Cross Margin Versus Isolated Margin

What is margin in crypto trading and how does it relate to leverage?

When trading with leverage, the term “margin” refers to the amount of capital required to enter a leveraged position. Initial margin refers to the minimum amount of margin required to enter a leveraged position, while maintenance margin refers to the amount required to prevent a position from being liquidated.

Cryptocurrency traders use different strategies when tradingwith margin — Margex provides traders with two margining methods that offer different advantages and disadvantages:

Isolated margin restricts the margin for a position to a dedicated margin pool defined by the trader. Should the margin fall below the maintenance margin level required to maintain an open position, the position will be liquidated.

Cross margin shares margin between all open positions that use the same settlement asset. Should a position require more margin, it will be drawn from the total balance of the relevant asset to prevent liquidation.

Understanding how each of these margining methods worksand how they differ from each other can assist traders in preventing the liquidation of open positions and promote more efficient use of trading capital.

How profit changes with leverage in the conditions cross margin trading

Enter Crypto Markets

User Convenience in Every Aspect

Everything at a Glance

Cross and Isolated in a Single Account

Multilaterals Enabled

Why Margex

What is Cross Margin?

Cross margin, sometimes referred to as “spread margin,” shares the available balance of an asset across all relevant open leveraged positions in a trader’s account. The funds available in a trader’s available balance are used to avoid liquidation in open positions with the same settlement asset. Within the context of cross margin, an account is sufficiently margined if the collective maintenance margin requirements of all open positionsare lower than the available balance.

Cross Margin Example

A trader with 0.1 BTC may choose to open a long (buy) cross margin position on BTC/USD at a price of $10,000/BTC, for 1 BTC. The initial margin requirements of this position is calculated usingthe maximum permissible leverage for the trading pair using cross margin, placing the initial margin requirement at 1% of 1 BTC. The trader will, therefore, need to stake 0.01 BTC in initial marginin order to open the position. Should the price of Bitcoin decline, the initial margin of the traderwill also decline. A cross margin position will draw from the total balance of the trader — in this case, 0.1 BTC — as additional margin.This practice allows traders to utilize the totality of their available funds to avoid liquidation

Pros and Cons of Cross Margin

| Pros | Cons |

|---|---|

Cross margin can be used to offset unrealized losses with unrealized profits, minimizing the probability of position liquidation | Cross margin places the entire available balance of a trader at risk — in the case of significant adverse market movements a trader may lose their entire balance should the market price of an asset challenge liquidation level |

Cross margin reduces the overall probability of liquidation by taking a holistic approach to margin | Cross margin provides traders with less control over specific positions. Traders seeking to manage a position on an individual basis may use isolated margin to gain a greater degree of control |

Cross margin is useful for traders seeking to hedge existing positions | Traders seeking to manage a position on an individual basis may use isolated margin to gain a greater degree of control |

| Pros |

|---|

Cross margin can be used to offset unrealized losses with unrealized profits, minimizing the probability of position liquidation |

Cross margin reduces the overall probability of liquidation by taking a holistic approach to margin |

Cross margin is useful for traders seeking to hedge existing positions |

| Cons |

|---|

Cross margin places the entire available balance of a trader at risk — in the case of significant adverse market movements a trader may lose their entire balance should the market price of an asset challenge liquidation level |

Cross margin provides traders with less control over specific positions. Traders seeking to manage a position on an individual basis may use isolated margin to gain a greater degree of control |

Traders seeking to manage a position on an individual basis may use isolated margin to gain a greater degree of control |

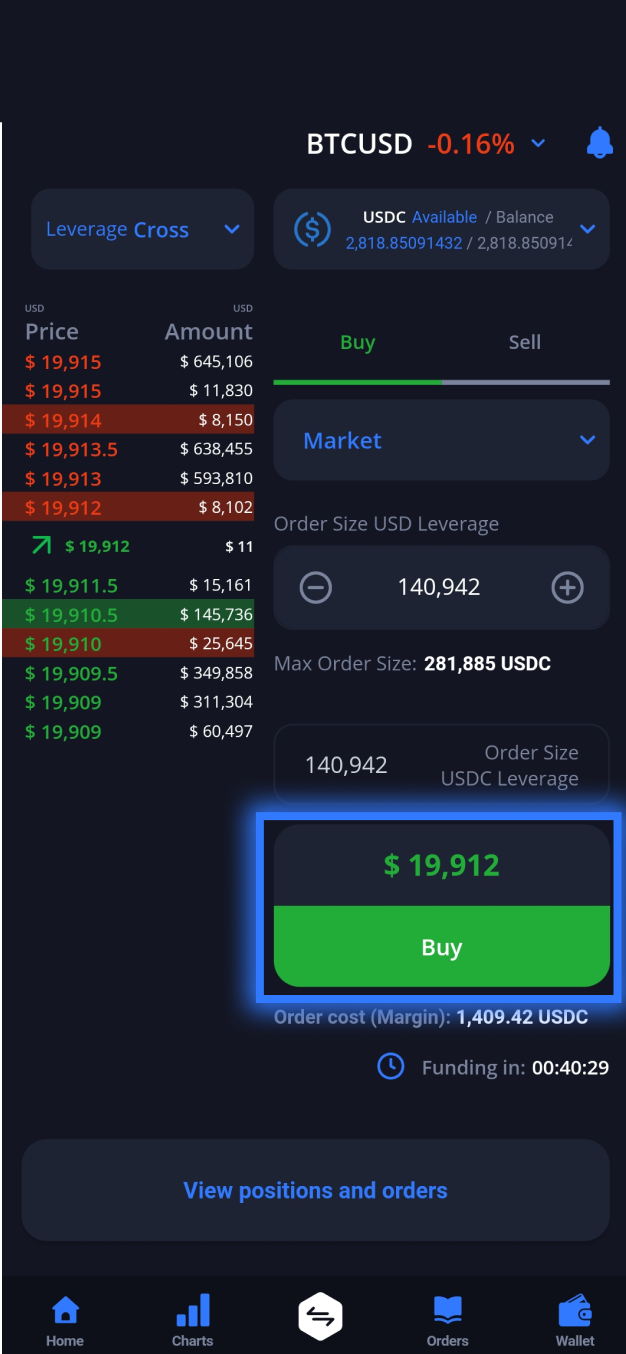

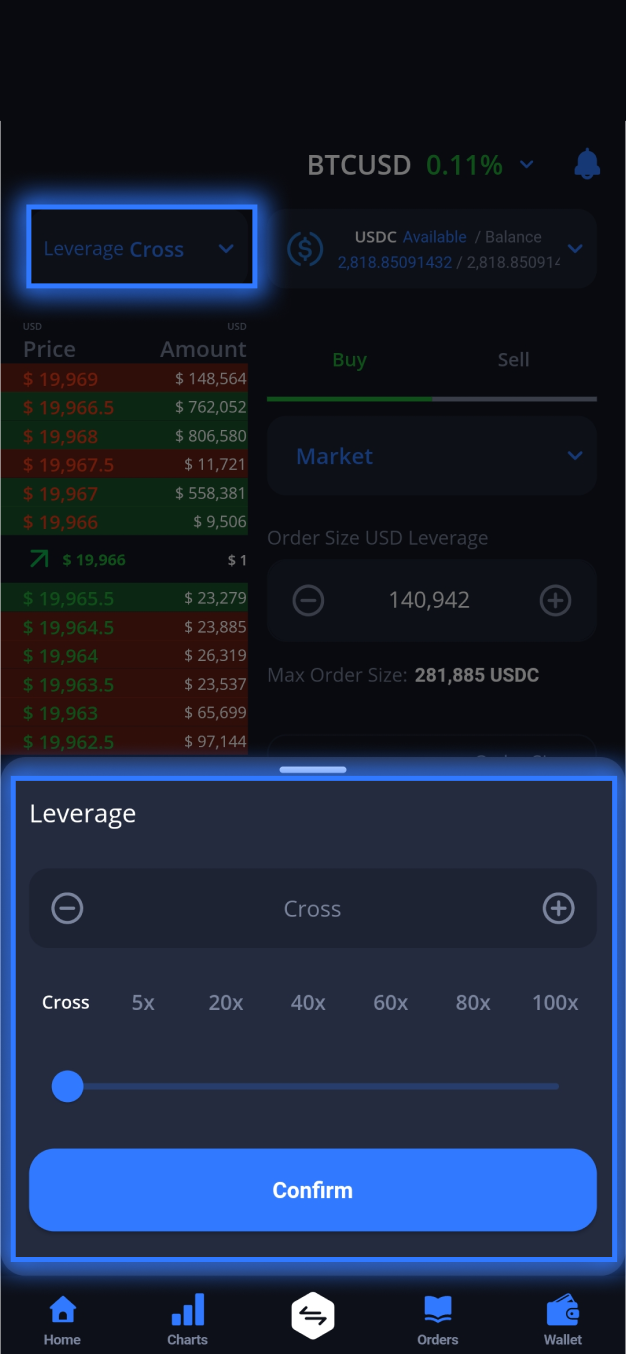

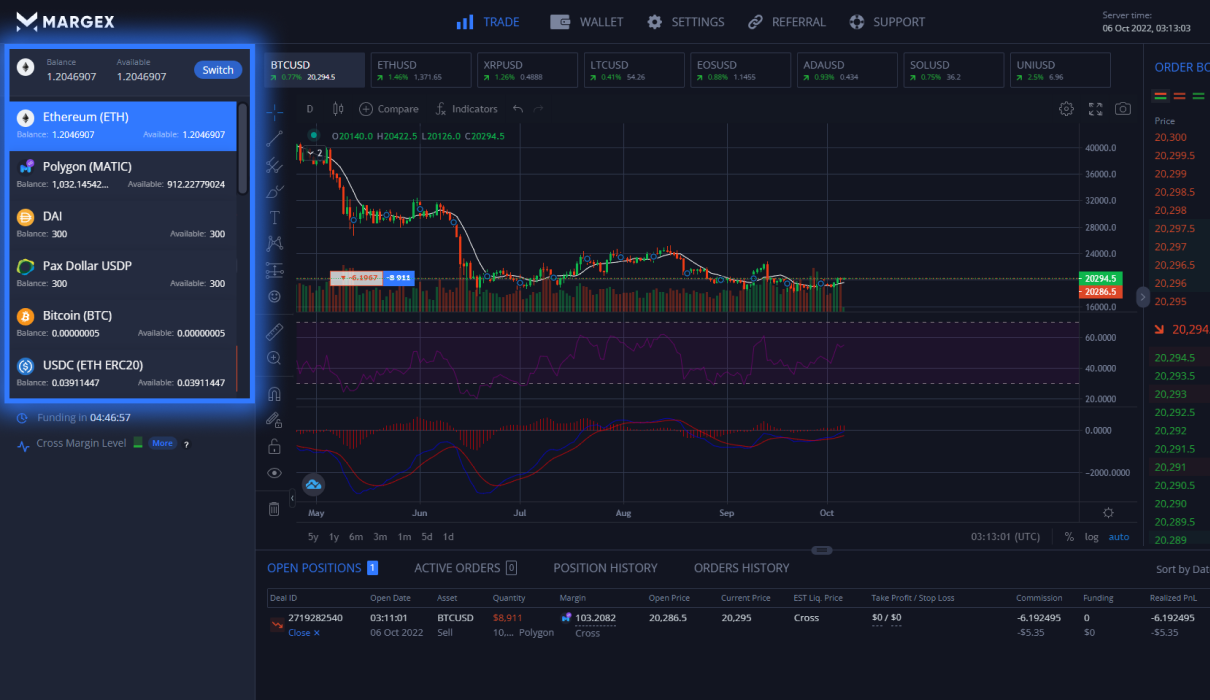

Trading With Cross Margin on Margex

Open a Margex trading account

Confirm your email

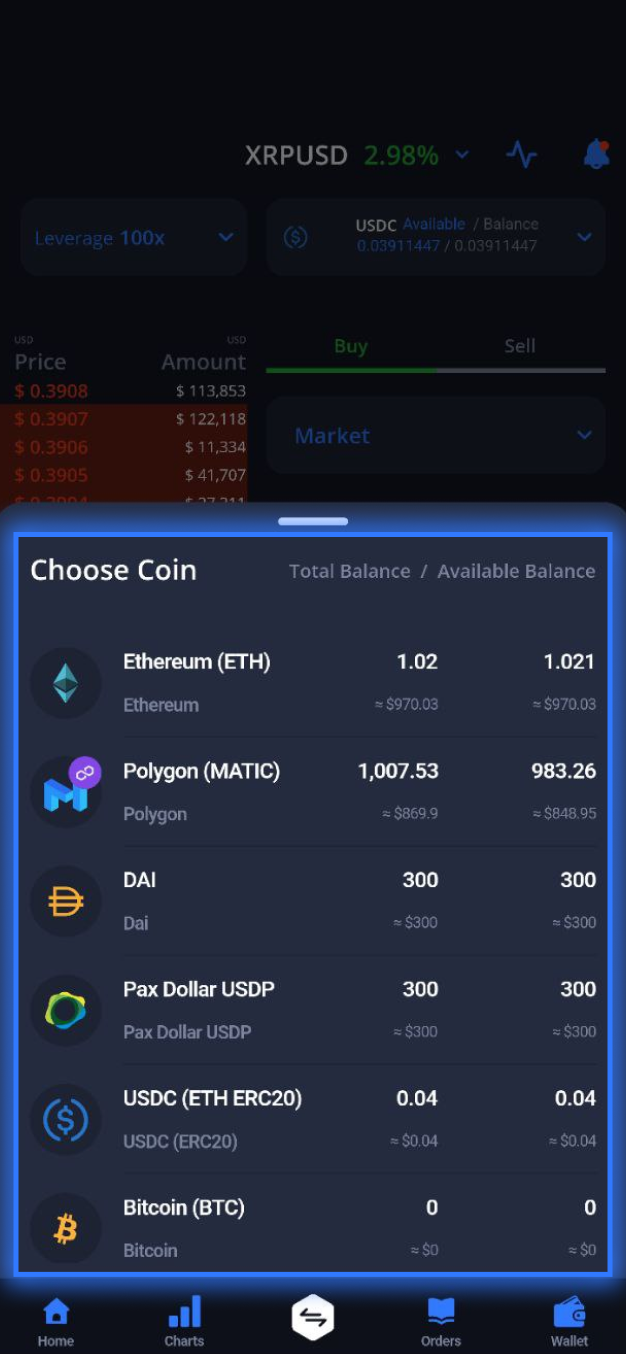

Fund your trading account

Trade with Cross Margin

What is Isolated Margin?

Isolated margin dedicates margin on an individual basis to each open position. A trader that opens a position with isolated margin must allocate a specific amountof margin either equal or greater to the initial margin required to open the position. In the context of isolated margin, the margin allocated by a trader to open a position is referred to as a position margin. Profit or loss generated by a position opened with isolated margin does not impact any other open positions. Isolated margin limits the liability of an open position to the initial margin defined by the trader. Unlike cross margin, any trader's available balance is not used to balance the margin of an open position.

Isolated Margin Example

A trader may choose to open a long BTC/USD position with BTC price of $10,000. The total balance held on Margex by the trader is 0.01 BTC, so the trader opens an isolated margin BTC/USD position for 1 BTC with 100x leverage. The initial margin required to open the trade must be staked in order to open the position — unlike cross margin, however, the trader defines the margin balance they would like to assign to the positionby either increasing or decreasing the leverage used in the trade. Should the price of Bitcoin decline to a value that would liquidate the position, the position will be automatically liquidated as an isolated margin position will not draw more funds from the total balanceof the trader in order to keep the margin requirementsof the position afloat. In this case, the trader must manage the amount of margin assigned to an open position but only risks the initial margin assigned when opening the position, not their entire account balance.

Pros and Cons of Isolated Margin

| Pros | Cons |

|---|---|

Isolated margin provides traders with a greater degree of control over individual traders and is suitable for speculative trades opened with high leverage | If unrealized losses reduce the position margin of an isolated margin position, the position will be liquidated regardless of the total balance of a trader’s account |

While isolated margin positions expose traders to higher liquidation risk, only the position margin defined by the trader is exposed to risk — not the trader’s entire account balance | Isolated margin positions expose traders to higher liquidation risk |

The isolated margin amount for an open position can be managed — a trader can prevent liquidation by allocating additional margin | Isolated margin positions must be carefully managed |

| Pros |

|---|

Isolated margin provides traders with a greater degree of control over individual traders and is suitable for speculative trades opened with high leverage |

While isolated margin positions expose traders to higher liquidation risk, only the position margin defined by the trader is exposed to risk — not the trader’s entire account balance |

The isolated margin amount for an open position can be managed — a trader can prevent liquidation by allocating additional margin |

| Cons |

|---|

If unrealized losses reduce the position margin of an isolated margin position, the position will be liquidated regardless of the total balance of a trader’s account |

Isolated margin positions expose traders to higher liquidation risk |

Isolated margin positions must be carefully managed |

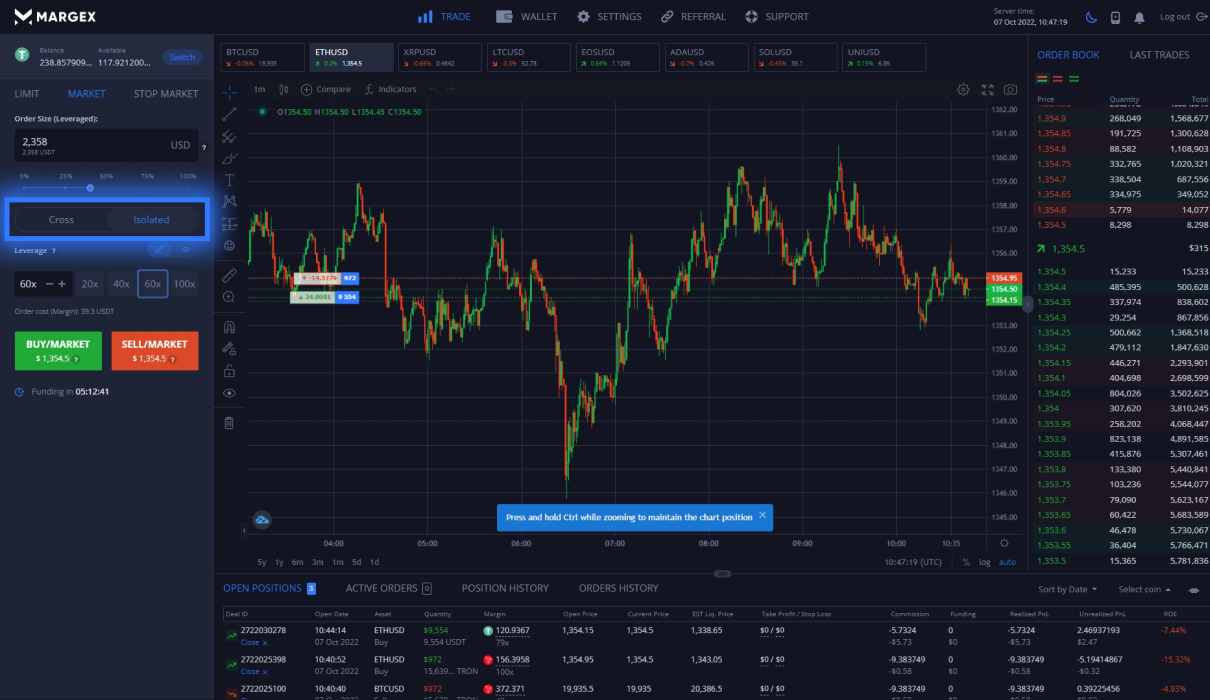

Trading With Isolated Margin on Margex

To open a trade using isolated margin, you need to go to your Margex trading account, select the pair you will trade, go to the leverage slider and drag it to select the preferred leverage for the trade. You can also use the small pen next to the slider to manually enter your preferred margin on the trade, ranging from 5x to 100x for all pairs. Once you select your preferred leverage, you can enter your order size. Note that the order size you enter is already leveraged, meaning that the leverage you selected above is already accounted for in the trade.

Cross Margin vs. Isolated Margin. What to choose?

Cross margin and isolated margin offer different advantages and disadvantages that vary based on the trading strategy employed by the user. In general terms, cross margin is a straightforward approach that can be employed by novice traders or traders seeking to offset unrealized losses with unrealized profits, while isolated margin provides traders with a far greater degree of control over the amount of risk they are exposed to.

| Cross Margin | Isolated Margin |

|---|---|

Offers a holistic approach to margin | Defines individual margin for each open position |

Can increase the probability of liquidating entire the account balance of a trader | Reduces the risk of account balance liquidation |

Offers simple margin management | Requires ongoing management |

Suitable for novice traders | Suitable for speculative trades with high leverage |

| Cross Margin |

|---|

Offers a holistic approach to margin |

Can increase the probability of liquidating entire the account balance of a trader |

Offers simple margin management |

Suitable for novice traders |

| Isolated Margin |

|---|

Defines individual margin for each open position |

Reduces the risk of account balance liquidation |

Requires ongoing management |

Suitable for speculative trades with high leverage |

Сhoosing the right leverage

The effective leverage of an open position in cross margin vs. isolated margin can be calculated by comparing the maximum possible loss of a position compared to the value of the trader’s position. In the case of a cross margin position with unrealized profit, for example, the effective leverage is equal to the position value divided by the position margin combined with the trader’s available balance and unrealized profit. Cross margin positions can transfer loss across a trader’s entire balance. In the case of a cross margin position with unrealized loss, the effective leverage is equal to the position value divided by the position margin combined with the available balance. Higher effective leverage increases the risk of liquidation, as the liquidation price range closer to the mark price.