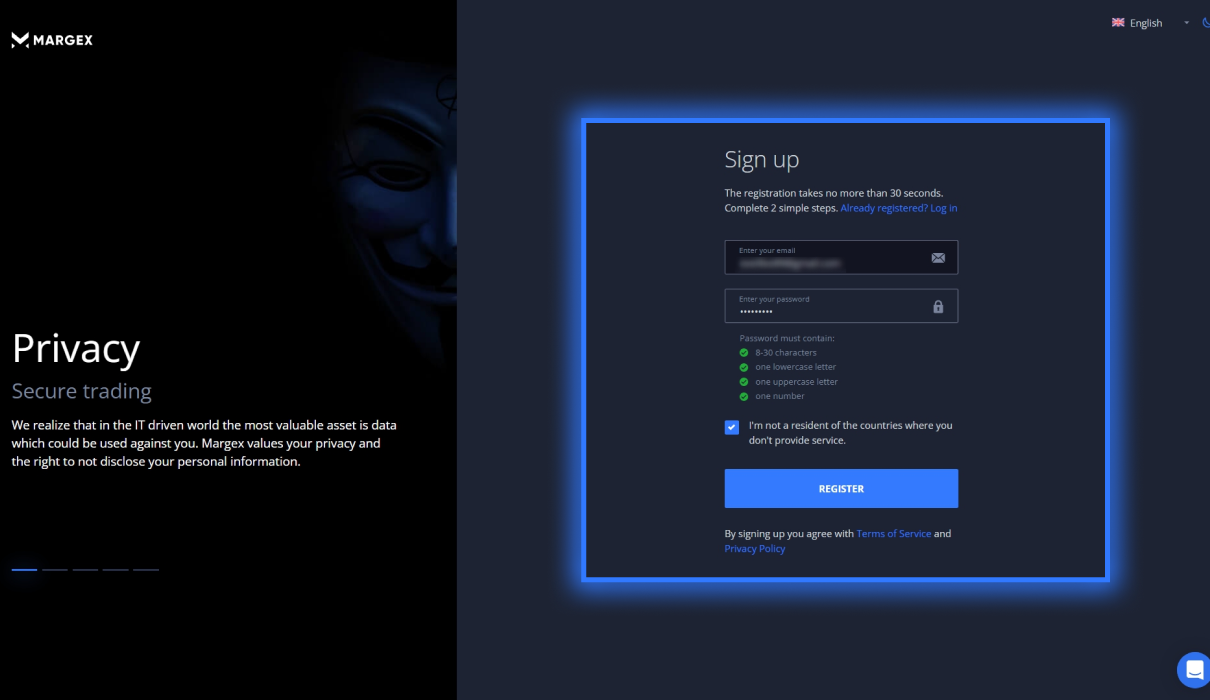

Want to start trading Crypto Futures? This is how you can start

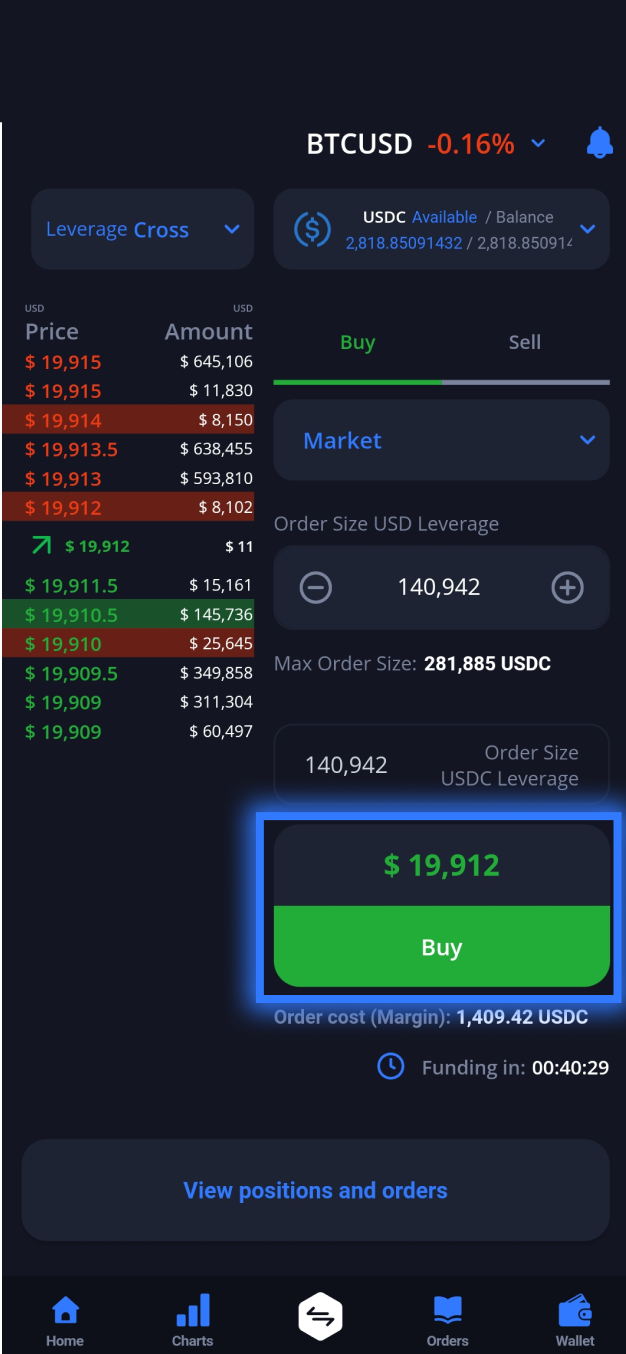

Filling out the order submission window is quite simple. Select the leverage you’re going to be trading with and enter your order quantity in USD, keeping in mind that leverage is already applied.

As an example, if your order size is $1000 and your leverage is set to 20x, your actual margin impact (the funds at risk) is $50. This means that you’re risking $50 to trade with $1000.

Bitcoin futures trading, What are its risks and advantages?

When trading crypto futures, consider the following advantages, and risks to preserve your capital and profit in any market condition.

| Advantages | Risks |

|---|---|

Magnify Return on Equity by risking a small portion of your funds. | Market volatility could work in your favor, but also trigger your stop loss order or liquidate your position, depending on the amount of leverage used in the trade. |

Make profits with relatively small market moves. | Poor risk management habits could result in heavy losses in a short span of time. |

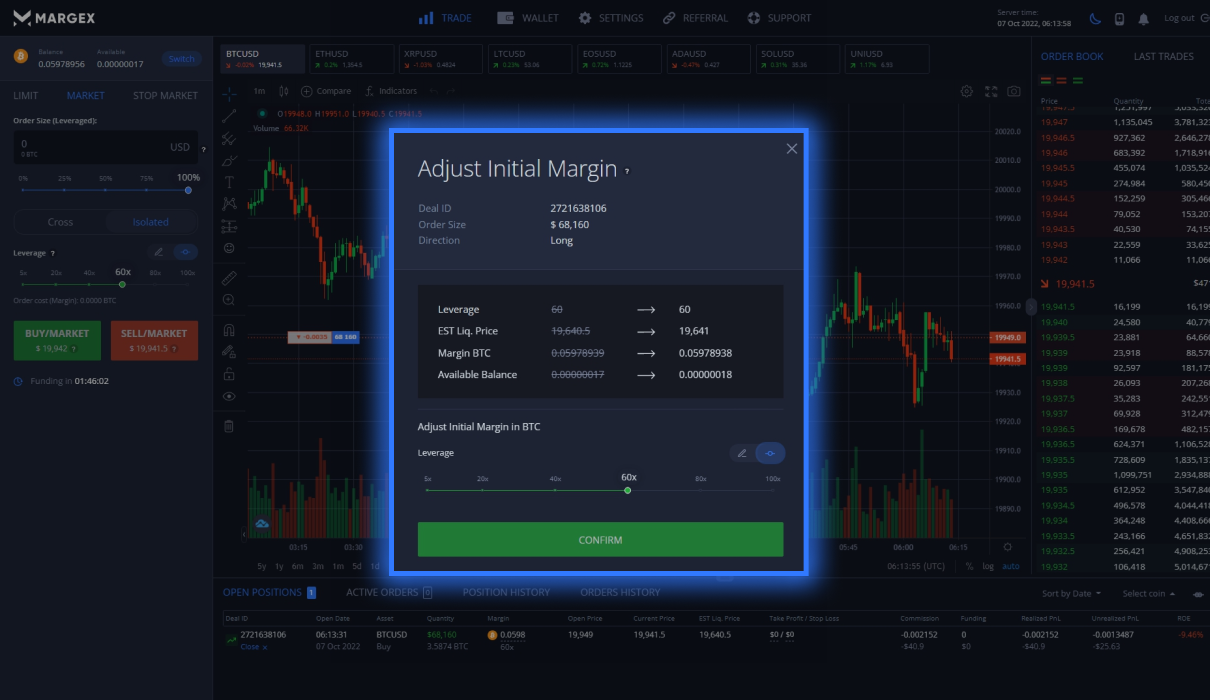

Add or remove collateral at any time by leveraging Margex isolated Bitcoin futures contracts. | Futures trading could require more management, depending on the trader’s strategy |

Stop profit and take profit orders let you minimize losses and maximize gains semi-automatically. |

| Advantages |

|---|

Magnify Return on Equity by risking a small portion of your funds. |

Make profits with relatively small market moves. |

Add or remove collateral at any time by leveraging Margex isolated Bitcoin futures contracts. |

Stop profit and take profit orders let you minimize losses and maximize gains semi-automatically. |

| Risks |

|---|

Market volatility could work in your favor, but also trigger your stop loss order or liquidate your position, depending on the amount of leverage used in the trade. |

Poor risk management habits could result in heavy losses in a short span of time. |

Futures trading could require more management, depending on the trader’s strategy |

This is how to start trading crypto futures for free

Start TradingMargex allows you to trade for free by participating in its referral program. If you invite friends into the platform, you will receive a fixed 40% every time they pay for a trading commission, which can be withdrawn or used to trade with.

This will help you earn daily payments in BTC while increasing your sources of passive income.. These codes can get you a considerable bonus to start with your Bitcoin futures trading journey.

The platform also grants you bonuses by participating in its events or by winning deposit bonuses after making a deposit for a fixed amount.

Trade fees and Funding rates:

| Maker fee | Taker fee |

|---|---|

0.019% (for LIMIT orders) | 0.060% (for MARKET orders) |

| Maker fee |

|---|

0.019% (for LIMIT orders) |

| Taker fee |

|---|

0.060% (for MARKET orders) |

Understanding the cost and fee structure for Bitcoin futures trading

Start TradingAs mentioned, Margex aims to provide users with the most transparent and the fairest in the crypto market. The team behind the platform gives you all the necessary information for you to understand and easily find trading fees.

These are divided into trade fees (make and taker) and funding fees and can be visualized in the table below the chart. Maker fees are triggered when a trader places a delayed order (limit order) above the current price or below it while Taker fees are triggered when a trader places an order that is executed immediately (market order).

On the other hand, funding fees are calculated based interest rates and premiums that are determined by volatility, longs vs shorts, and spread. When the price of the underlying asset in a perpetual contract is higher than the mark price, the funding is positive, which means that traders who are holding a long position open pay for short positions. Same goes for negative funding rates - if the price of the underlying asset in a perpetual contract is lower than the mark price, the funding rate is negative, which means that traders who are holding a short position open pay for long positions.

What you need to know before starting your crypto futures trading journey

Liquidity assessment

The crypto market consists of over 20,000 cryptocurrencies . Many of them have low liquidity and are vulnerable to sudden market moves to either the upside or downside. This can jeopardize your position.

Fortunately, Margex only offers trading pairs with high liquidity, unlike its competitors. The platform has incorporated a solution that combines the liquidity of over 12 different providers This gives all traders an equal chance at making profits.